Greetings,

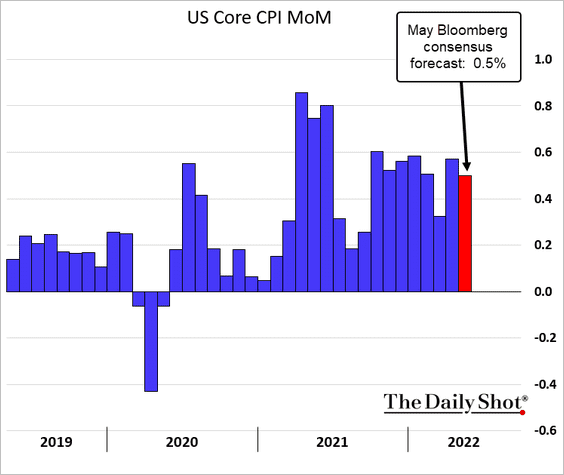

The United States: Starting off, the consensus estimate for the core CPI in May is an increase of 0.5%. The markets could react violently if we get an upward surprise, especially if calls for more aggressive Fed rate hikes get louder.

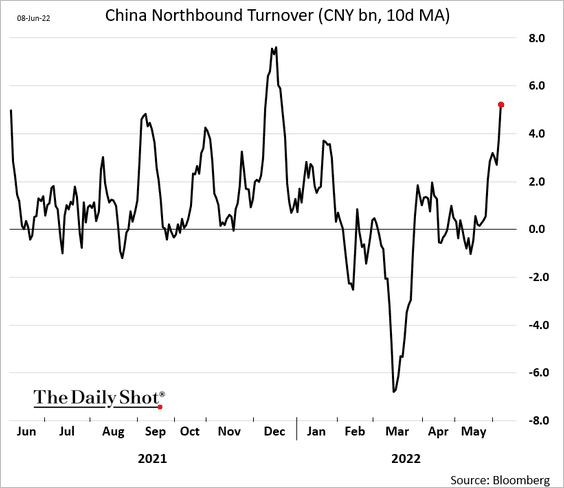

China: Hong Kong-based and foreign investors are returning to mainland equity markets.

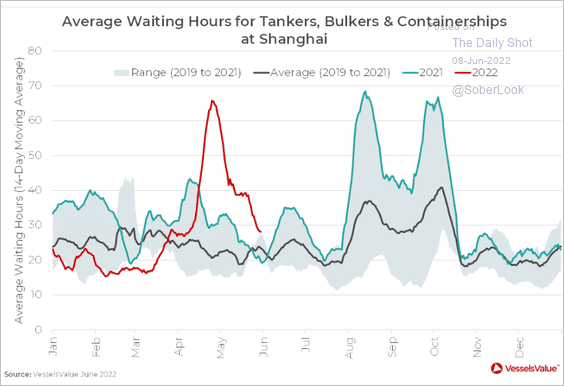

Also, the Port of Shanghai is nearly back to normal, easing supply chain concerns.

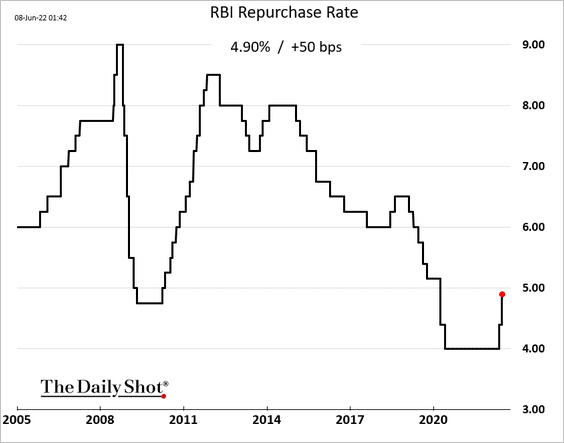

Emerging Markets: India’s central bank hiked rates to address inflationary pressures.

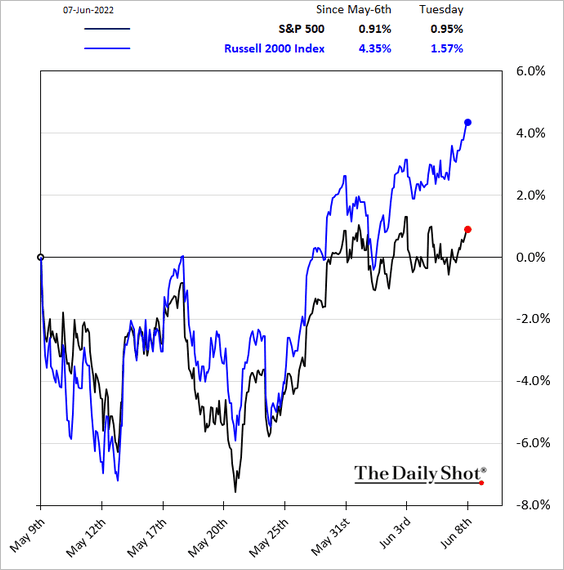

Equities: Small caps have been outperforming in recent days.

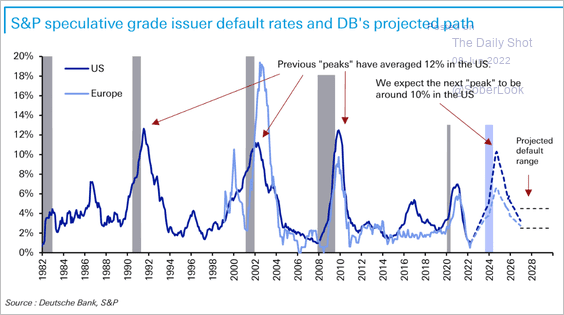

Credit: In the next few years, high-yield defaults could hit the highest level since the financial crisis, according to Deutsche Bank.

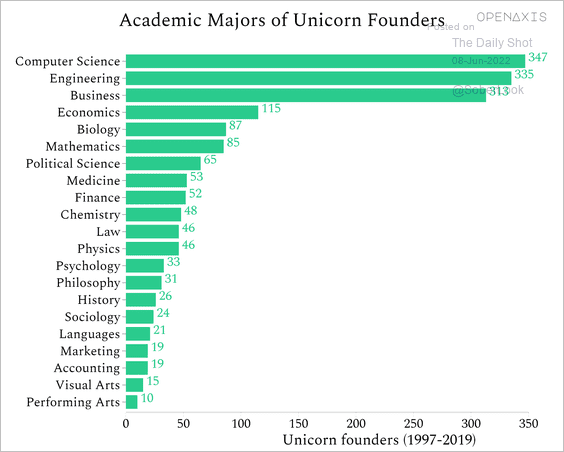

Food for Thought: Lastly, let’s take a look at the academic majors of unicorn founders.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com