Greetings,

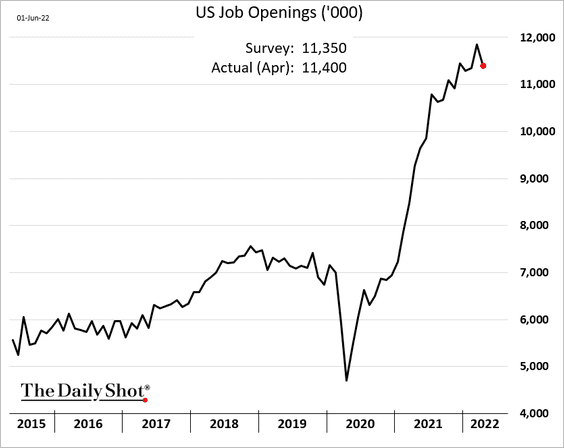

The United States: To begin, US job openings remained remarkably strong in April, indicating persistent tightness in the labor market.

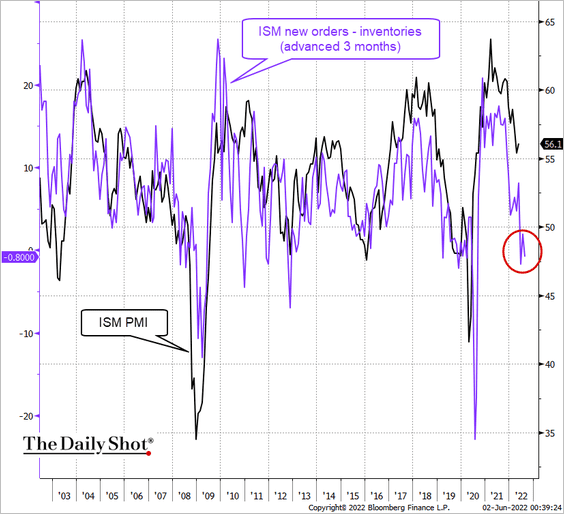

Economists are skeptical about manufacturing strength persisting in the months ahead despite improvement in May. The spread between new orders and inventories points to weakness in the ISM PMI later this year.

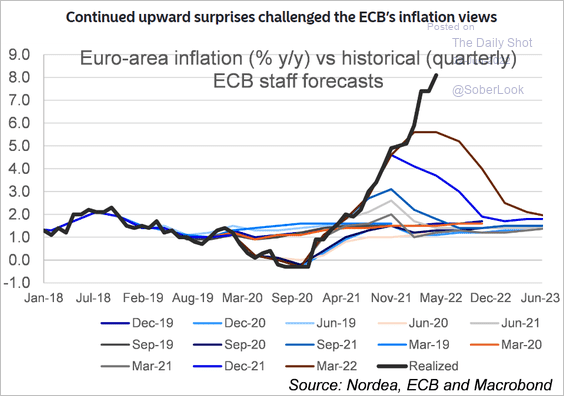

The Eurozone: The persistent upside inflation surprises are creating a credibility problem for the ECB.

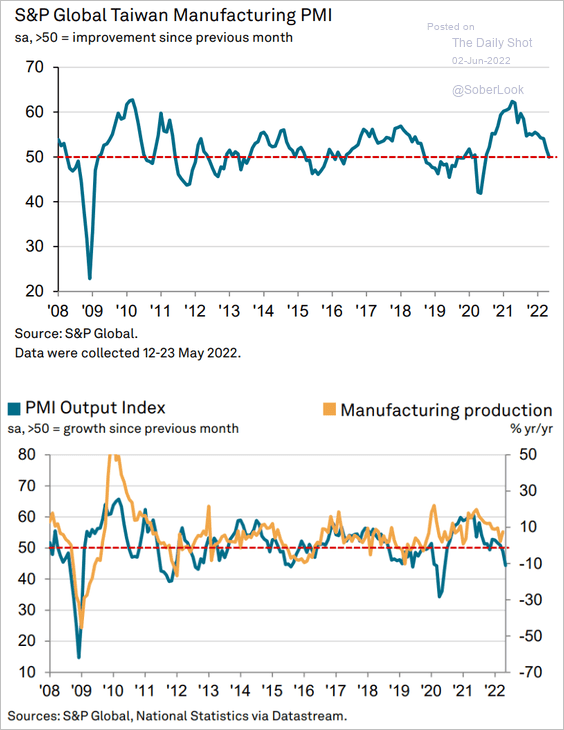

Asia-Pacific: Taiwan’s factory activity stalled, with output contracting (2nd panel).

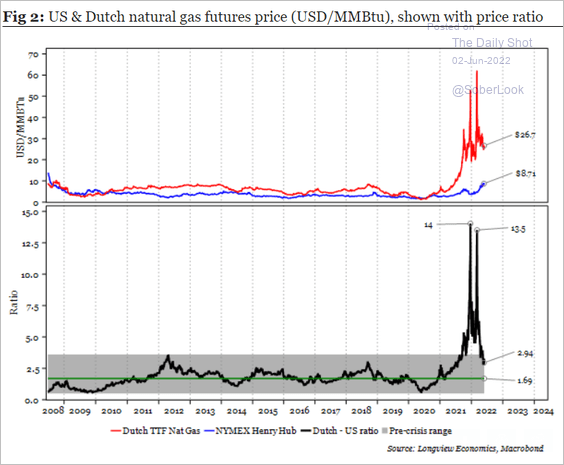

Energy: US natural gas is trading at multi-year highs. The Europe-US gas price ratio is moving toward its long-term average.

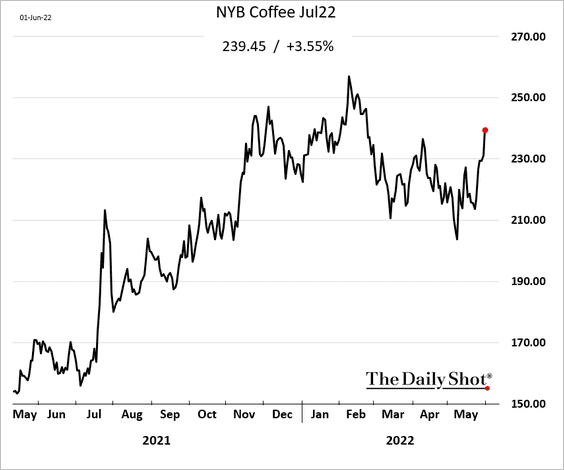

Commodities: Coffee is rebounding due to tightening inventories and cold weather in Brazil.

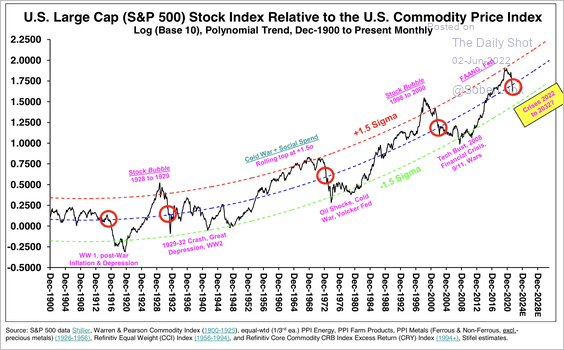

Equities: The stocks/commodity ratio is breaking below its long-term uptrend, similar to what occurred during previous market shocks.

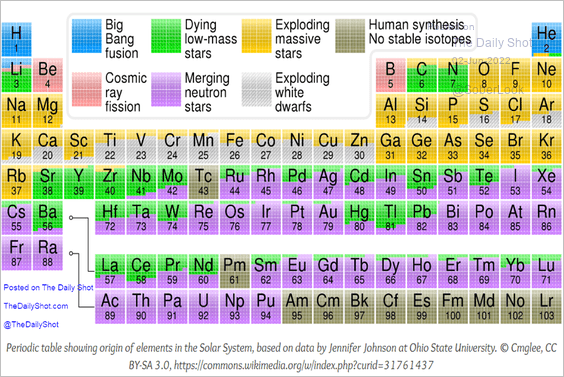

Food for Thought: Lastly, here are the origins of elements in the Solar System:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com