Greetings,

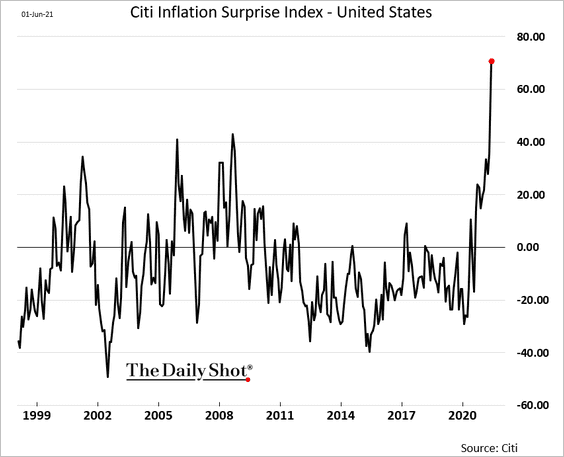

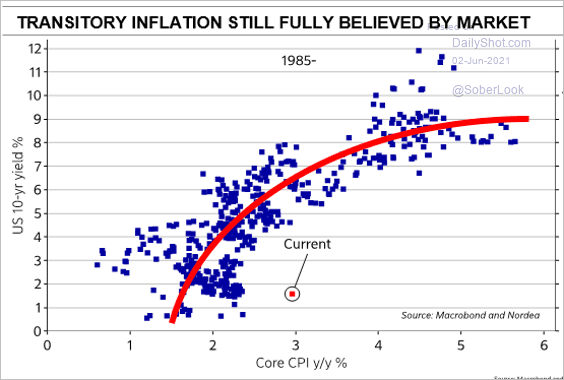

United States: Economists were surprised by the intensity of the pandemic recovery price gains. The Citi Inflation Surprise Index hit a record high.

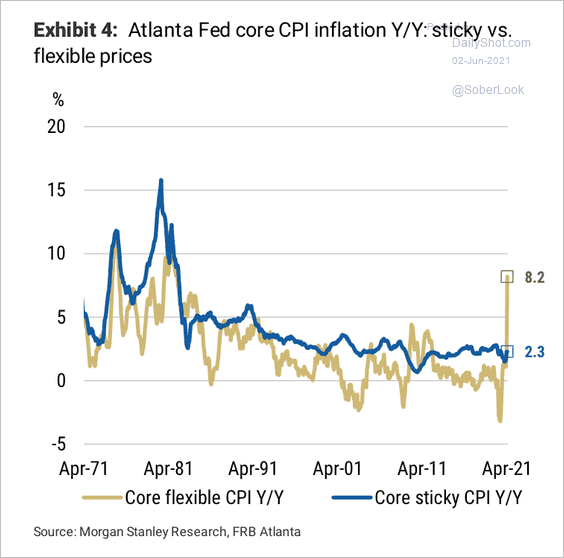

A majority of inflation gains in the April CPI report came from flexible prices, not sticky prices, which tend to move more slowly.

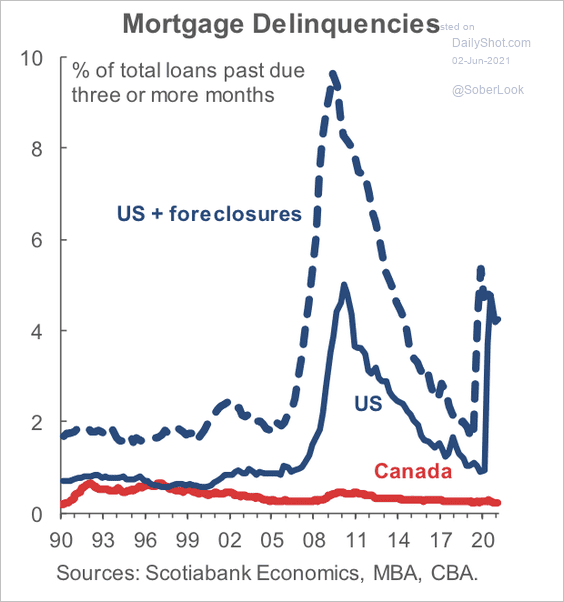

Canada: Unlike the US, Canada did not experience a spike in mortgage delinquencies during the pandemic.

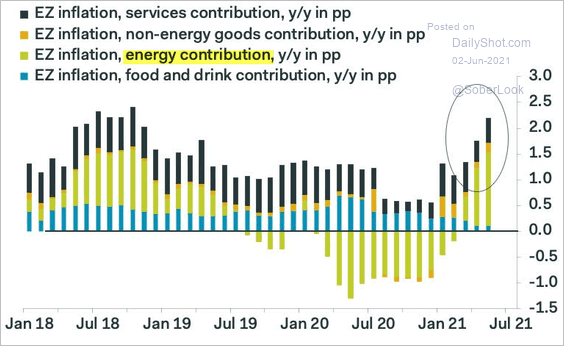

Eurozone: Energy drove most of the year-over-year increases in the headline CPI.

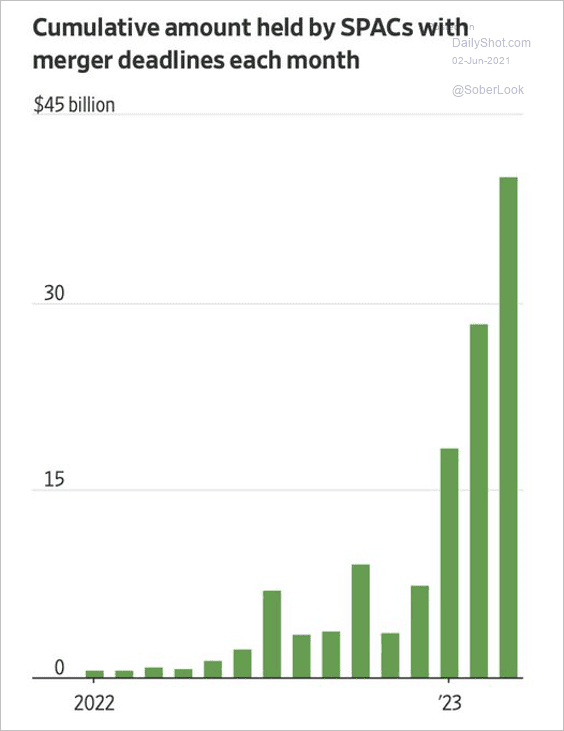

Equities: Many SPACs will be forced to buy overpriced companies before hitting their deadlines (to return cash to investors).

Rates: The bond market still doesn’t expect high inflation to persist for very long. The Fed’s QE also contributes to lower yields.

Food for Thought: Types of economics papers:

Edited by Richard Holmes

Contact the Daily Shot Editor: Editor@DailyShotLetter.com