Greetings,

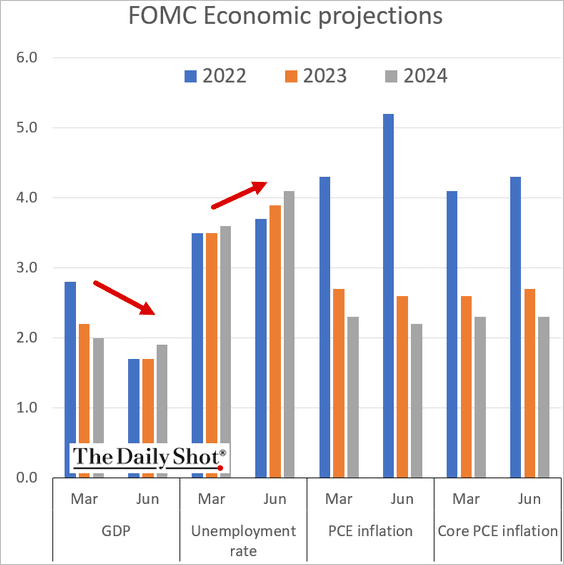

The United States: Following the 75 bps rate hike Wednesday, the FOMC downgraded its GDP projections and boosted the forecasts for unemployment. The collateral damage from this inflation battle is now expected to be more severe, narrowing the path to a “soft landing.”

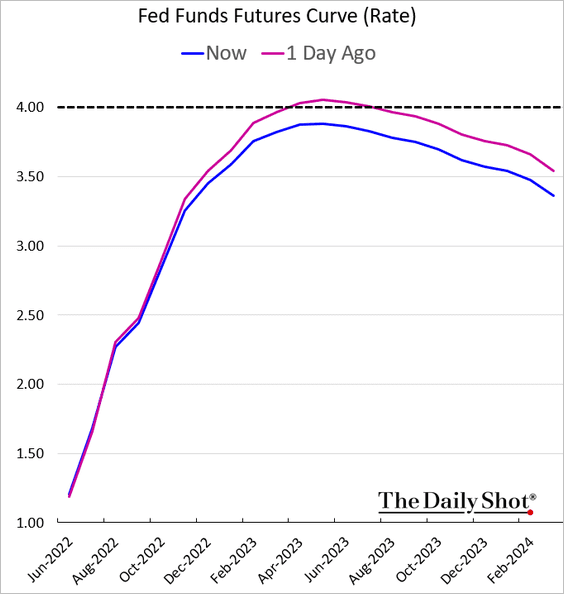

The terminal rate expectations are back below 4%.

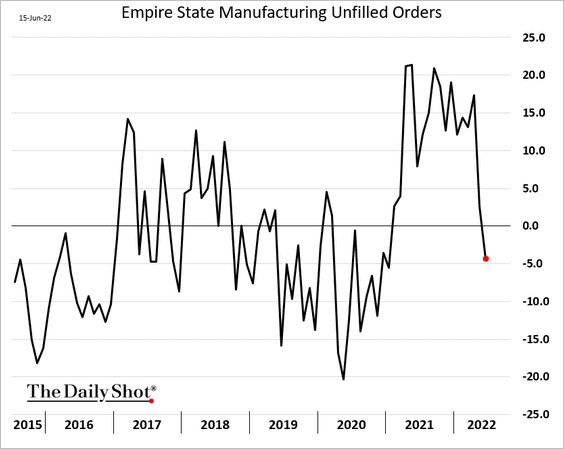

The first regional manufacturing report of the month (from the NY Fed) showed slowing demand. Here are unfilled orders:

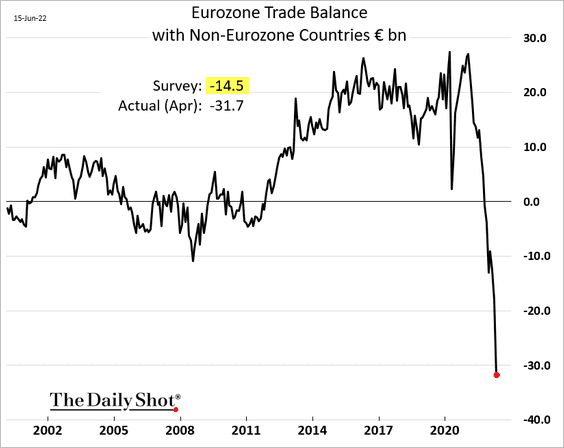

The Eurozone: The trade deficit was much wider than expected, hitting a new record. This trend is driven by surging energy costs and a bigger deficit with China.

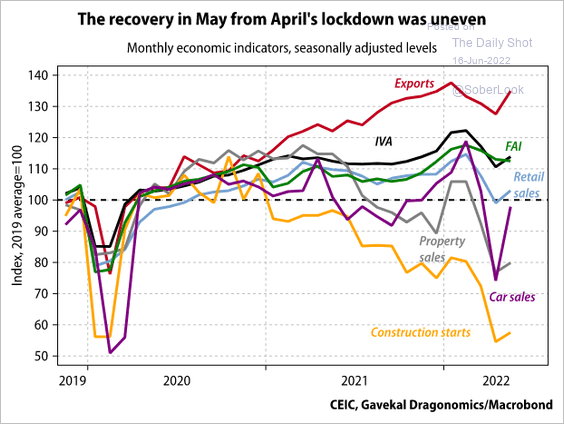

China: In China, the post-lockdown recovery has started.

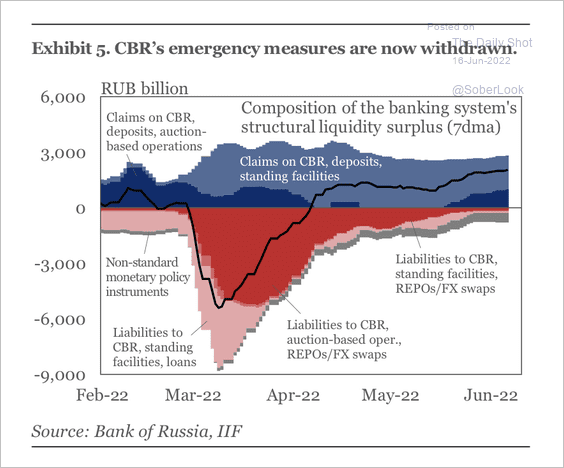

Emerging Markets: The Central Bank of Russia’s emergency measures are now withdrawn.

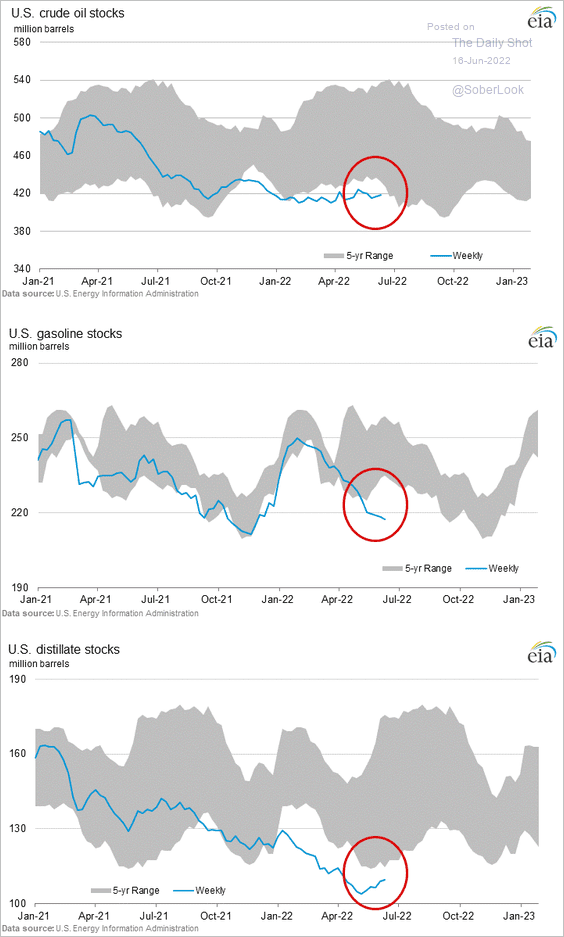

Energy: US crude oil and distillates inventories showed some improvement, but gasoline stocks continue to plummet.

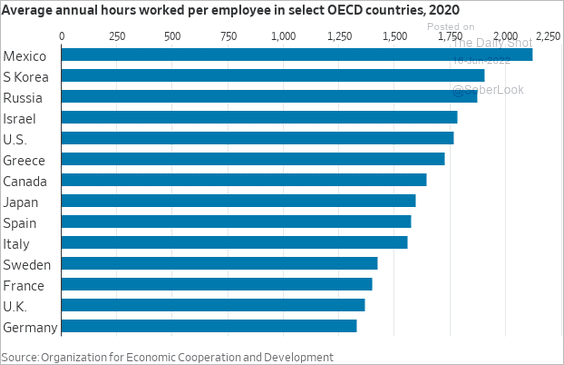

Food for Thought: To end off, here are the annual hours worked by country:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com