Greetings,

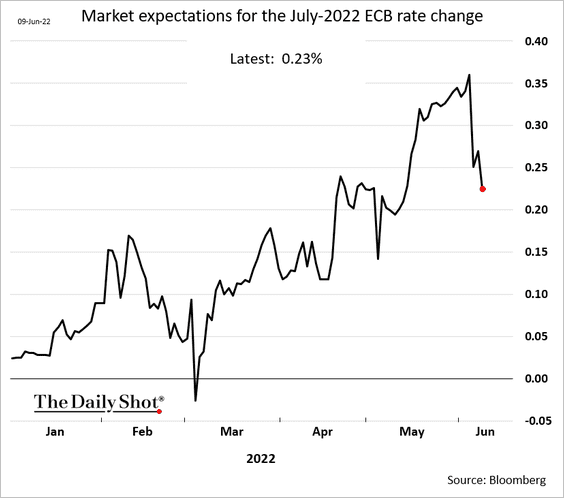

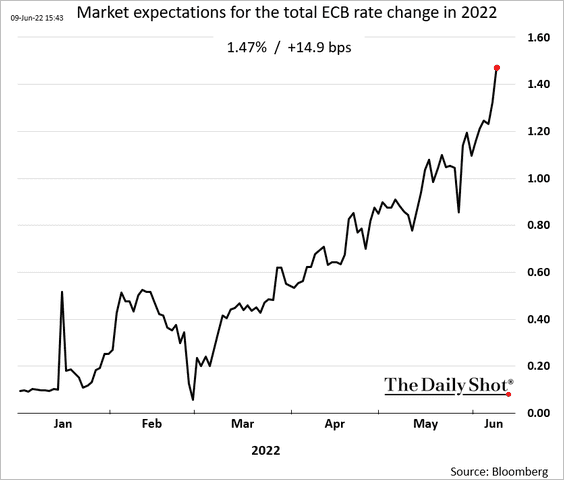

The Eurozone: First, the ECB struck a hawkish tone, confirming the start of its first rate-hiking cycle since 2011.

The July rate increase is now expected to be 25 bps (a more cautious start).

The market now expects the ECB to deliver nearly 150 bps worth of hikes by the end of the year.

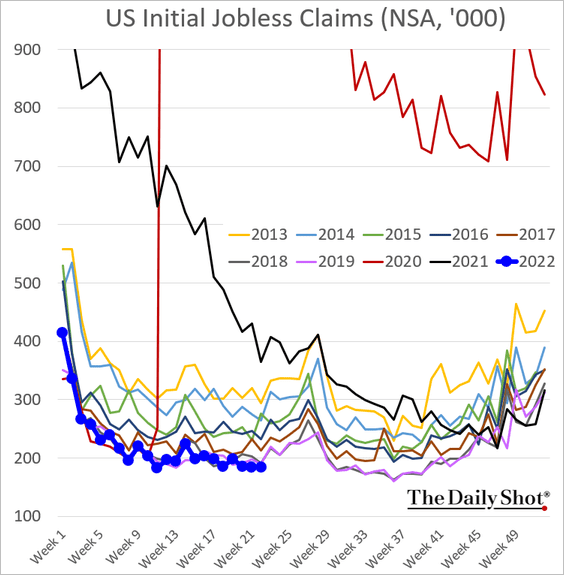

The United States: Initial jobless claims remain near multi-year lows.

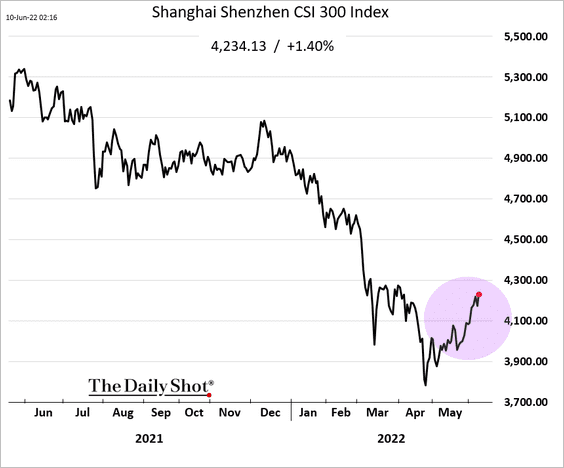

China: Mainland stocks continue to rebound, driven by foreign inflows.

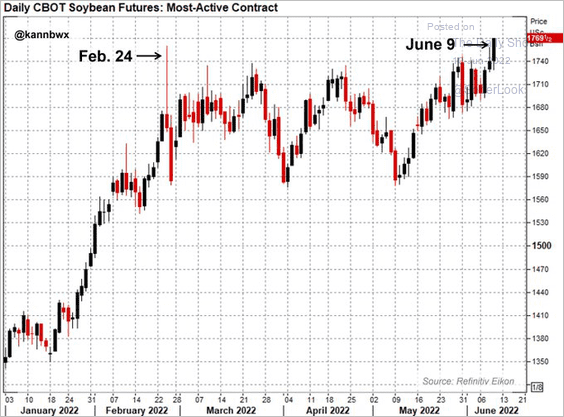

Commodities: US soybean futures are hitting new highs amid robust foreign demand.

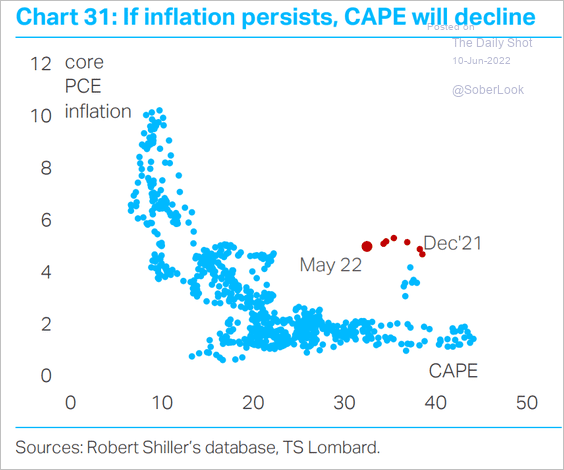

Equities: Further valuation pullbacks are likely if inflation continues to surprise to the upside.

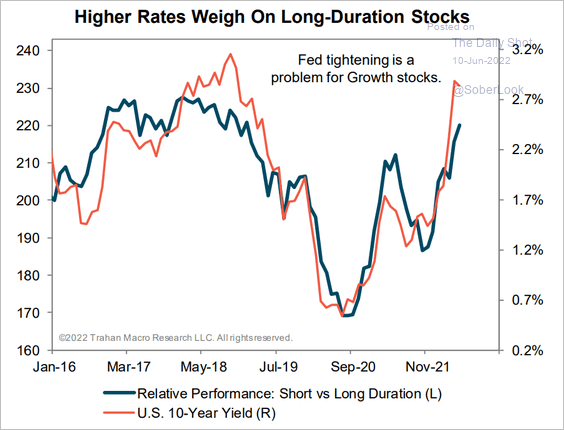

“Long-duration” stocks (such as growth companies) are vulnerable to rising rates.

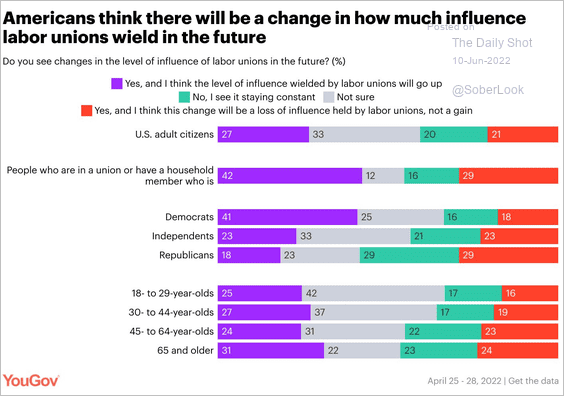

Food for Thought: Lastly, here are expected changes in the level of influence wielded by labor unions:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com