Greetings,

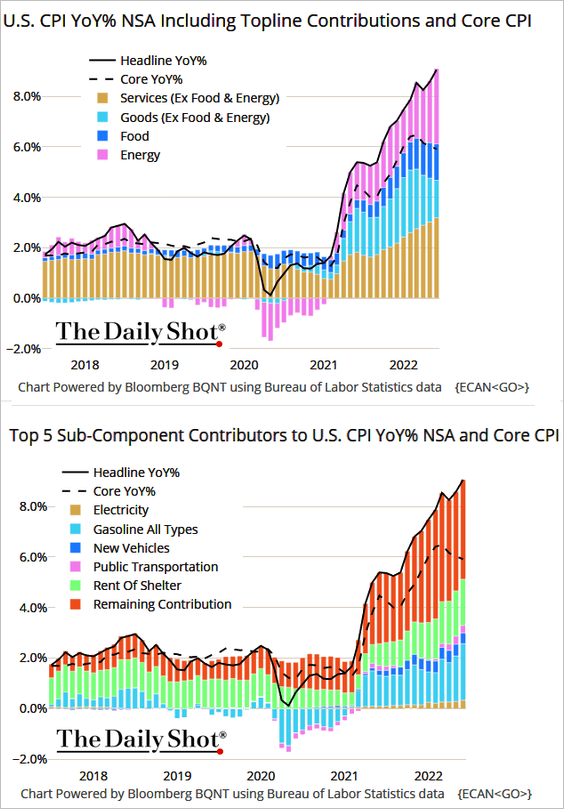

The United States: To start off, the June CPI report delivered another shocker, with price gains exceeding most forecasts. Here is the attribution chart for the year-over-year figures.

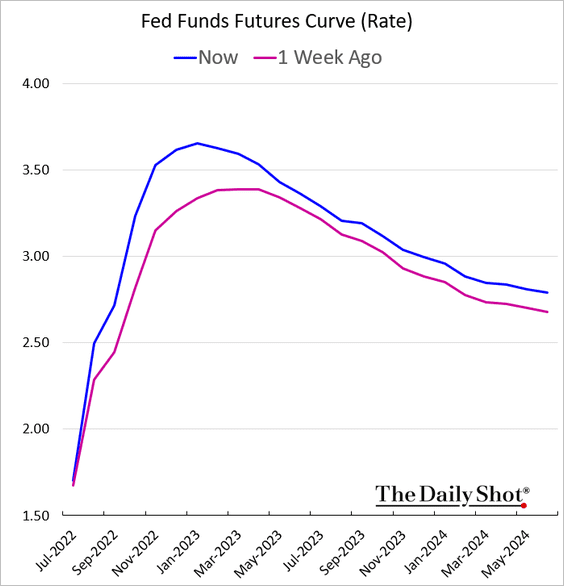

The terminal rate climbed back above 3.5% as the market priced in a significant probability of a 100 bps Fed rate hike this month.

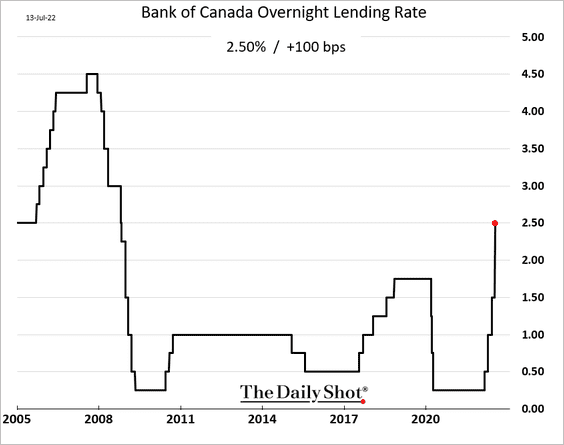

Canada: The BoC surprised the markets with a 100 bps hike. The Fed is likely to follow.

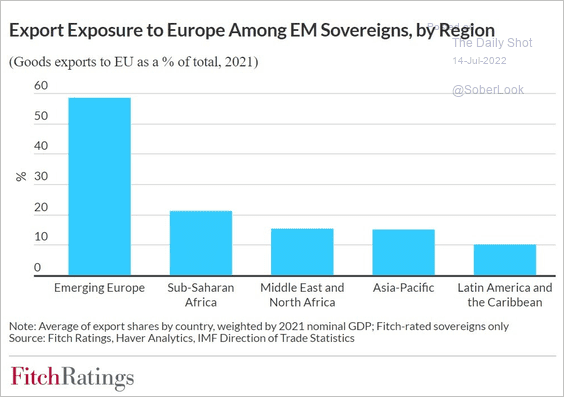

Emerging Markets: Here is EM exposure to an economic downturn in the EU.

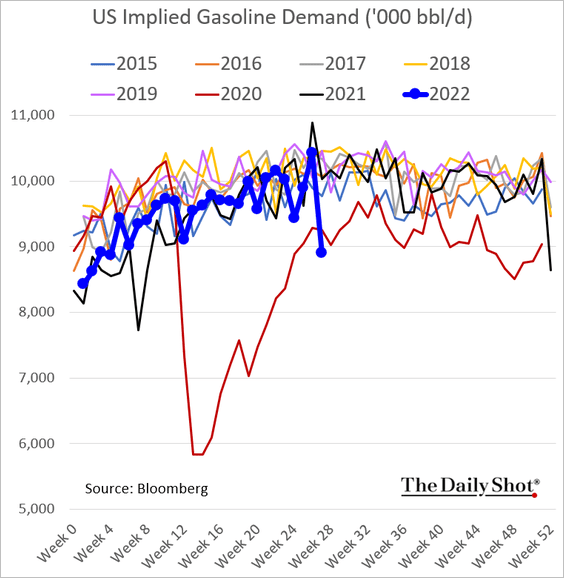

Energy: US gasoline demand tumbled last week as prices remained elevated nationwide.

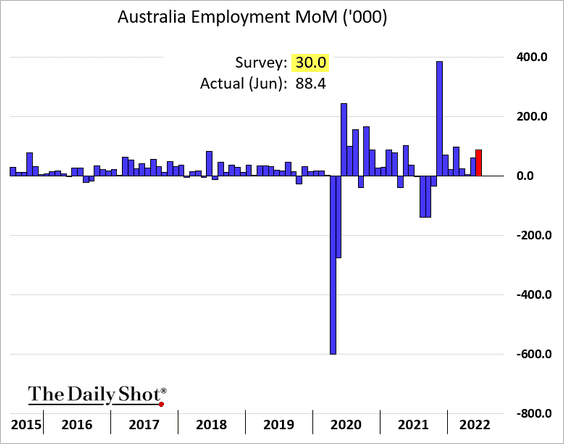

Asia-Pacific: Australia’s labor market remains remarkably strong. Job gains were almost three times the expected number.

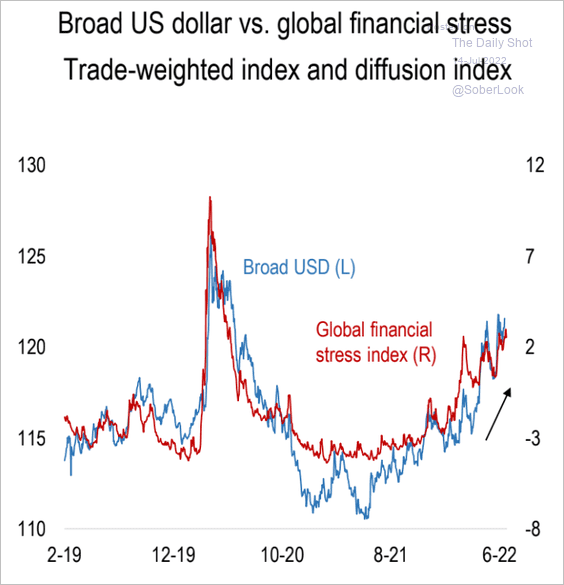

Global Developments: Global financial stress levels and the US dollar tend to be correlated.

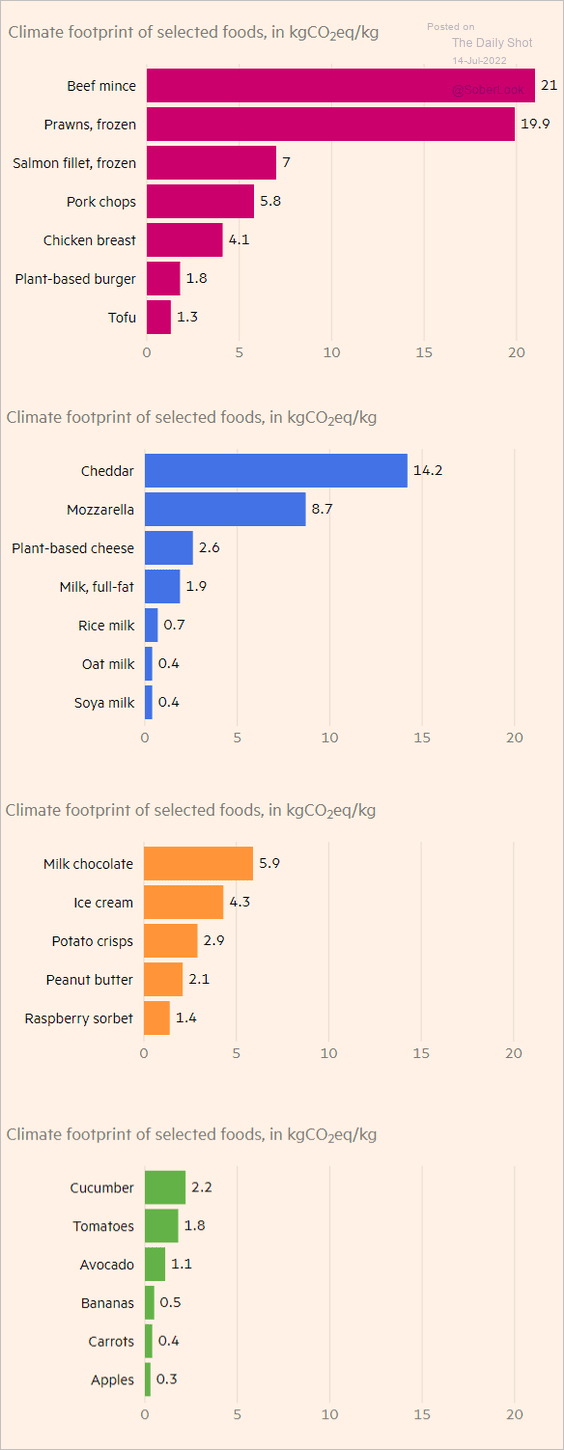

Food for Thought: To finish, here are the climate footprints of selected foods:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com