Greetings,

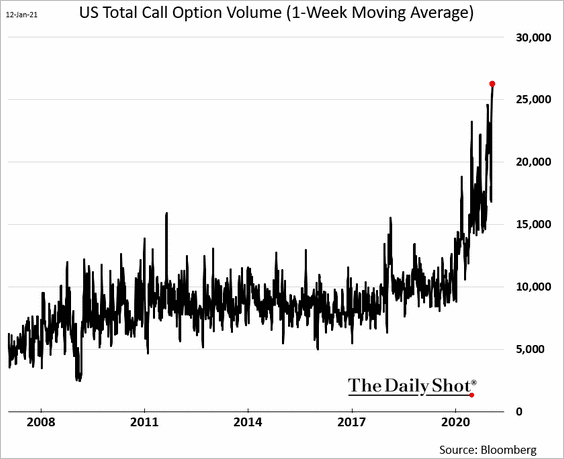

Equities: The volume of call options is hitting unprecedented levels. These are effectively leveraged bets that allow retail investors to punch above their weight.

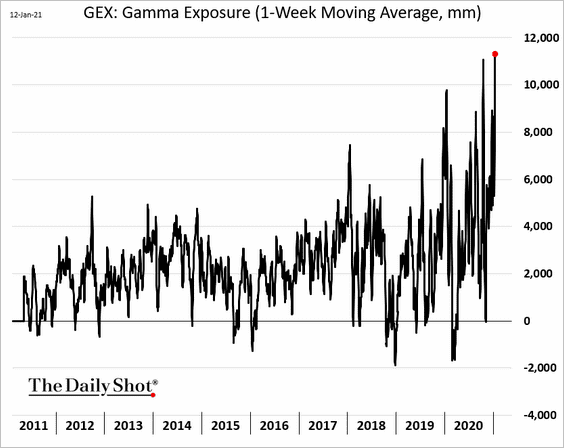

Dealers are increasingly short gamma as they sell more options to clients. This tends to exacerbate volatility, especially during selloffs. Here is the GEX index, which is a rough estimate of gamma exposure.

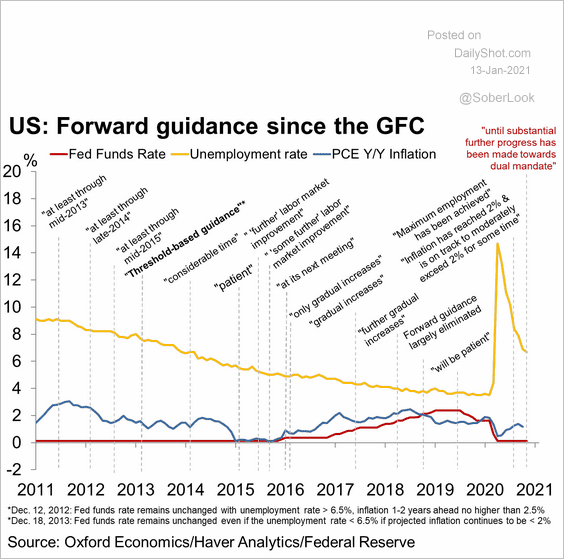

Rates: This chart shows the history of the Fed’s forward guidance since the GFC.

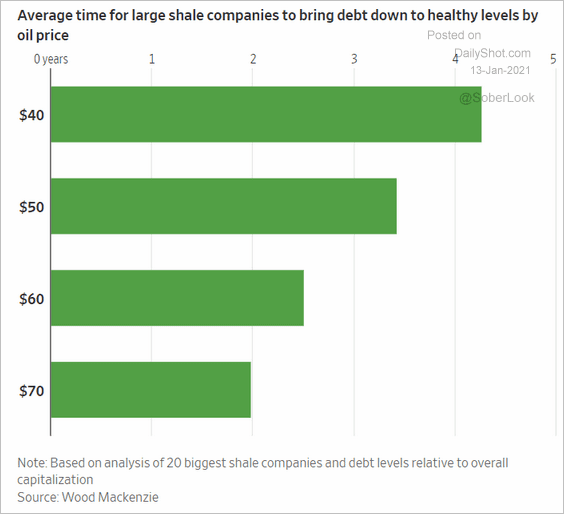

Energy: Shale firms need further price gains to reduce their leverage.

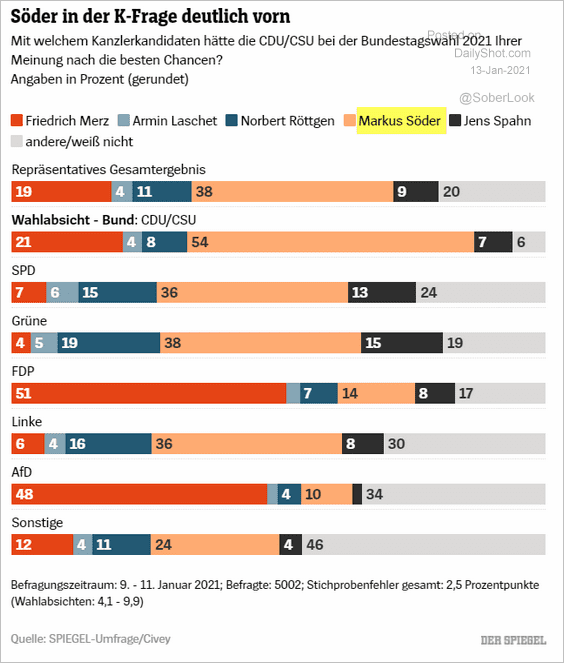

Eurozone: Who will replace Angela Merkel? Analysts suggest that it will be Friedrich Merz.

But polls show a preference for Markus Söder, which would change the direction for Germany’s leadership.

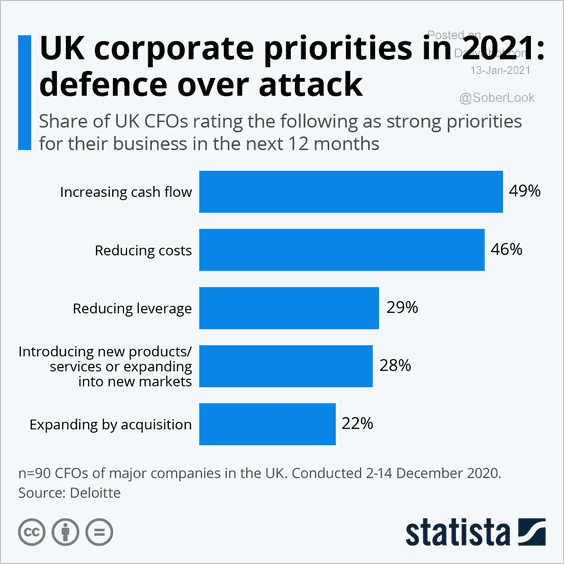

United Kingdom: What are the corporate priorities for this year?

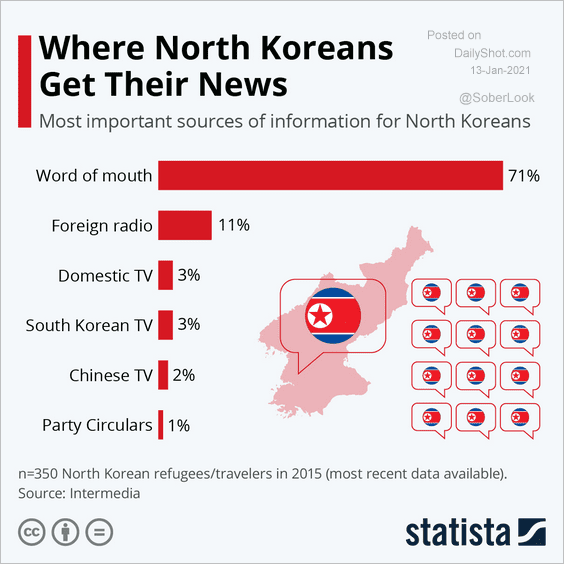

Food For Thought: How North Koreans get their news:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com