Greetings,

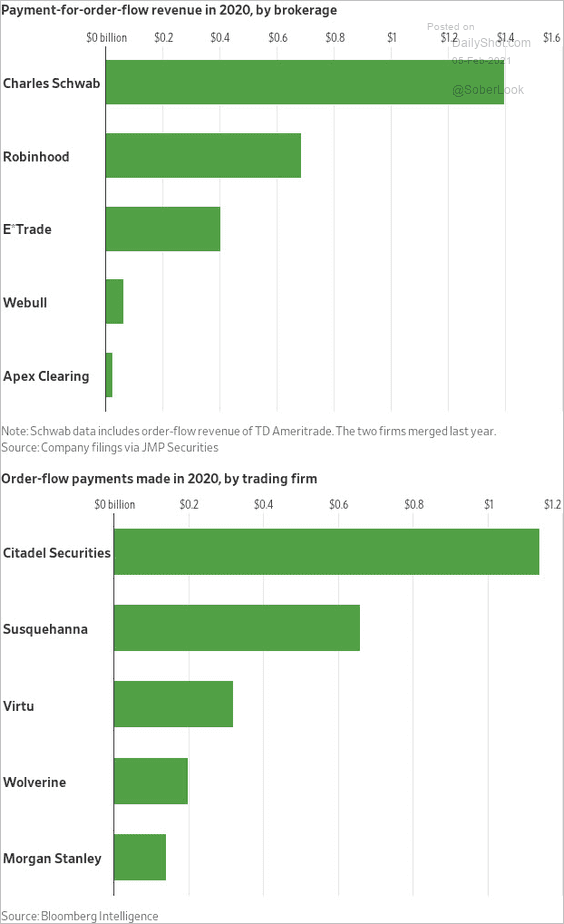

Equities: Who are the largest sellers and buyers of order flow?

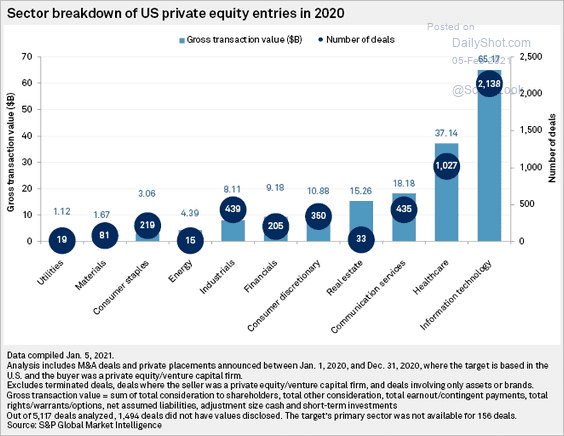

Alternatives: Which sectors saw the most private equity deals last year?

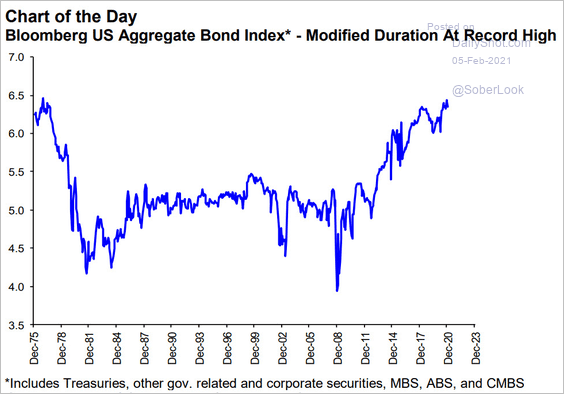

Rates: The aggregate duration of fixed-income markets keeps climbing, which will exacerbate losses if rates rise suddenly.

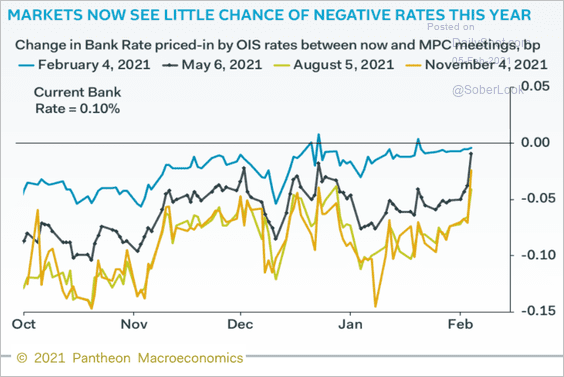

United Kingdom: The BoE told banks they have six months to get ready for negative rates, which are probably not coming.

Market-based probability of negative rates collapsed.

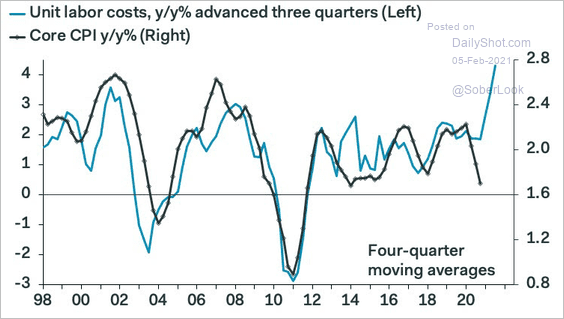

United States: Unit labor costs jumped, pointing to higher inflation ahead.

However, this increase in labor costs is exaggerated. Here is a comment from Andrew Husby, Economist at Bloomberg LP.

• … unit labor costs likely exaggerate aggregate cost pressures for the same reason as the productivity statistics, namely the pandemic’s severe impact on select industries.

• It also overstates the total degree of cost pressures facing businesses, as unit non-labor payments, which account for subsidies like those provided by the Paycheck Protection Program, fell markedly in the fourth quarter (-6.3%) and for the year as a whole (-4.1%).

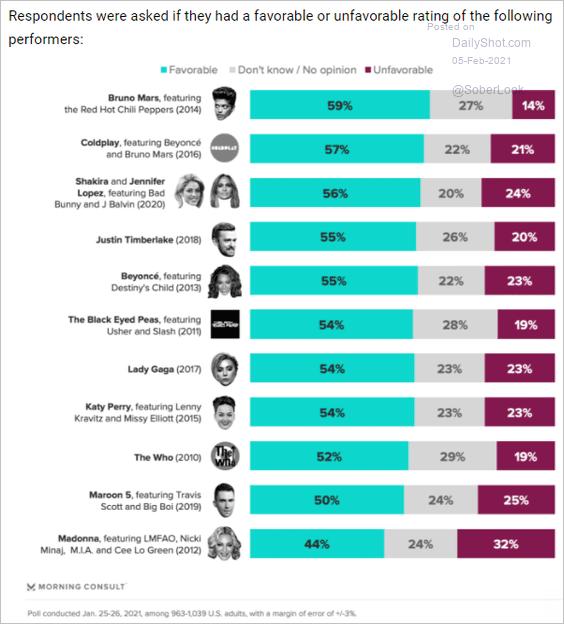

Food For Thought: Super Bowl halftime performers:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com