Greetings,

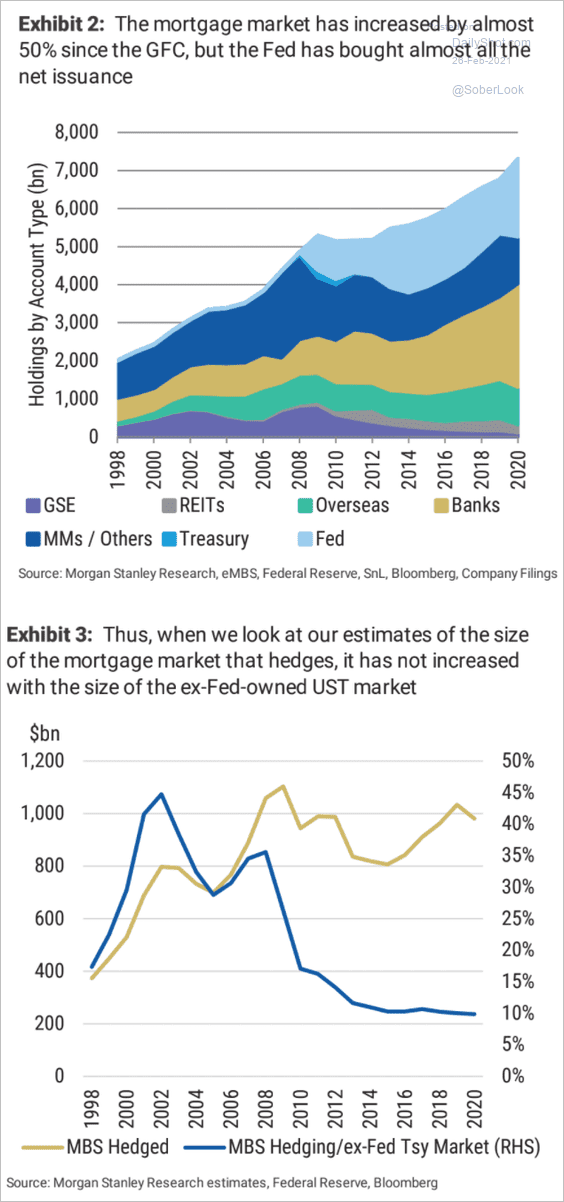

Rates: With longer-term rates rising, mortgage refinancing is expected to slow down, extending the duration of MBS securities. Holders of MBS (who are short convexity) found themselves increasingly long duration and were forced to hedge their exposure (often happens when rates rise suddenly). The hedging processes, which is usually done via rate swaps, added to downward pressure on Treasuries.

It’s unclear just how much of an impact mortgage convexity hedging is having on the market. The mortgage market increased by some 50% since the financial crisis, but the Fed now holds a substantial portion of MBS securities. The second chart below shows Morgan Stanley’s estimate of mortgage market hedges.

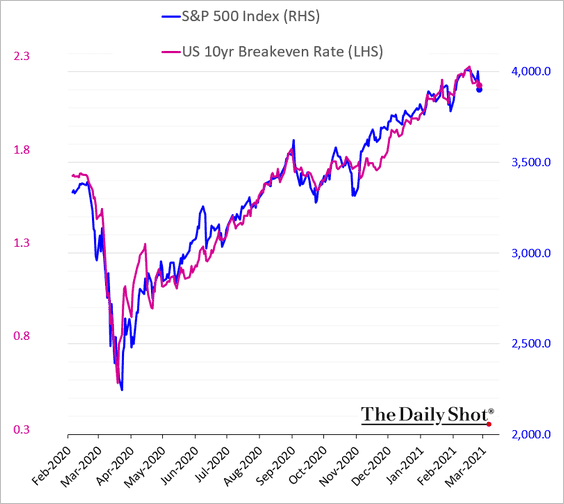

Equities: The correlation between the S&P 500 and the 10-year breakeven rate over the past 12 months has been remarkable. Longer-term breakeven rates have pulled back in recent days

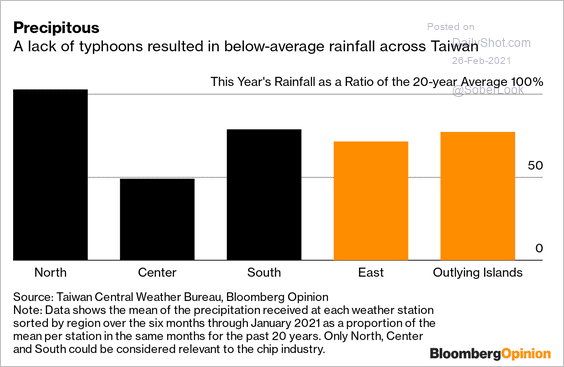

Asia-Pacific: Below-average rainfall created some water shortages in Taiwan, which held back chip production.

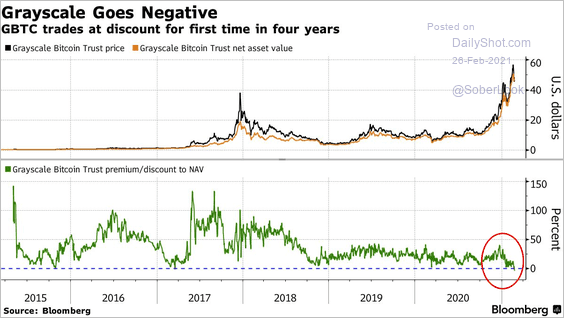

Cryptocurrencies: The largest public fund holding Bitcoin (Grayscale) started trading at a discount to NAV.

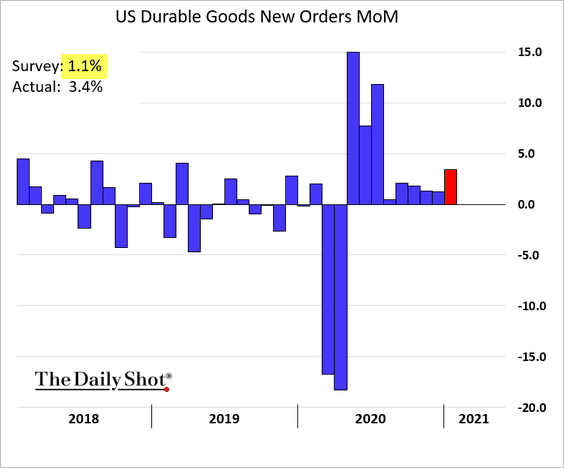

United States: Durable goods orders surprised to the upside.

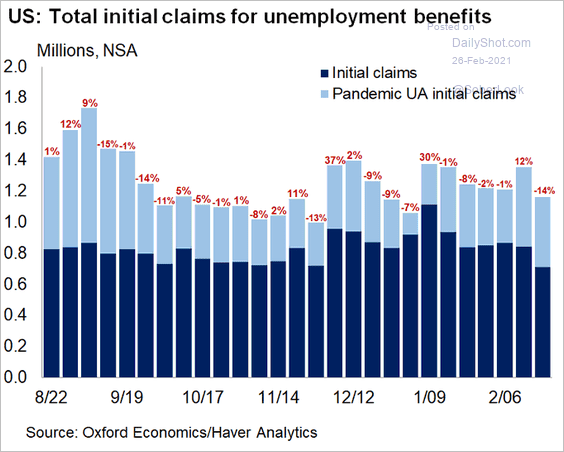

Jobless claims declined last week. The combination of strong durable goods orders and this improvement in unemployment applications put downward pressure on Treasuries on Thursday.

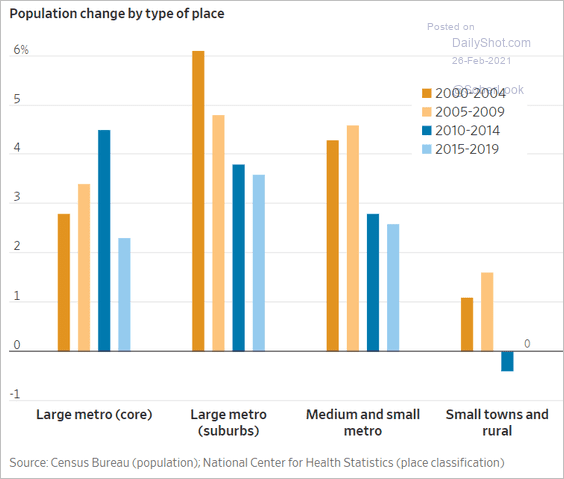

Food For Thought: Population change by type of community:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com