Greetings,

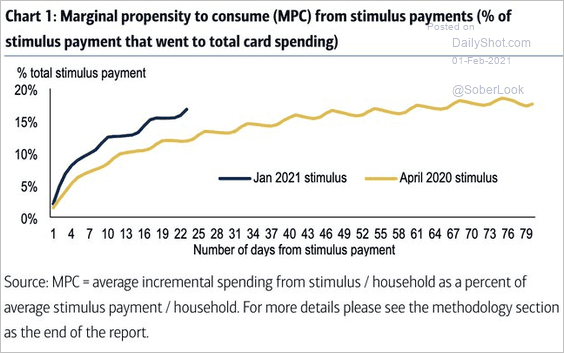

United States: Consumers are more apt to spend the new stimulus checks than the CARES Act payments last year.

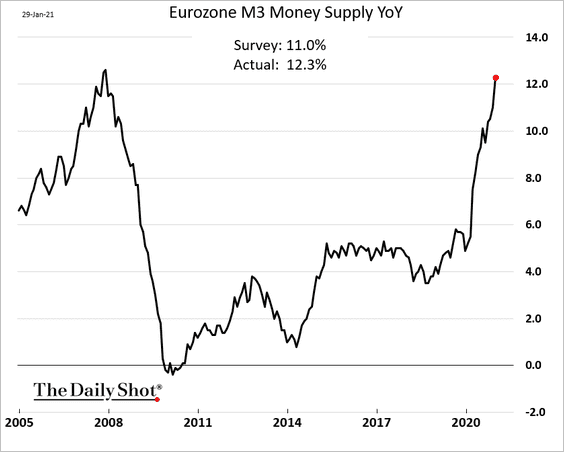

Eurozone: The euro-area broad money supply expansion accelerated further in December.

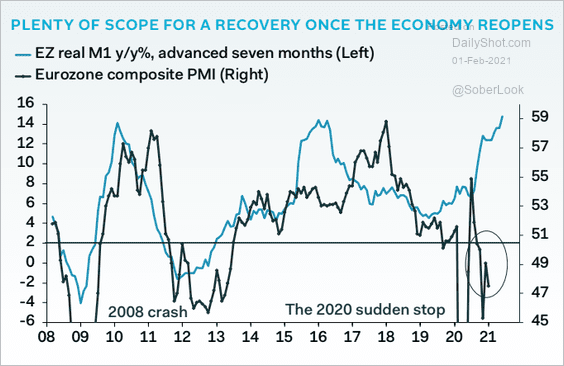

The rapid money supply expansion points to a potential rebound in economic activity once the pandemic is under control.

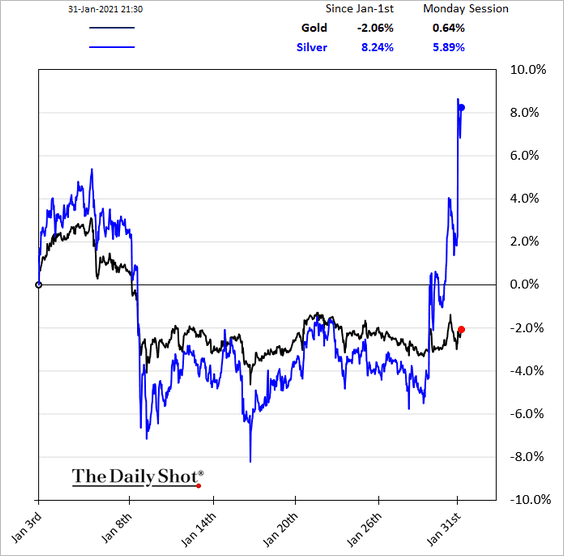

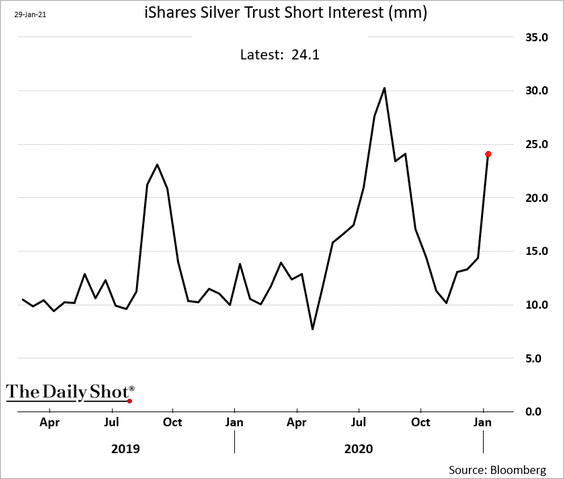

Commodities: The Reddit crowd is going after silver, …

… generating a short-squeeze in silver ETFs.

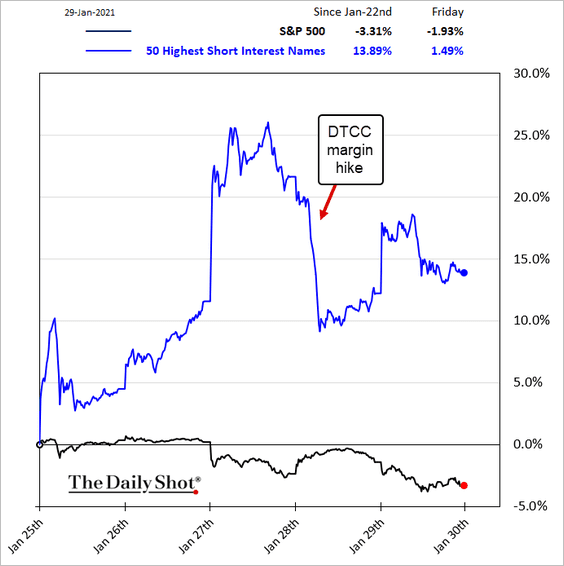

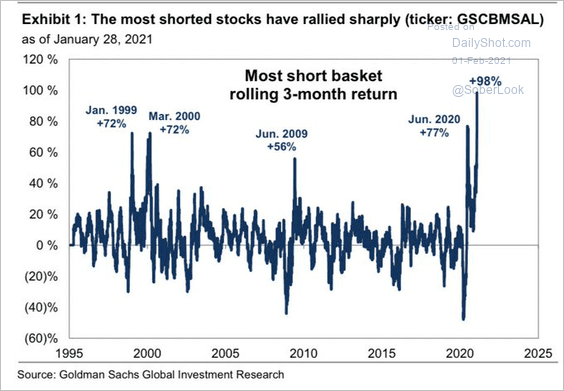

Equities: Most shorted names continued to outperform on Friday.

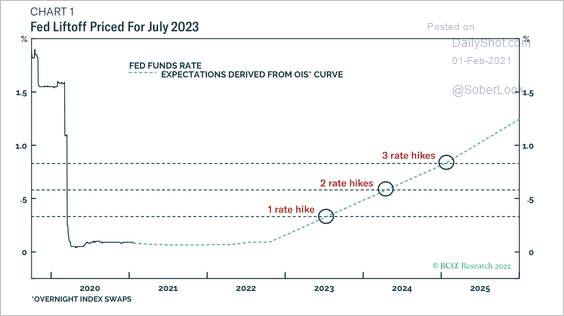

Rates: BCA Research expects a Fed rate hike in late-2022 or the first half of 2023.

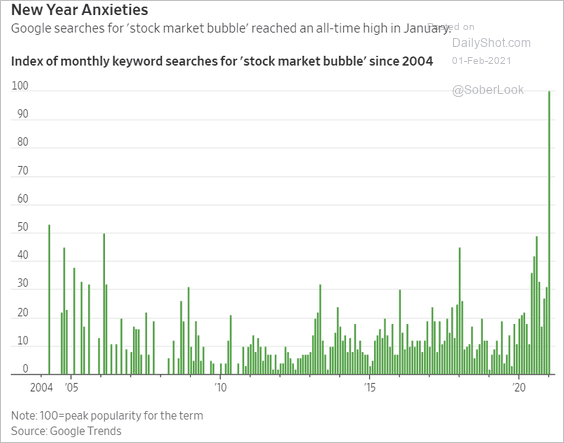

Food For Thought: Online search for “stock market bubble”:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com