Greetings,

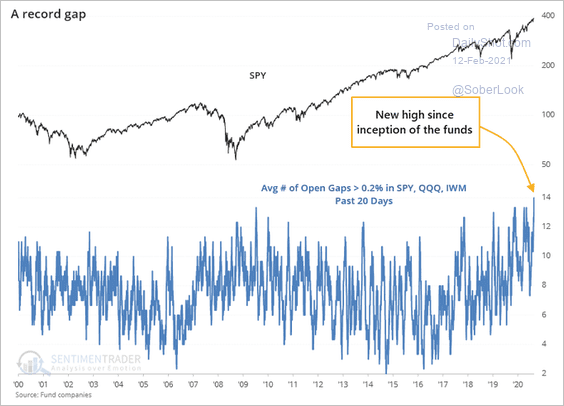

Equities: The most liquid US ETFs (SPY, QQQ, and IWM) have been gapping up at the open more frequently than ever before.

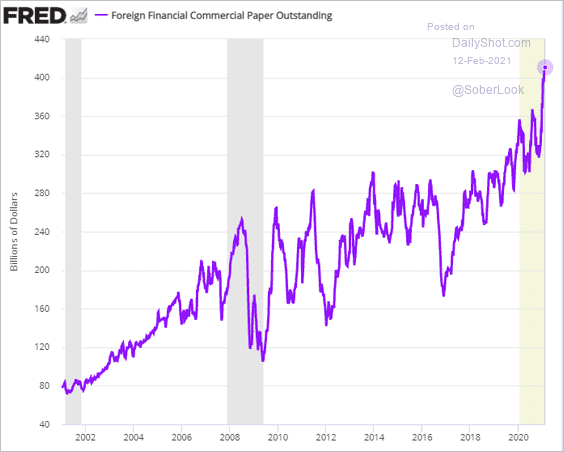

Credit: Foreign banks have been tapping the US commercial paper market. Unlike their US counterparts, foreign banks typically don’t have access to US dollar deposits. Given the massive spike in money-market fund AUM last year, there is plenty of demand for short-term paper.

Cryptocurrency: Crypto investors continue to enjoy a streak of positive news.

Bitcoin is pushing toward $50k.

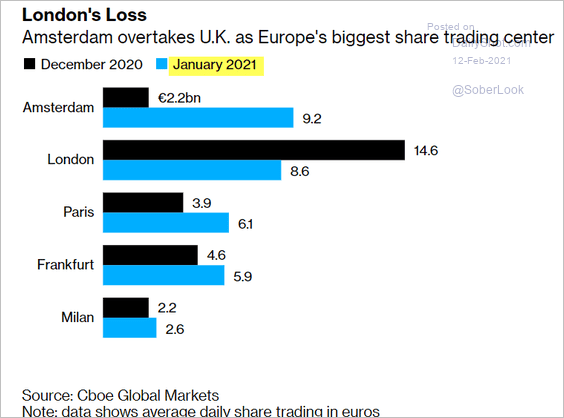

United Kingdom: Amsterdam has overtaken London as Europe’s largest share trading center.

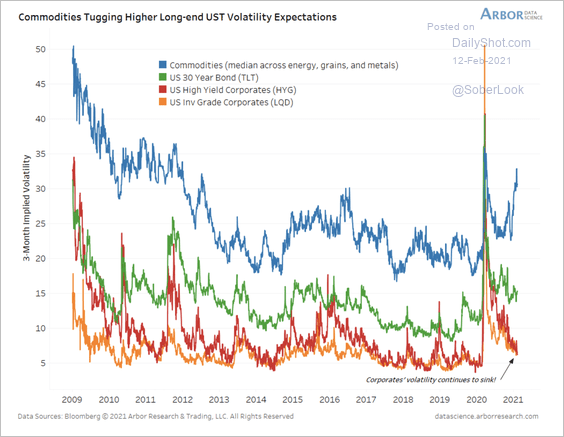

Credit: The average implied volatility across commodities rose over the past few months, while credit volatility continued to sink.

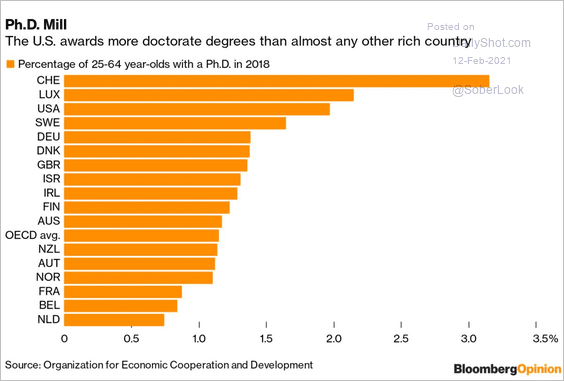

Food For Thought: Ph.D. percentages by country:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com