Greetings,

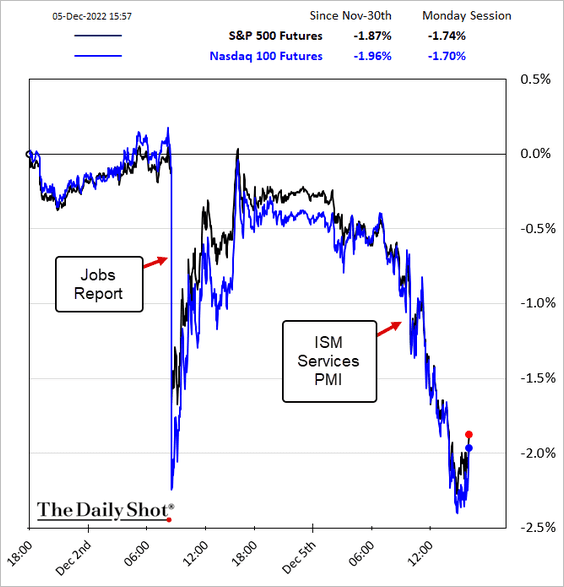

The United States: The stock market, which ended up taking Friday’s strong jobs report in stride, turned sharply lower on Monday in response to the ISM Services data that conveyed service sector resilience.

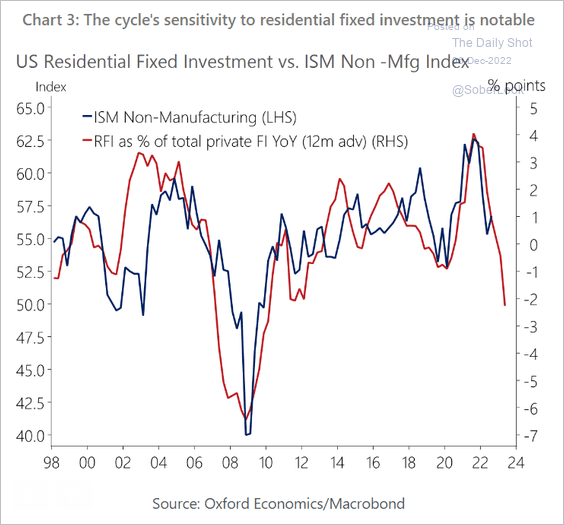

Despite the strong ISM Services report, tumbling residential investment (among other factors) will become a drag on the index.

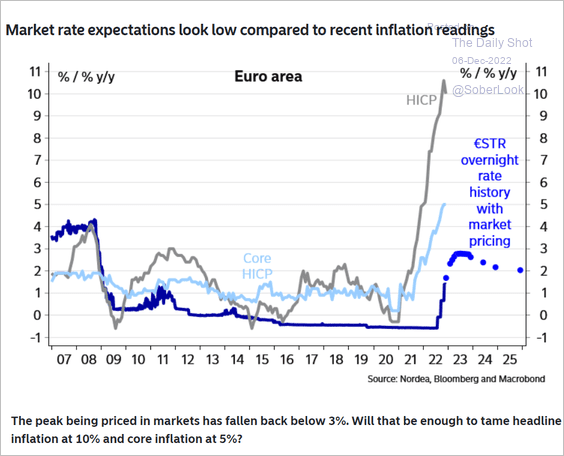

The Eurozone: The expected ECB terminal rate may be too low to tame red-hot inflation.

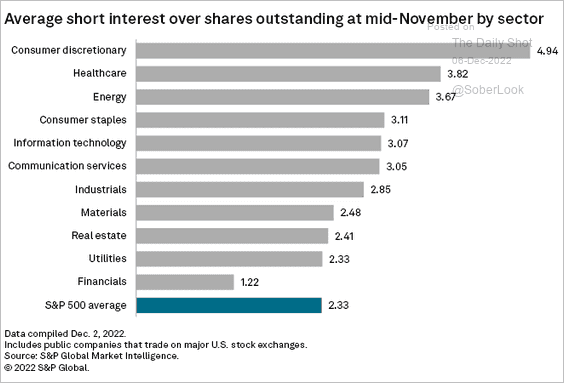

Equities: Here is short interest by sector.

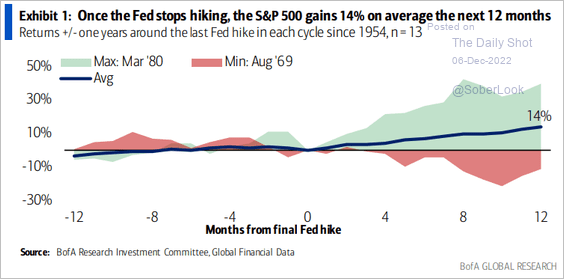

How does the S&P 500 perform after rate hikes stop?

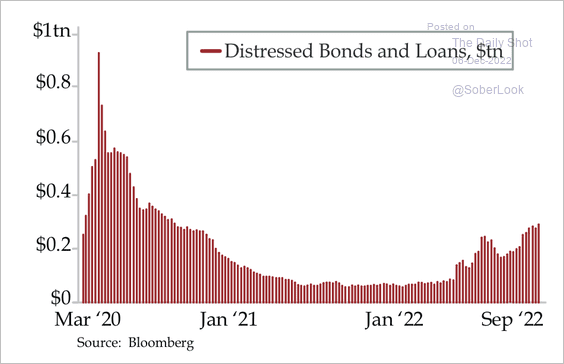

Credit: The amount of US distressed bonds and loans is rising, although well below 2020 levels.

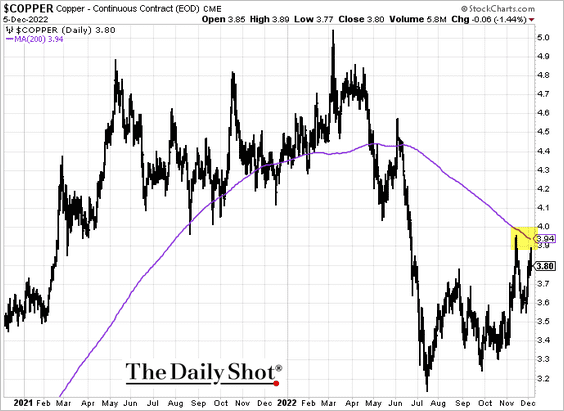

Commodities: Copper has been testing resistance at the 200-day moving average.

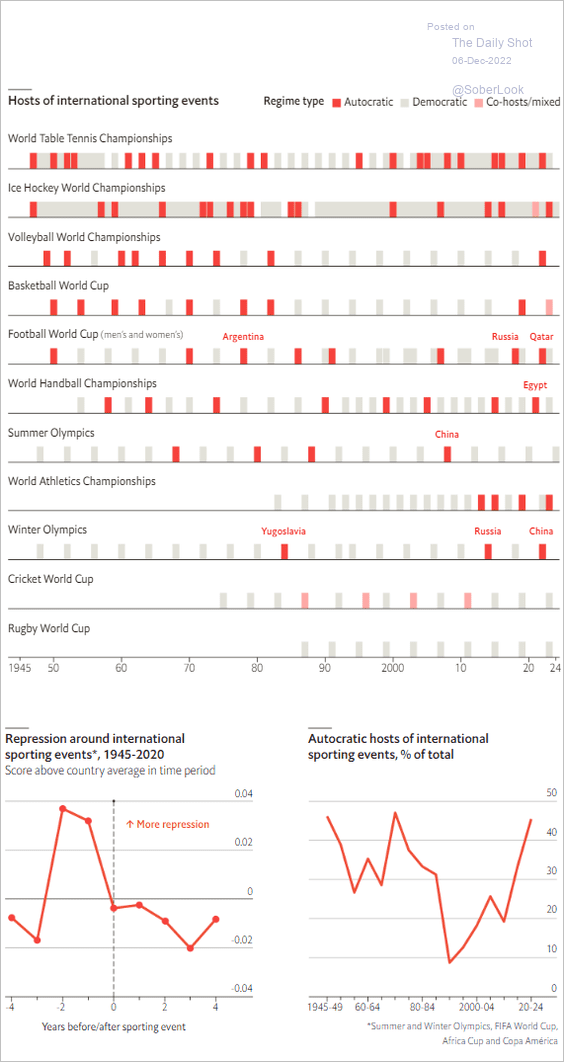

Food for Thought: Lastly, here are autocratic and democratic hosts of international sporting events:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com