Greetings,

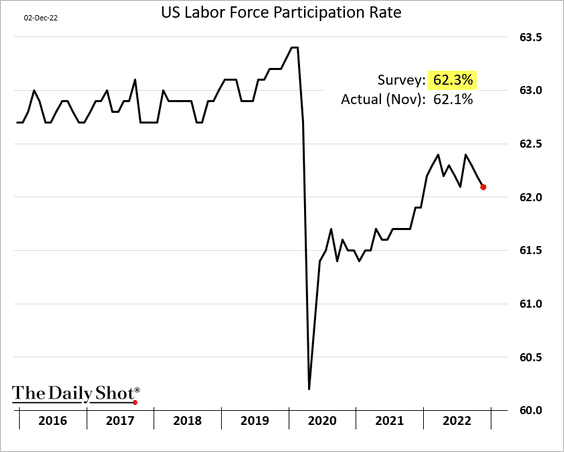

The United States: Labor force participation declined again, including prime-age workers, which could contribute to faster wage growth. This is not the trend the Fed wants to see.

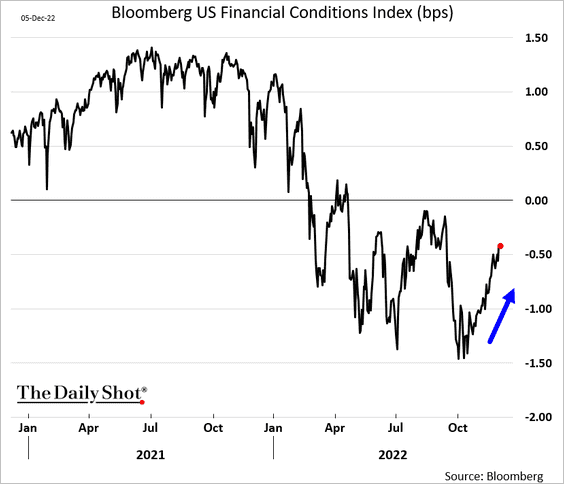

Given the recent improvement in US financial conditions, we could see the Fed’s terminal rate move higher.

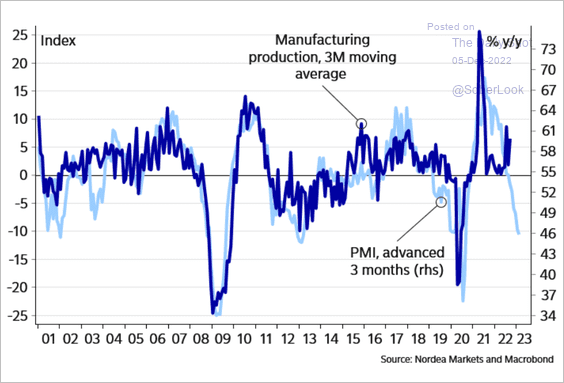

The Eurozone: Despite signs of inflation peaking, the expected ECB terminal rate appears to be too low to tame inflation.

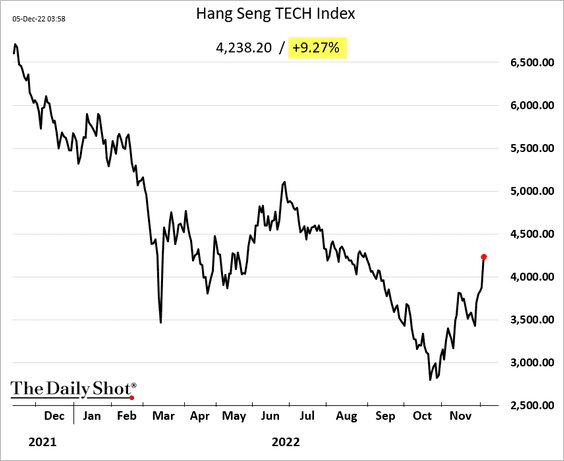

China: Stocks are surging as foreign capital returns – driven by easing lockdowns.

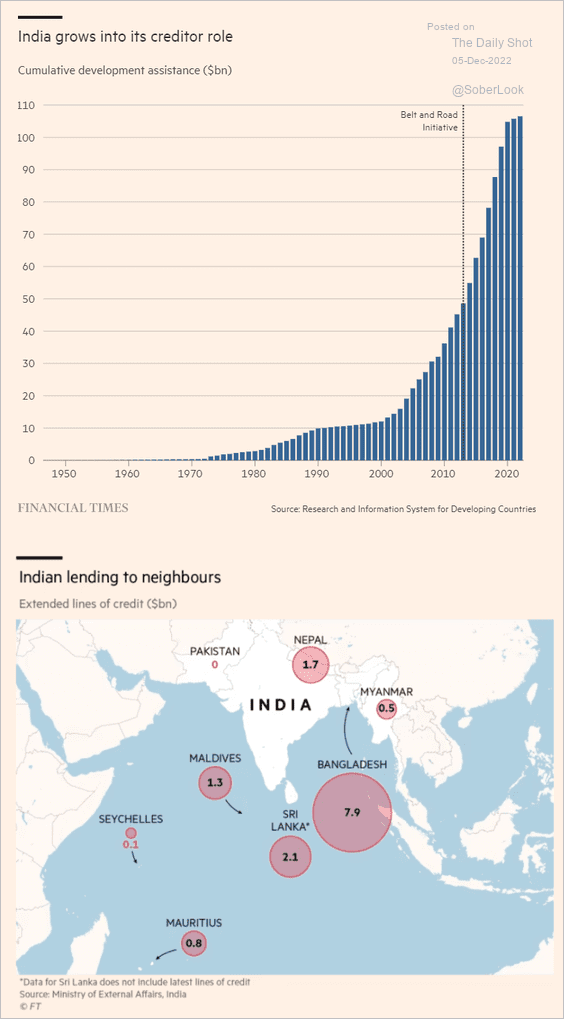

Emerging Markets: India has increasingly become a lender to other countries.

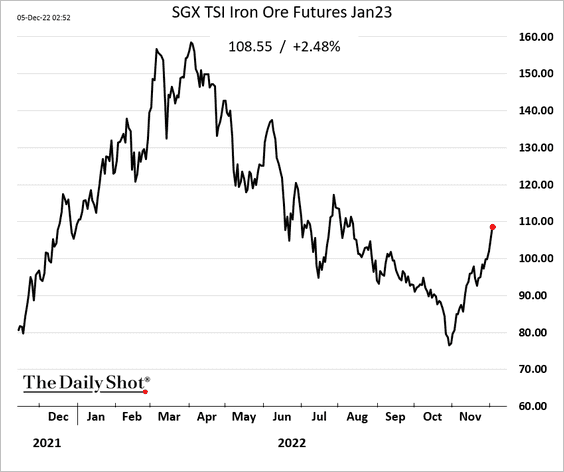

Commodities: Iron ore and other industrial commodities are rebounding on “China reopening” expectations.

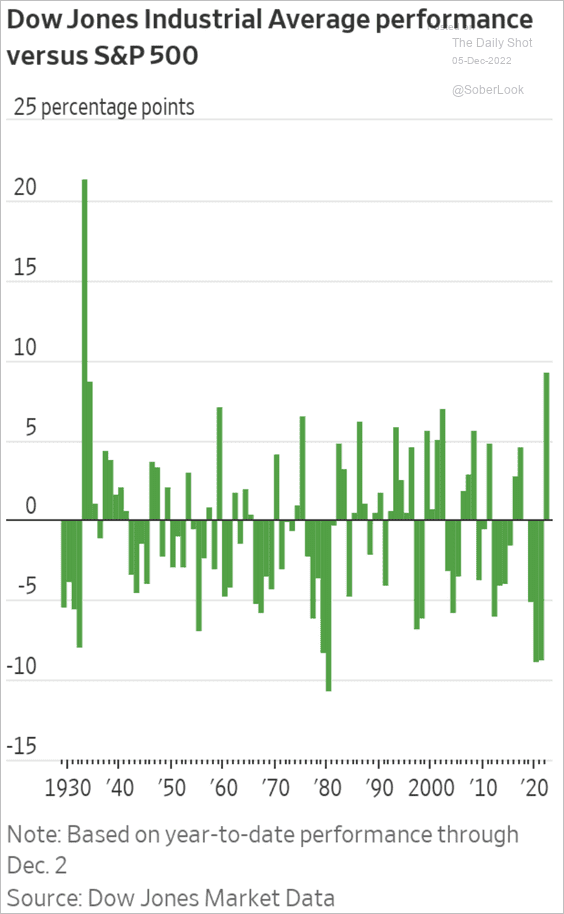

Equities: The Dow’s outperformance vs. the S&P 500 hasn’t been this large since the 1930s.

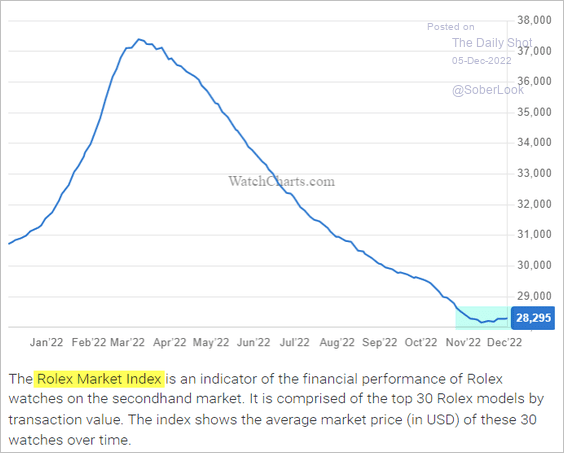

Food for Thought: The Rolex Price Index suggests that the luxury watch market may be bottoming.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com