Greetings,

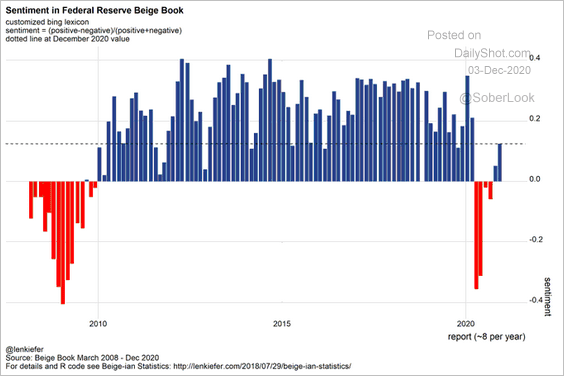

United States: The Fed’s Beige Book report appears to be somewhat more upbeat.

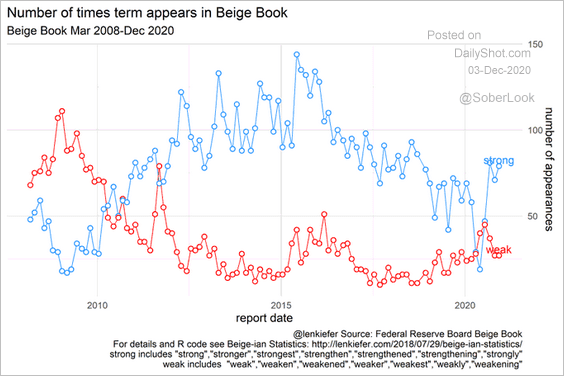

Here is the usage of the words “strong” and “weak.”

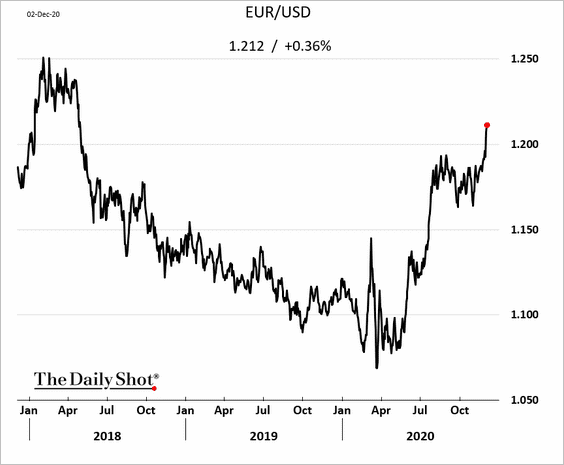

Eurozone: The euro continues to climb, exacerbating disinflationary pressures. This trend is bound to make the ECB nervous.

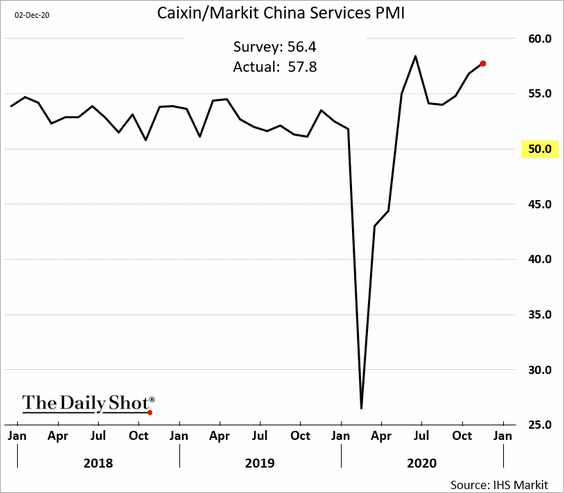

China: The nation’s service sector activity accelerated further last month.

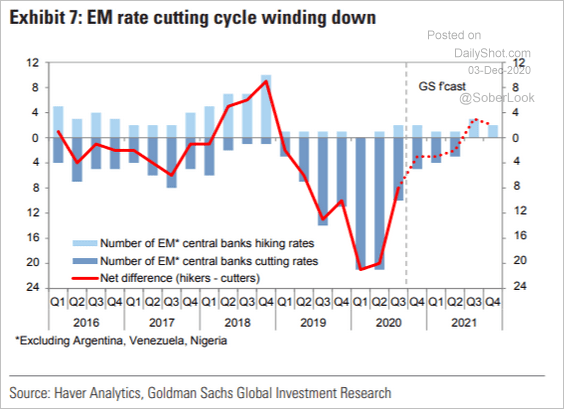

Emerging Markets: EM rate-cutting cycle is winding down, according to Goldman.

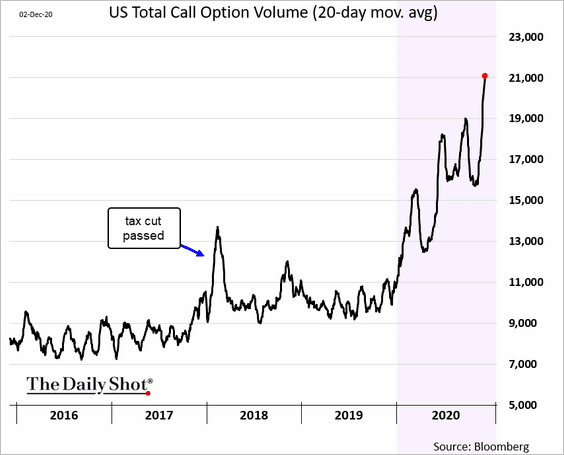

Equities: Demand for equity call options keeps climbing amid increasing speculative activity.

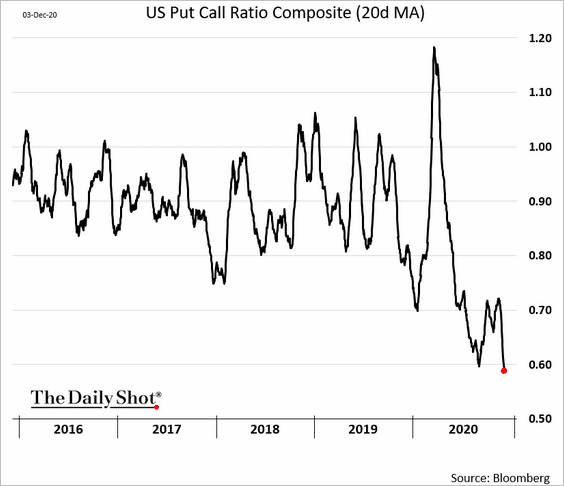

Here is the put-call ratio.

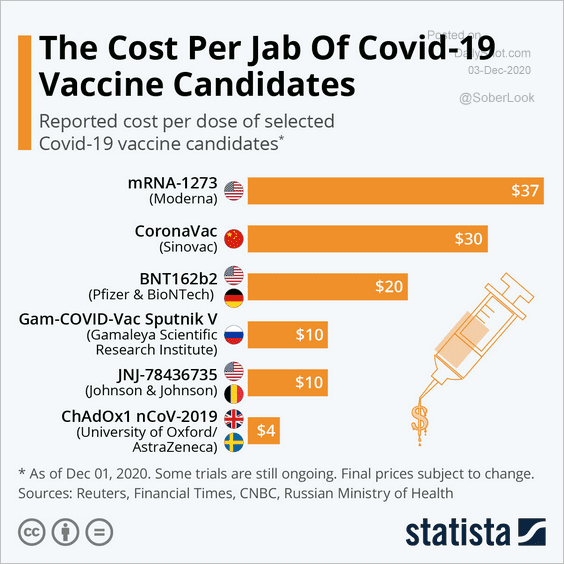

Food For Thought: Vaccine costs:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot