Greetings,

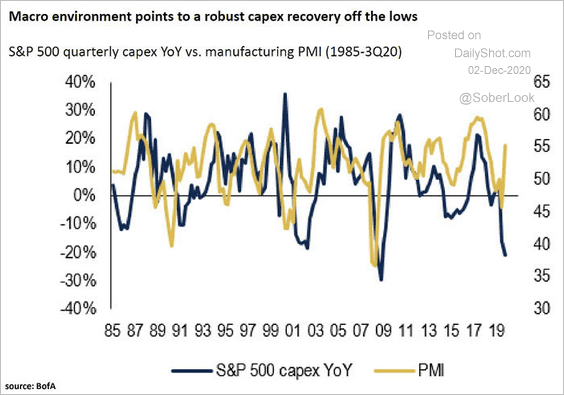

United States: Survey data, such as the ISM index above, point to improvements in business investment.

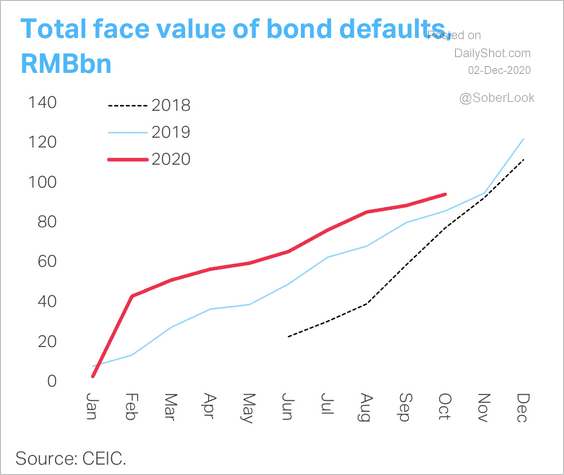

China: Increased defaults will lead to tighter liquidity for non-bank financial institutions, according to TS Lombard.

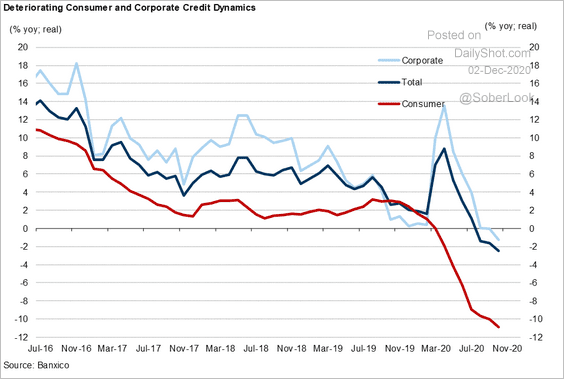

Emerging Markets: Mexico’s private credit continues to worsen.

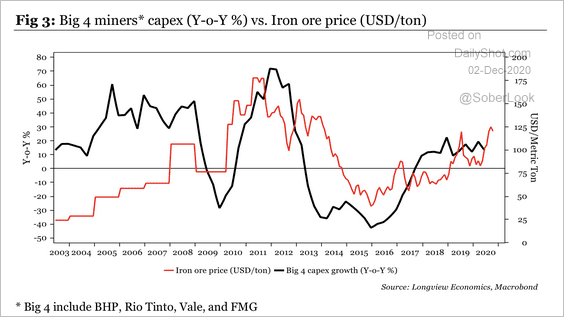

Commodities: Miners are adding new projects as iron ore prices rise.

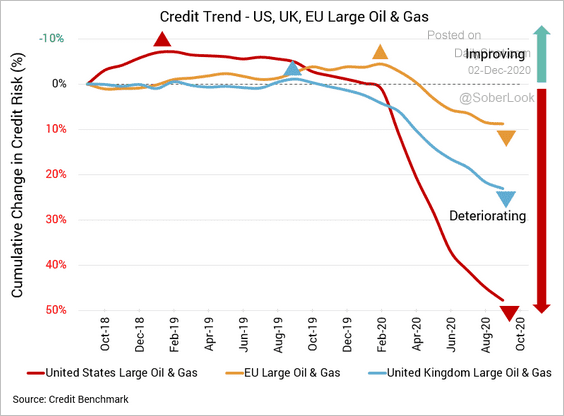

Energy: The US energy sector’s default risk is much higher than in the UK and EU.

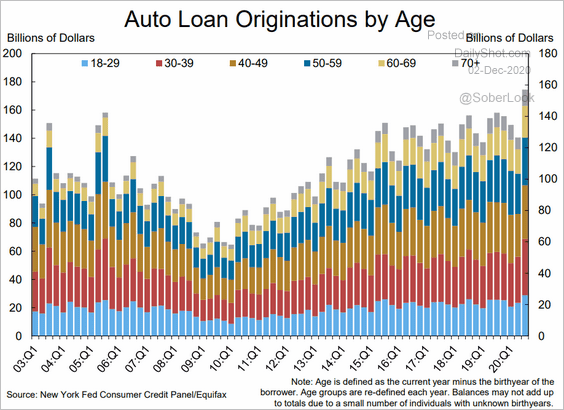

Food For Thought: US car loan originations by age:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot