Greetings,

Administrative Update: The Daily Shot Brief will not be published the week of December 27th.

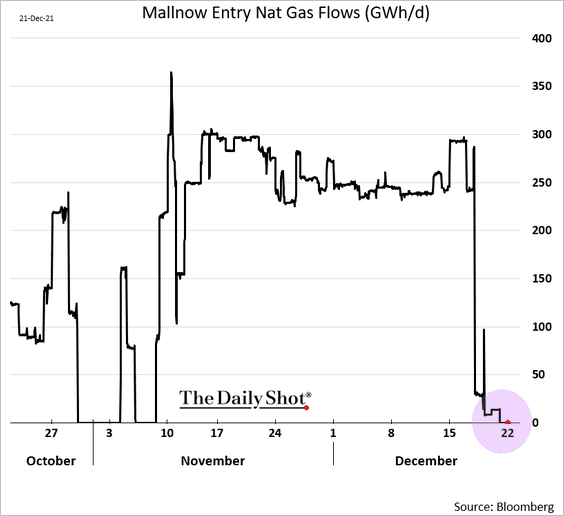

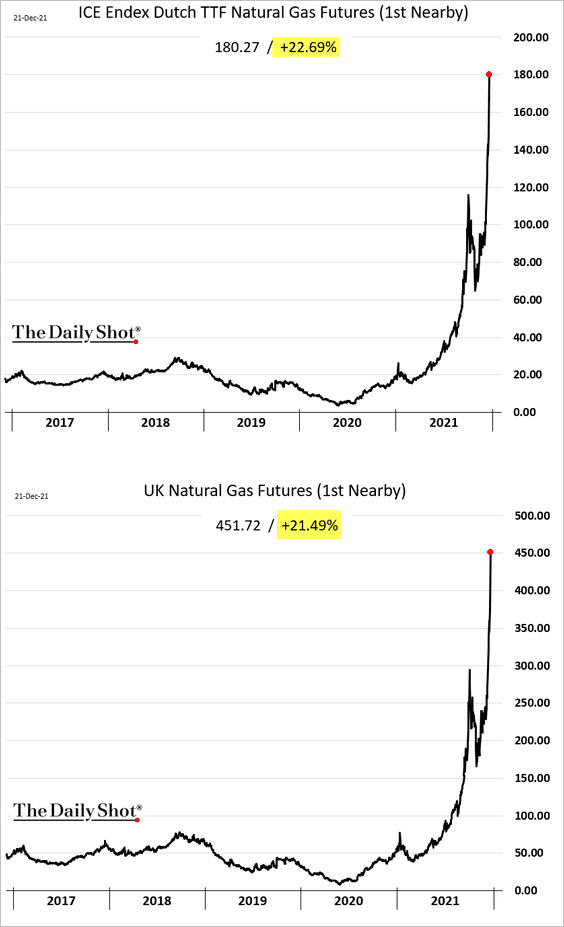

Energy: The European energy crisis continues to worsen as temperatures fall and Russia shuts off flows of natural gas.

Natural gas prices have gone vertical, jumping by over 20% in one day.

Europe competes with Asia for LNG, and it recently became more profitable for exporters to sell into Europe.

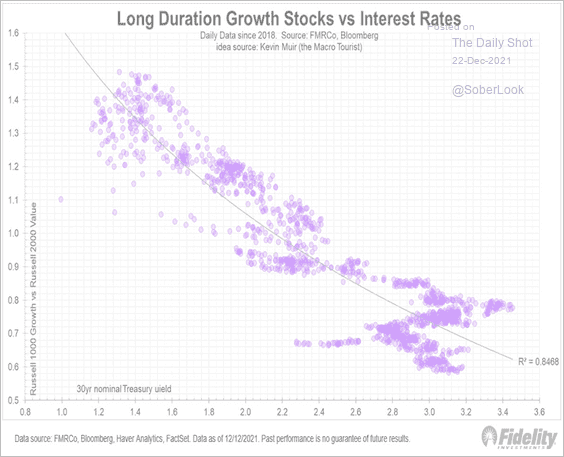

Equities: Long-duration (growth) stocks’ relative performance is highly sensitive to rates.

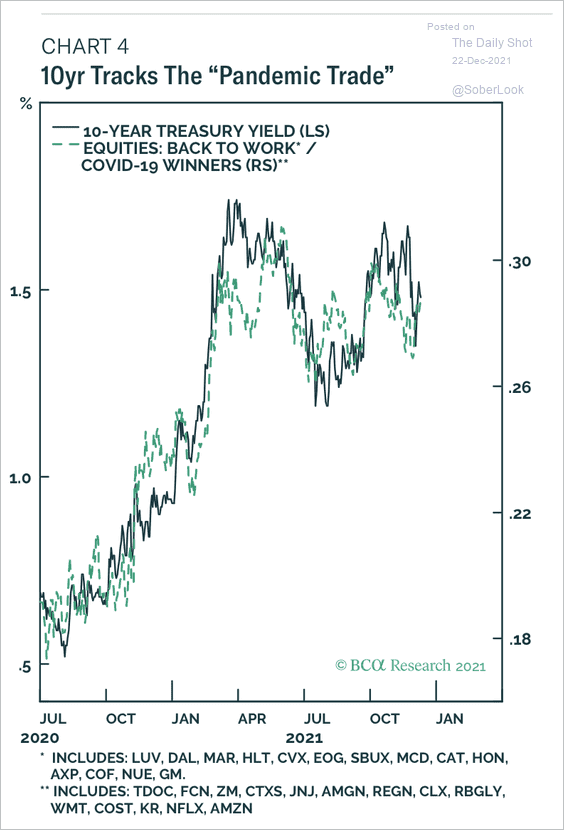

On the other hand, “reopening” stocks have moved in tandem with the 10-year Treasury yield over the past year (relative to COVID “winners”).

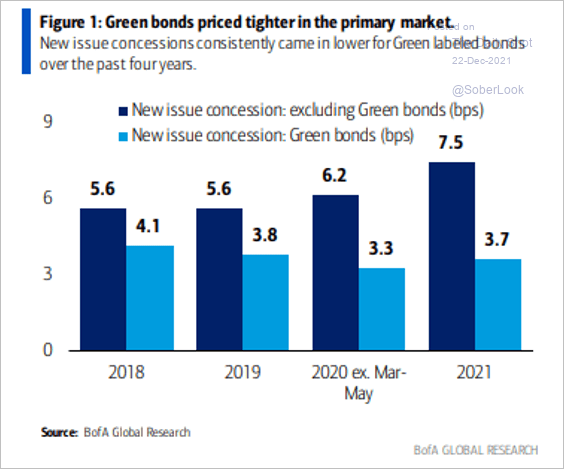

Credit: New-issue green bonds have been priced tighter than the overall market amid rising demand.

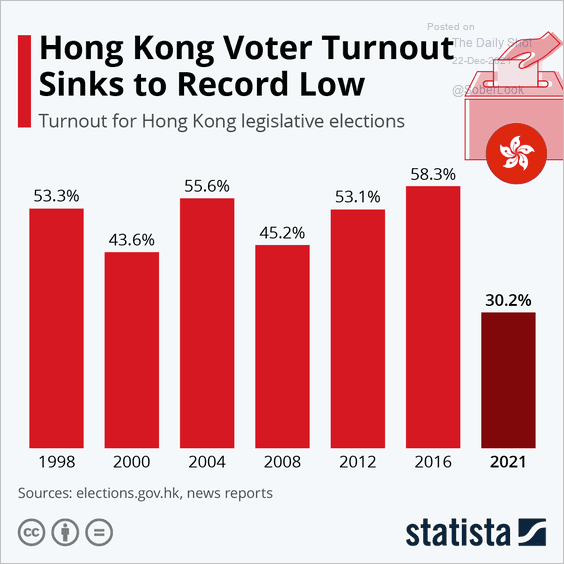

China: Hong Kong voter turnout tanked this year.

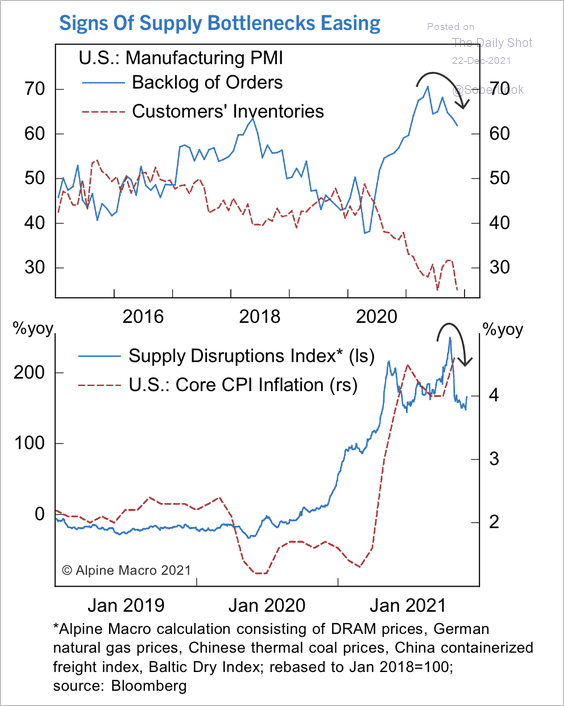

United States: Supply bottlenecks are starting to ease, which could reduce inflationary pressures.

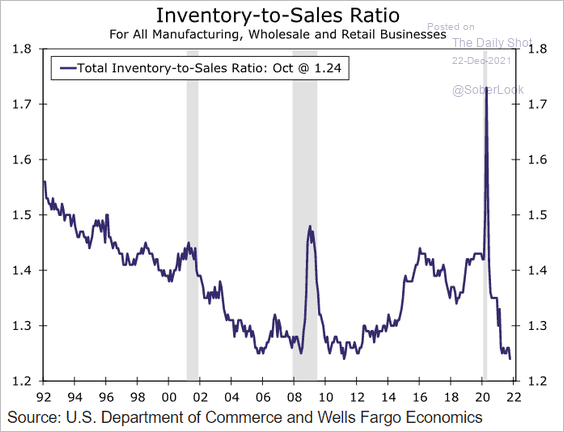

Will we finally see a rebound in the inventories-to-sales ratio?

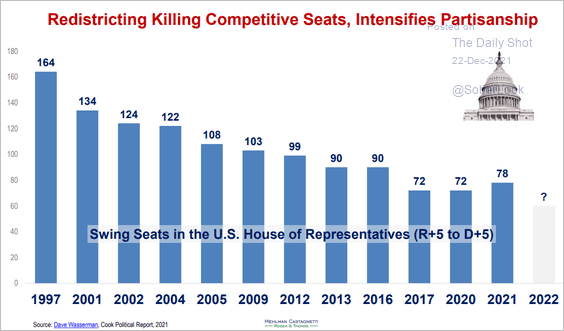

Food for Thought: Disappearing swing seats in the House of Representatives:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com