Greetings,

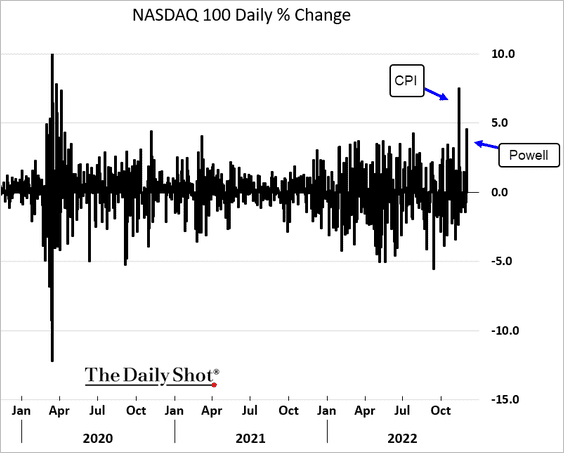

Equities: Stocks surged in response to Chair Powell’s dovish comments.

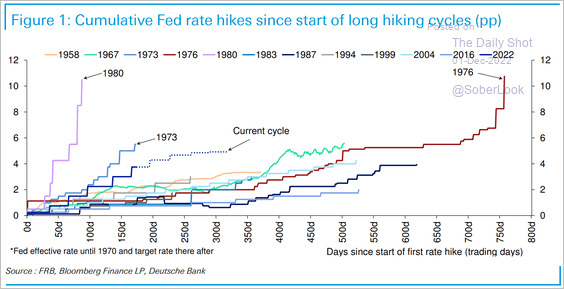

Rates: So far, the current Fed rate hike cycle is the fifth largest in magnitude and the fifth shortest in duration.

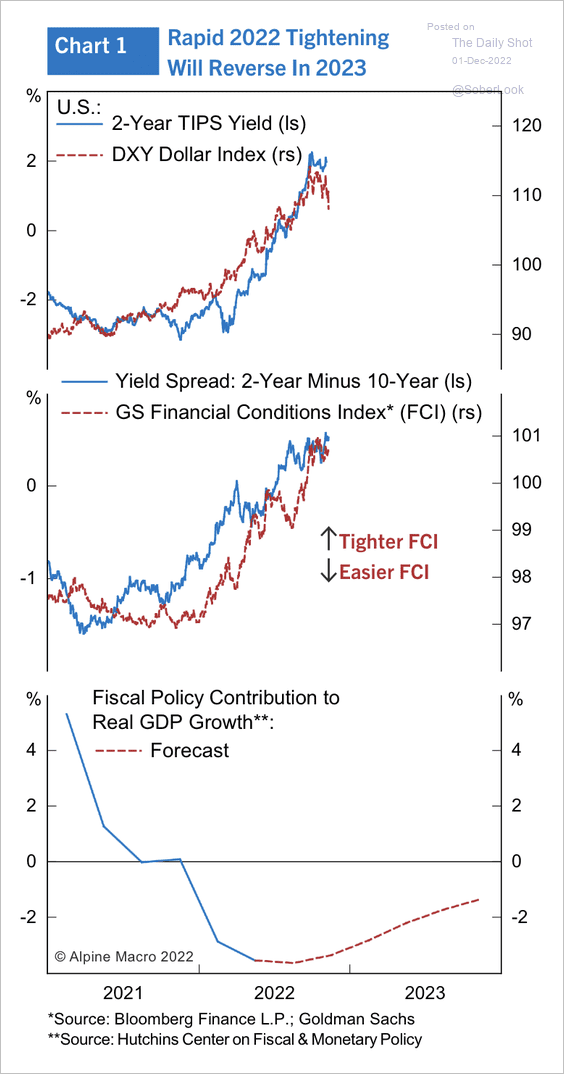

Alpine Macro expects markets to front-run a Fed pivot, triggering a reversal in yields. Is this the end of “monetary overkill?”

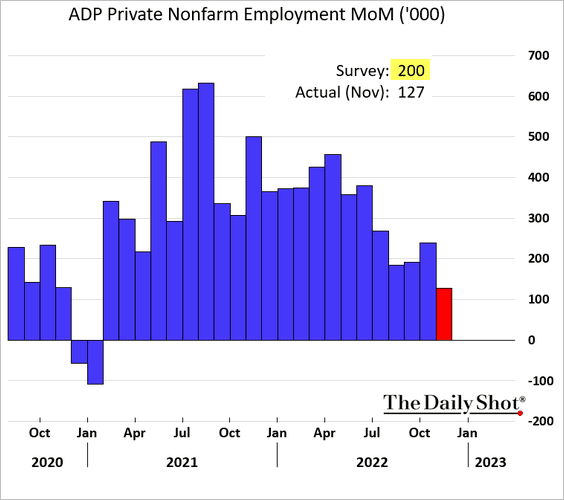

The United States: Alongside Chair Powell’s comments, a softer-than-expected November ADP private payrolls report boosted stocks and bonds. Hiring appears to be slowing rapidly.

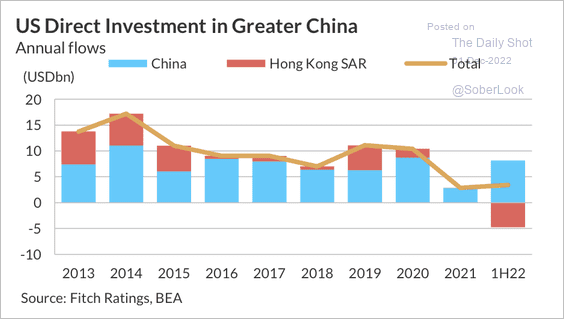

China: US overseas direct investment into greater China has slowed but is on track to partially recover this year. There are also signs of disinvestment from Hong Kong.

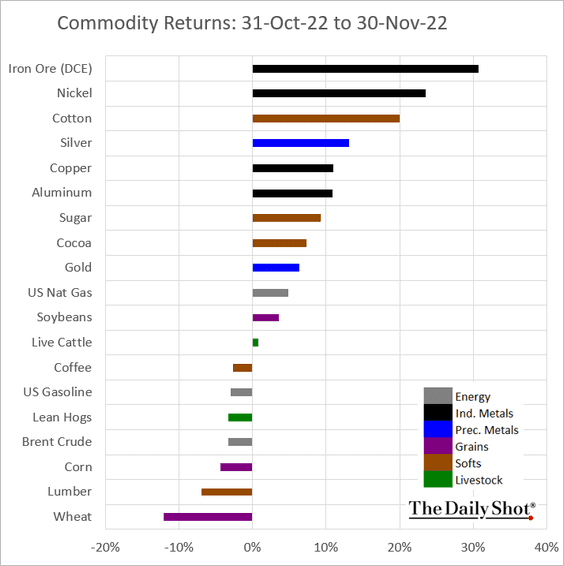

Commodities: Here is November performance data across key commodity markets. Some industrial commodities (like iron and aluminum) are rebounding amid hope for China’s reopening.

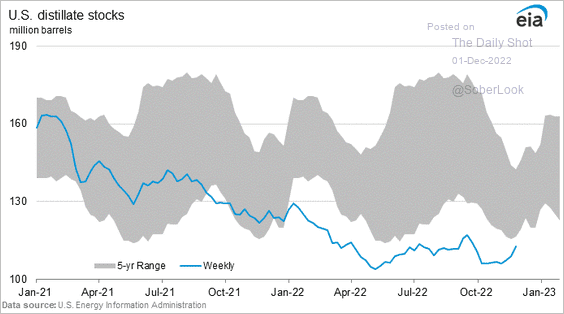

Energy: Distillates inventories appear to be recovering.

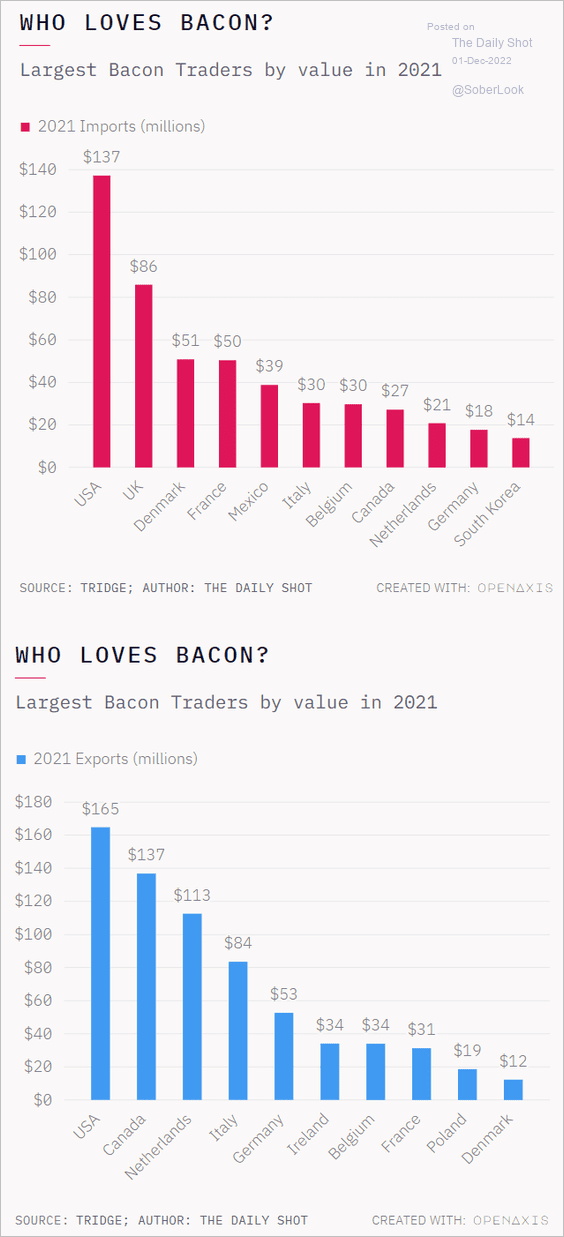

Food for Thought: To conclude, here are the largest importers and exporters of bacon:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com