Greetings,

United States: The Fed provided guidance for its asset purchases on Wednesday, with language suggesting that QE could continue for some time.

FOMC: … the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.

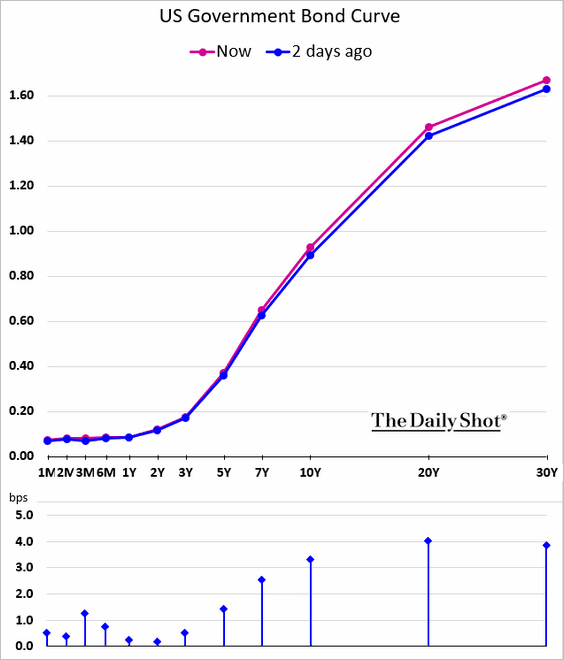

The market was a bit disappointed, with some expecting the central bank to boost the average maturity of bonds purchased. The yield curve steepened slightly in response.

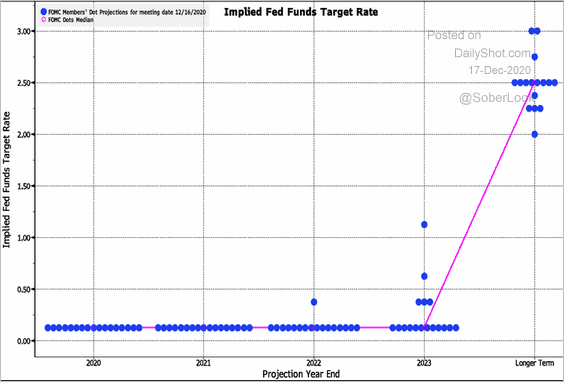

According to the FOMC’s dot plot, the fed funds rate will remain near zero through the end of 2023.

United Kingdom: The CPI surprised to the downside.

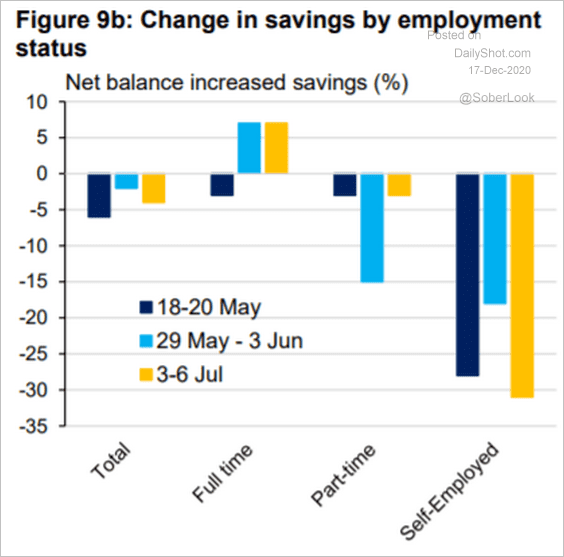

Savings declined the most among self-employed workers.

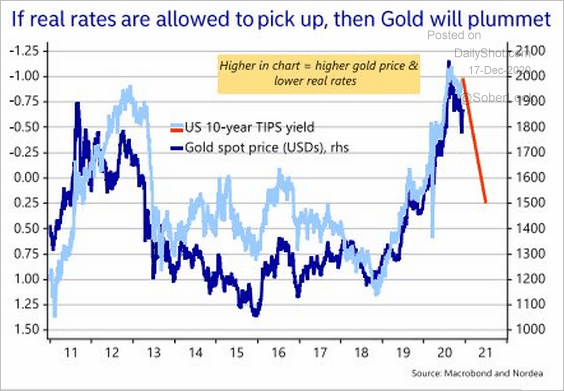

Commodities: Will gold come under pressure if real rates climb next year?

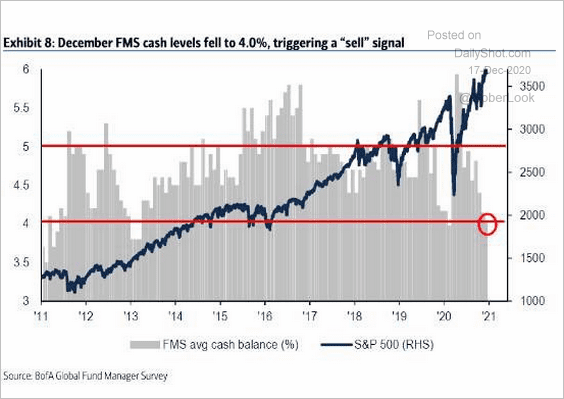

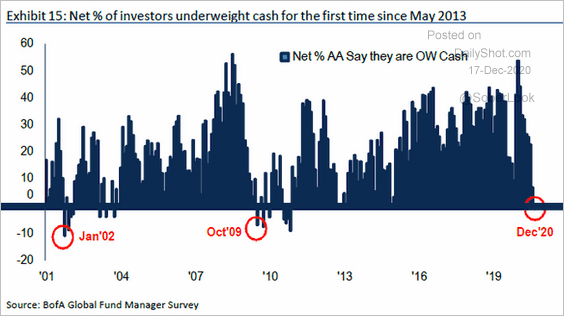

Equities: Fund managers are all-in, with cash levels at multi-year lows (2 charts).

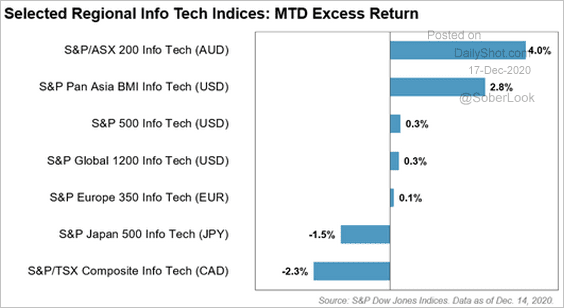

Global Developments: The tech sector has slowed its ascent in the US but has continued to climb in Australia. Here is a breakdown by select regions.

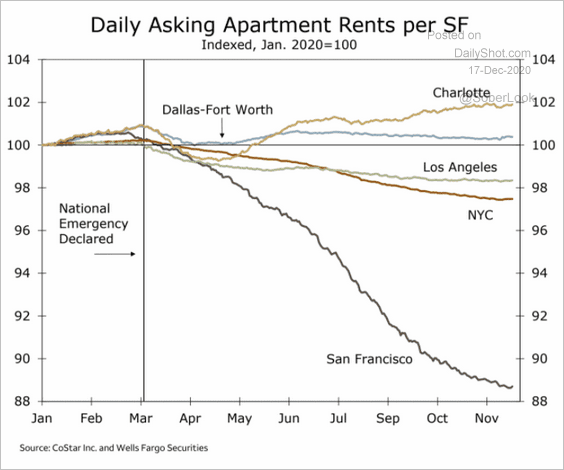

Food For Thought: Apartment rents in select cities:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot