Greetings,

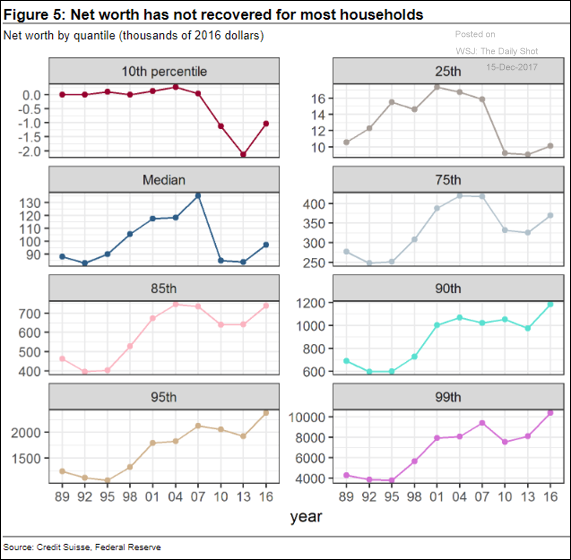

The United States: Overall, American’s net-worth has been climbing, but the improvements have been highly uneven.

That’s why the mean net worth is now above the pre-recession peak, while the median is not even close. The two indicators have completely diverged.

A big part of the disconnect has to do with the ownership rates of stocks and houses being sharply lower for the less-wealthy groups.

China: Dollar-denominated bond issuance spiked this year.

The Eurozone: The ECB left its monetary policy unchanged but upgraded the GDP forecasts: +0.5% for 2018 to 2.3% and +0.2% for 2019 to 1.9%. The 2020 growth is projected to be 1.7%. The central bank raised its inflation forecast slightly (due to higher oil prices) but left the core CPI unchanged.

Credit: Outflows from leveraged loan funds continue.

Emerging Markets: Brazil’s retail sales have bifurcated between industries that are sensitive to income vs. those sensitive to credit.

Bitcoin: The number of cryptocurrencies spiked this year.

Food for Thought: Lying on your resume.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com