Greetings,

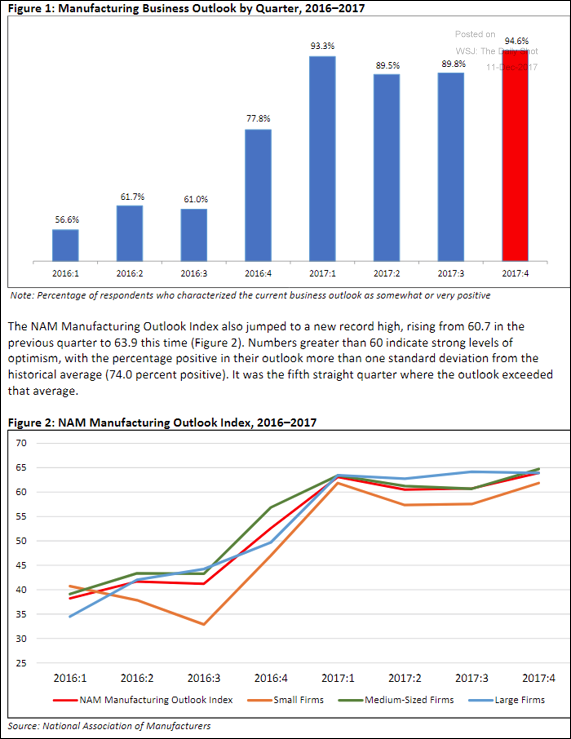

The United States: US manufacturers are increasingly optimistic. The impending corporate tax cut is expected to give this sector a boost.

And just like commercial builders, manufacturers are having a tough time hiring/retaining quality workers. High healthcare costs are also a problem.

Rates: JP Morgan says that when real fed funds rates hit 1%, we are in the “late cycle” territory

The Eurozone: The implied volatility in the euro hit a multi-year low despite the uncertainty around Italian elections. And there is quite a bit of anti-EU sentiment in Italy (second chart).

Credit: Negative convexity and tight spreads limit the upside in high-yield bonds.

Emerging Markets: The EM non-resident portfolio flows turned negative.

Asia: Singapore has dramatically boosted its national wealth over the past three decades. It has been suggested that the legislators’ incentive compensation was one of the reasons. A 17% corporate tax rate is another.

Energy Markets: Oil implied volatility keeps hitting multi-year lows as downside risks are priced out of the market.

Bitcoin: All of a sudden there is interest in buying futures. What could possibly the reason?

Food for Thought: Compare how much cost/value research you do when buying a car or a TV vs. purchasing health insurance.

How disciplined are you in saving for emergencies or retirement vs. healthcare?

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com