Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount). To subscribe, please register here and use the coupon number DSB329075 (please click the “apply” button for the discount to take effect). A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

If you are a Wall Street Journal subscriber, please see the announcement here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot

Greetings,

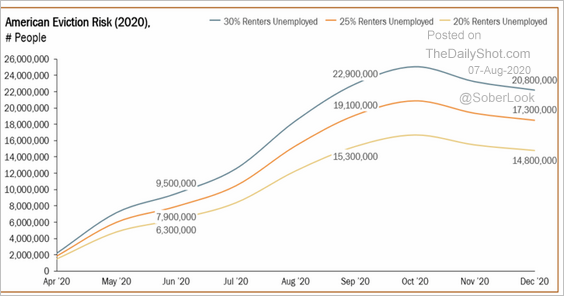

United States: The trajectory of US unemployment will determine the number of evictions (which are expected to peak in October).

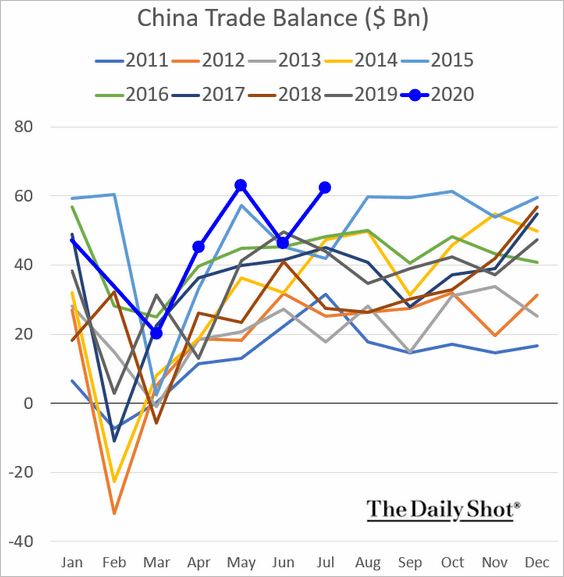

China: Exports have been robust, boosting China’s trade surplus to multi-year highs.

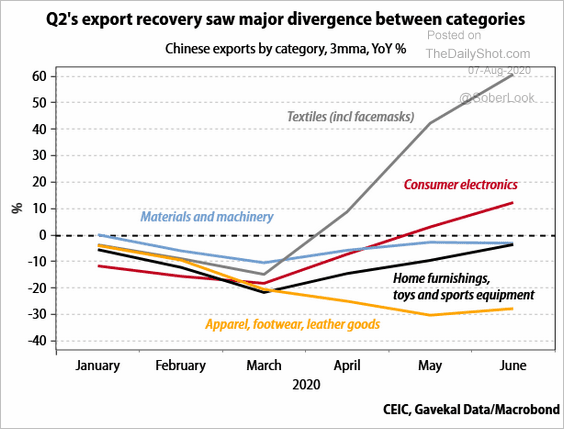

But the rebound in exports has been uneven across sectors.

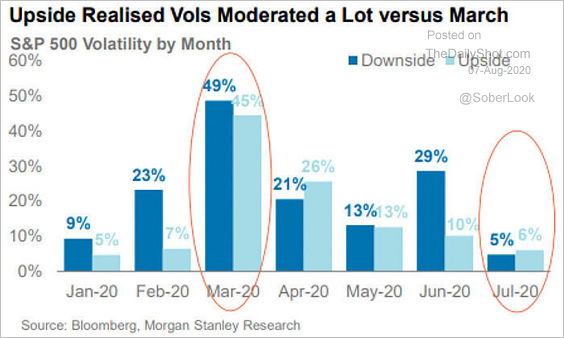

Equities: Downside volatility is at the lowest levels of the year.

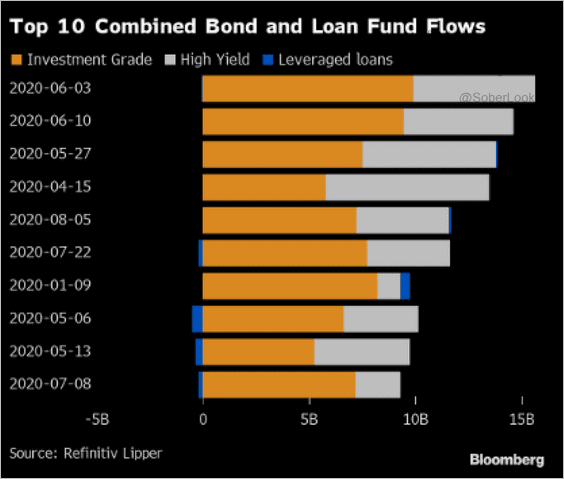

Credit: The biggest weekly flows into corporate bond and loan funds have occurred this year.

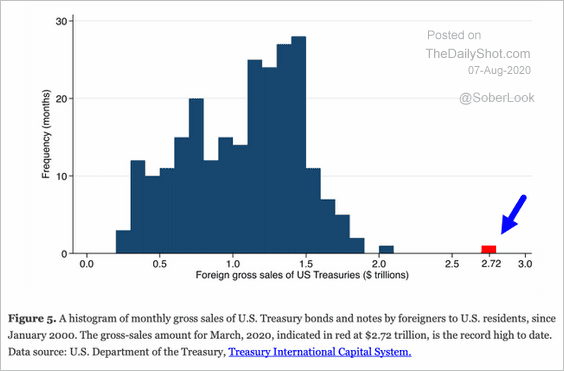

Rates: The chaos in the Treasury market at the start of the crisis had little to do with hedge funds (despite some media reports). It was all about foreign corporations, governments, and central banks selling US debt to raise liquidity.

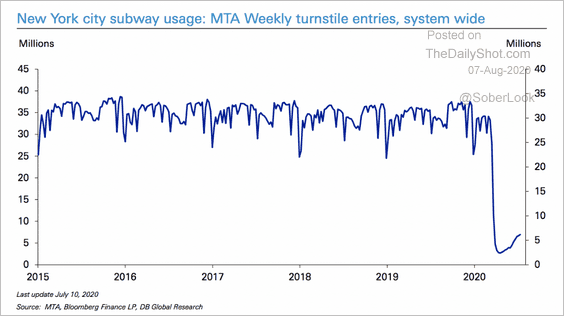

Food For Thought: New York City subway ridership:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Subscribe to the Daily Shot Brief