Greetings,

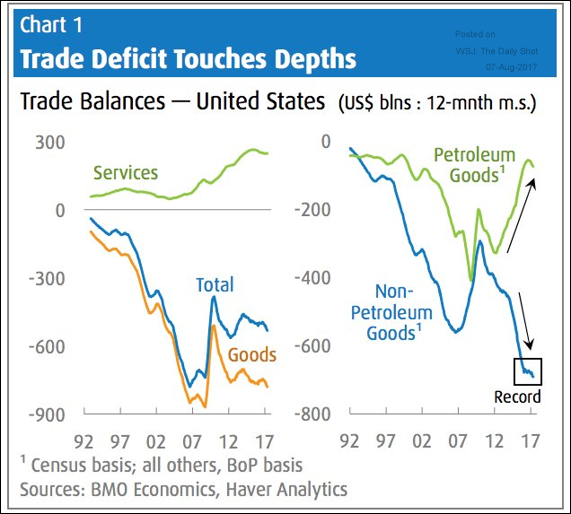

The United States: US trade deficit excluding petroleum products hit a new record.

Canada remains the biggest export destination for most states.

Finally, here are the exports to China. This chart indicates which states will struggle the most in the case of a US-China trade war.

Credit: The retail sector credit situation continues to deteriorate.

Equity Markets: US companies with the greatest sales exposure to the US (as opposed to global sales) have underperformed.

Emerging Markets: Saudi Arabia is facing a credit contraction as bank liquidity growth slows sharply.

The Eurozone: Is the ECB going to overestimate its inflation projection again? Will lower inflation counterbalance the negative impact of a stronger euro?

Is the central bank overestimating the Eurozone wage growth as the unemployment rate declines?

Energy Markets: The declines in global crude oil stockpiles have accelerated.

Food for Thought: Views on transgender bathroom use by country.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com