Greetings,

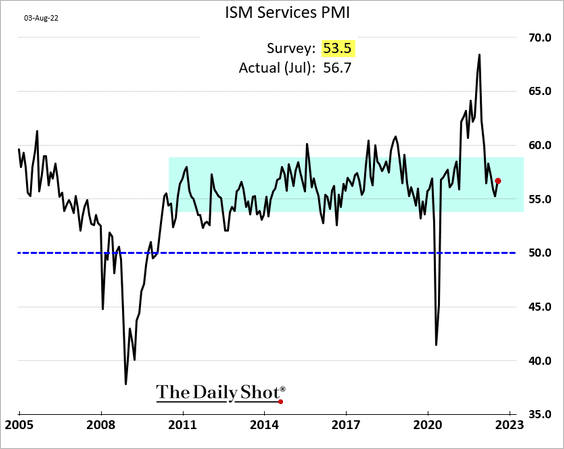

The United States: The July ISM Services PMI topped expectations. The report is not signaling a recession.

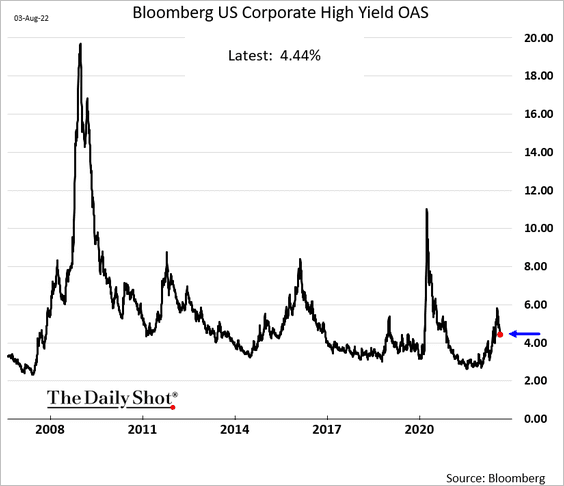

It should be noted that different indicators are providing mixed signals for the trajectory of the economy. The high-yield bond market suggests that the US will avoid a recession.

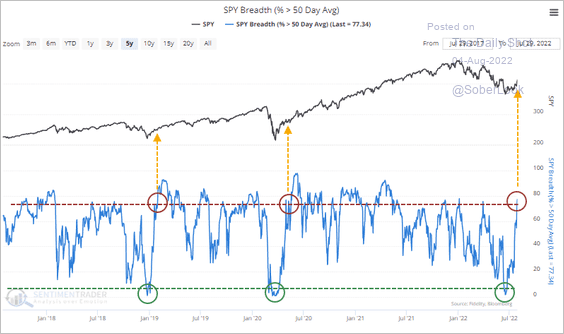

Equities: A majority of stocks are above their 50-day moving average, which typically leads to further market gains.

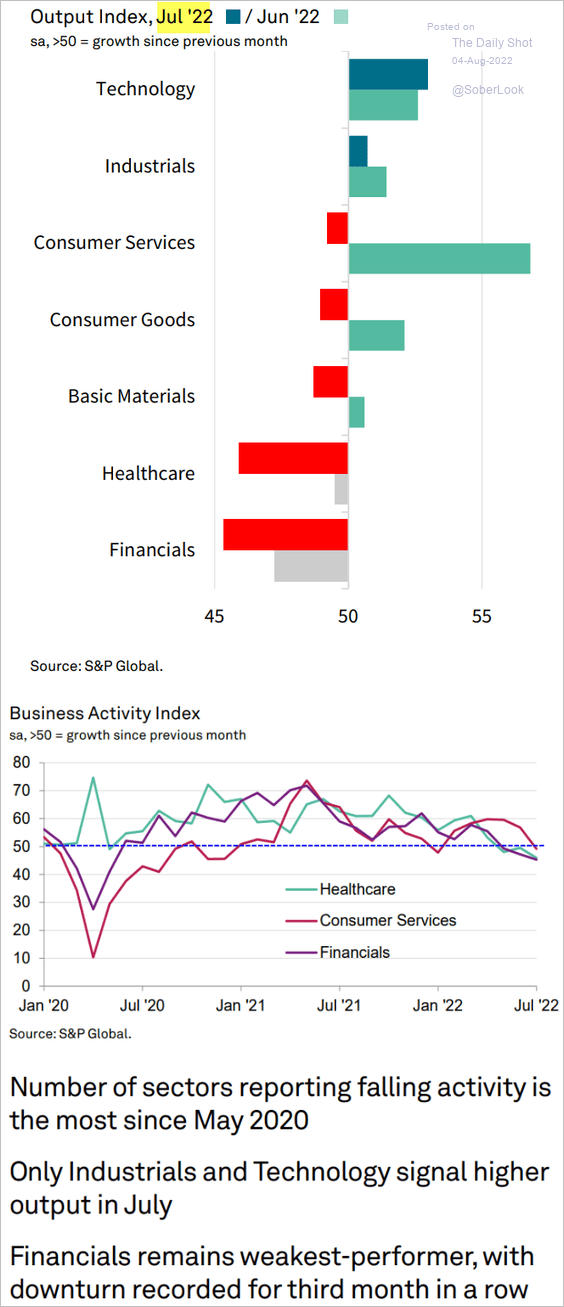

Outside of tech, most US sectors saw softer business activity growth or a contraction in July.

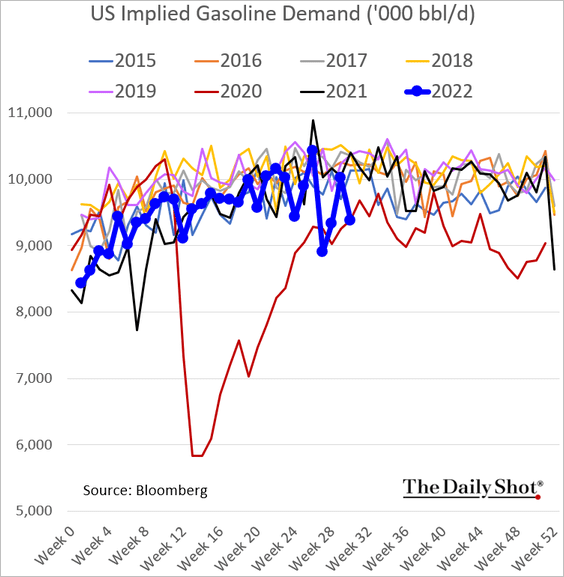

Energy: US gasoline demand tumbled last week.

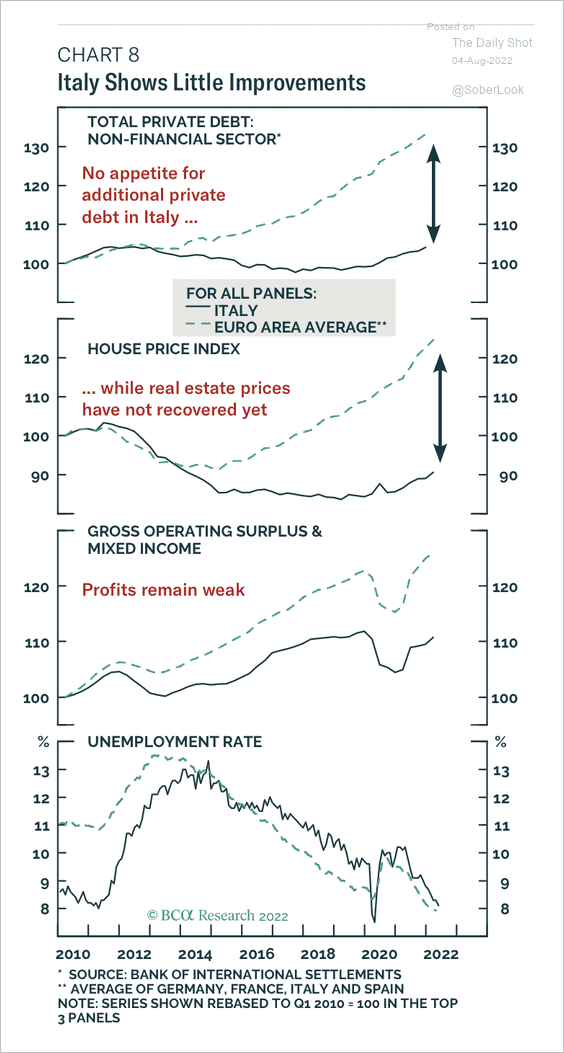

The Eurozone: Italian private credit, house prices, and profits have lagged far behind the European average.

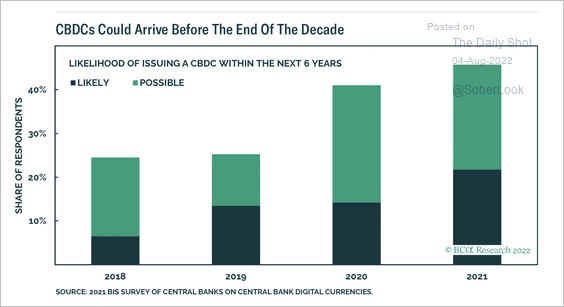

Cryptocurrency: More central banks believe that central bank digital currencies (CBDC) issuance is likely before the end of the decade, according to a survey by BIS.

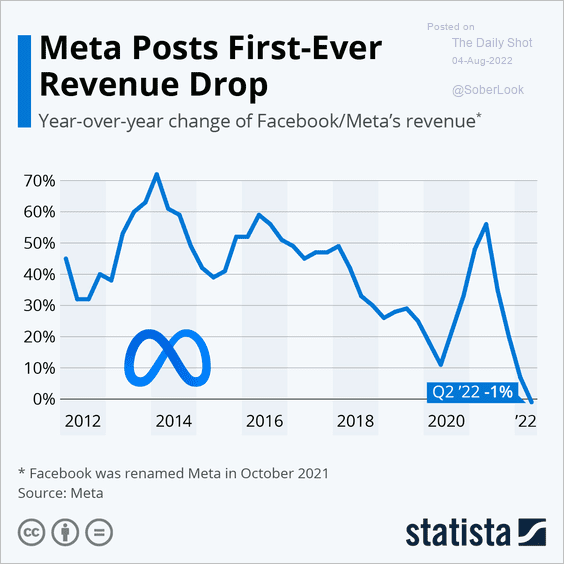

Food for Thought: To finish, here is Meta’s revenue growth over the past decade:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com