Greetings,

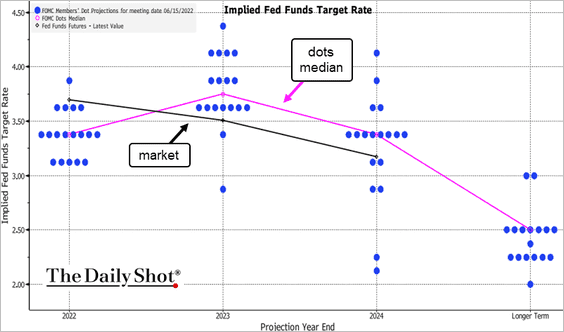

The United States: To begin, Powell’s Jackson Hole speech brought the market into a closer alignment with the FOMC’s dot plot.

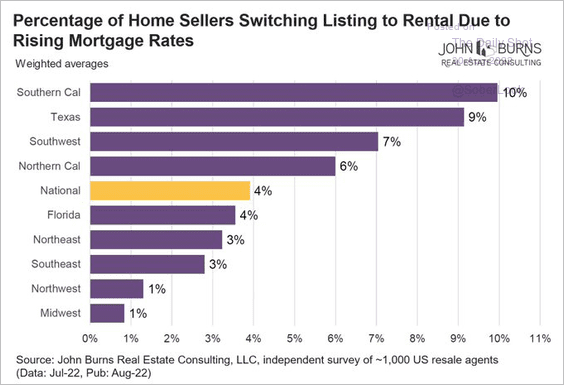

With slowing demand in the housing market, more sellers are switching their listings to rentals.

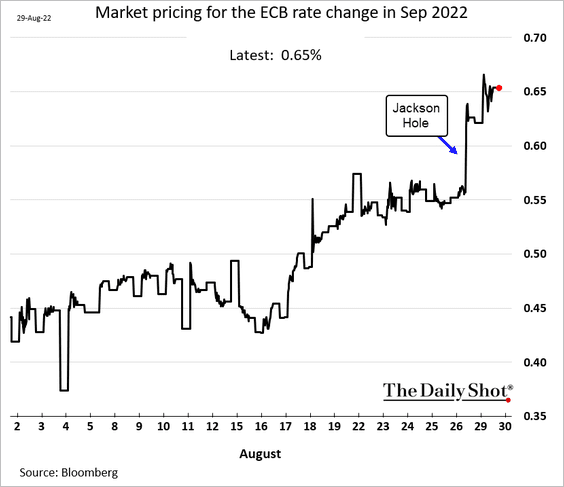

The Eurozone: A 75 bps ECB rate hike in September looks increasingly likely.

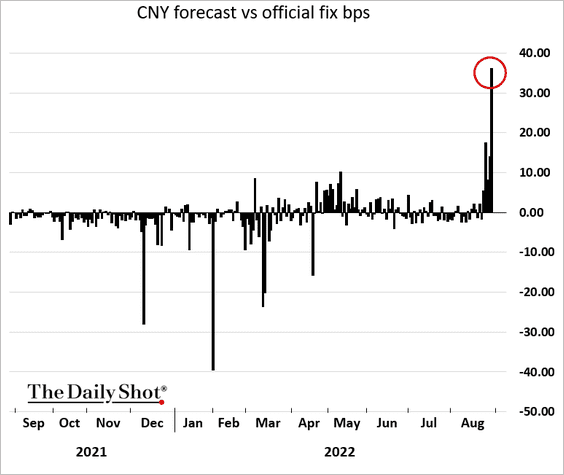

China: To counter renminbi depreciation, Beijing is now prodding the currency higher.

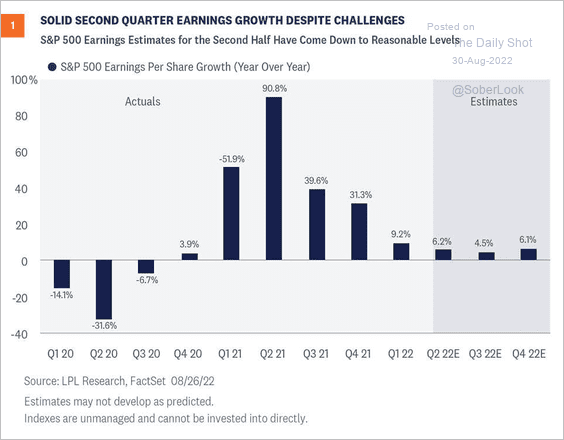

Equities: Earnings growth is expected to slow but remains positive on a year-over-year basis.

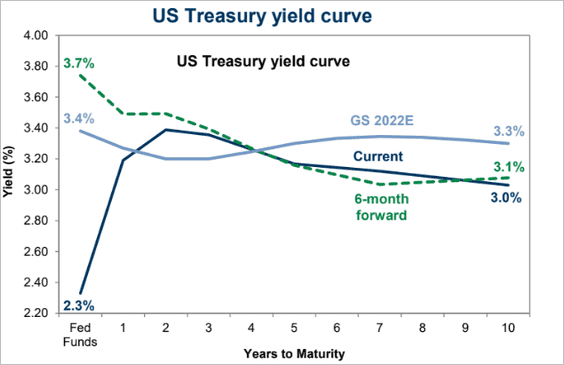

Rates: As the Treasury Yield curve continues to flatten/invert, markets are pricing in a full inversion in six months.

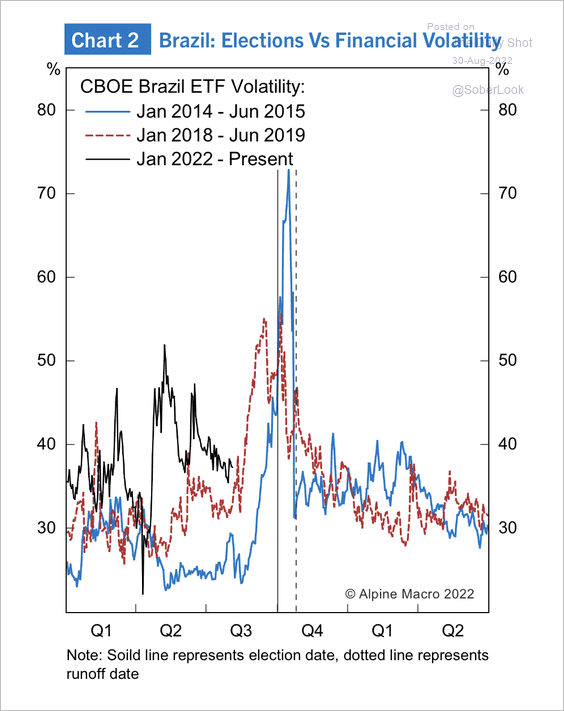

Emerging Markets: Brazilian equities have seen volatility spikes ahead of elections in previous cycles.

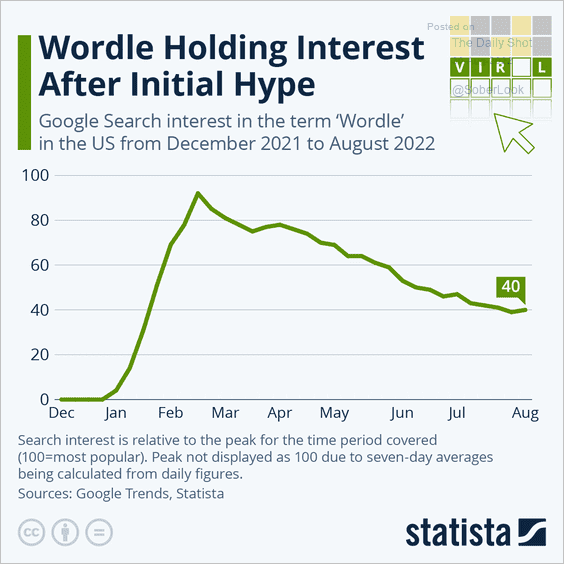

Food for Thought: Lastly, here is how search interest for Wordle evolved over the past months:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com