Greetings,

Administrative Update

1. Please note that The Daily Shot will not be published on Friday, September 3rd and Monday, September 6th.

2. All administrative updates are posted online.

United States: Fed Chair Powell reiterated the central bank’s intention to begin tapering later this year if the economy performs as expected. However, Powell decoupled taper from rate hikes.

The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.

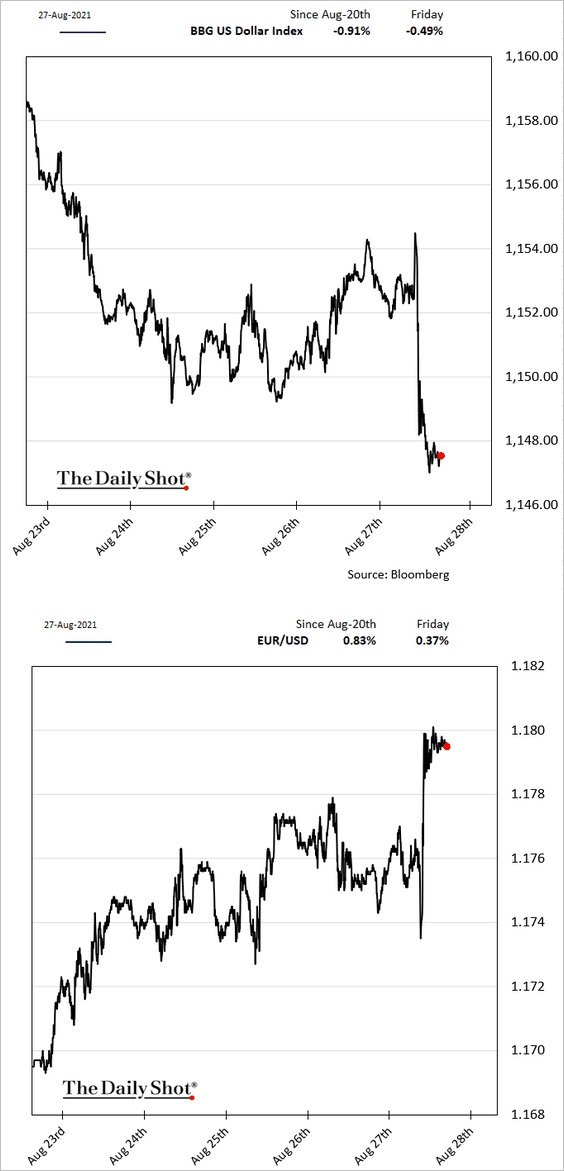

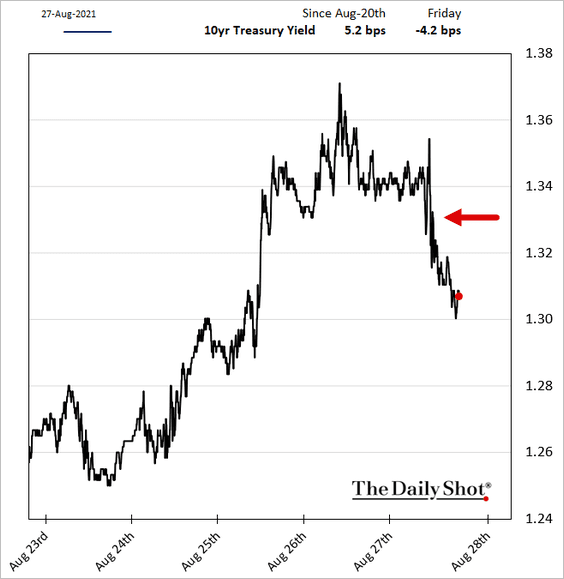

The dollar and Treasury yields slumped.

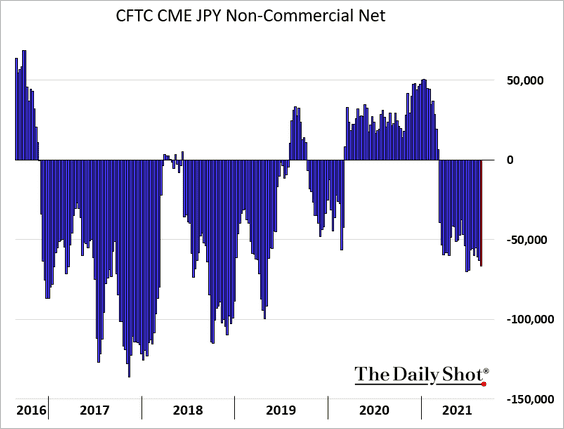

Japan: Speculators remain short the yen (often the short leg of carry trades).

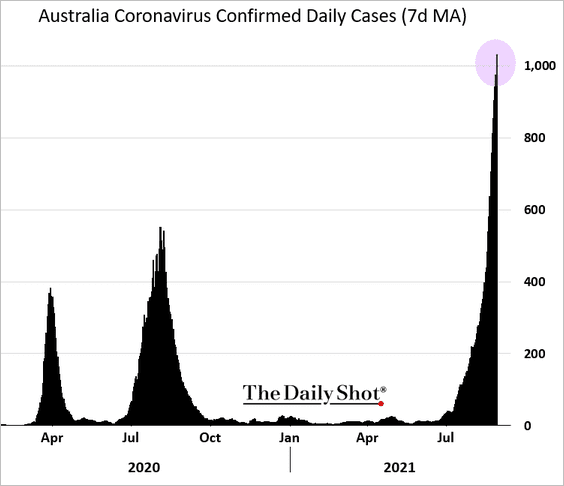

Asia-Pacific: Australia’s COVID cases hit a new high.

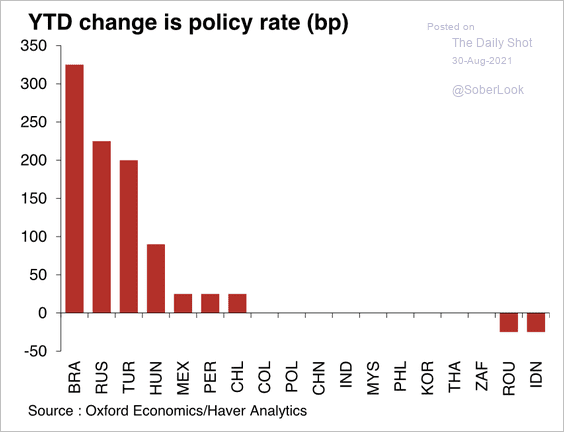

Emerging Markets: Many EM central banks have aggressively hiked rates since the beginning of this year.

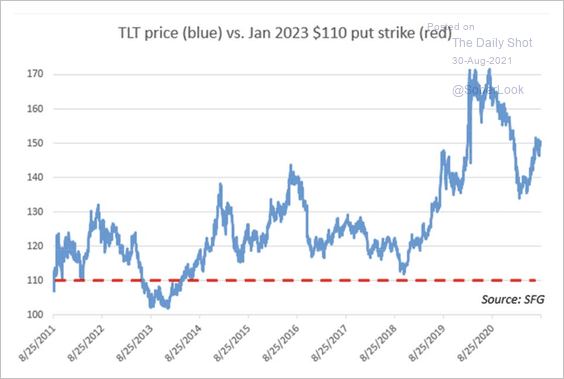

Rates: Last week, an investor sold 10K Jan. 2023 $110 puts in the iShares 20+ Year Treasury bond ETF (TLT). The last time TLT was trading below $110 was in 2014.

The investor may be betting that long-term Treasury yields will top out well below the highest levels from the financial crisis, or it could be a hedge against a short Treasury position, according to Chris Murphy at Susquehanna.

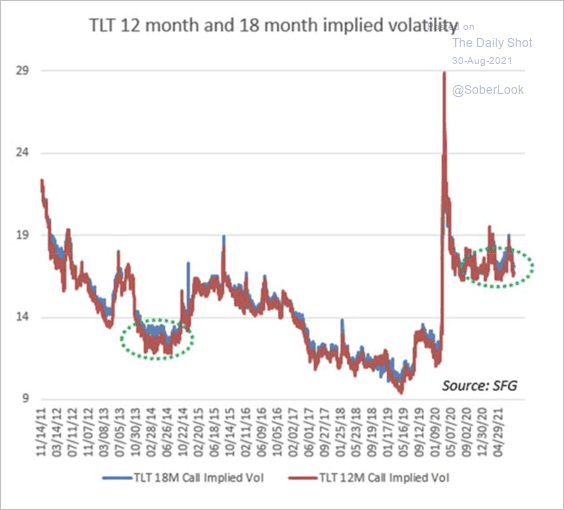

By the way, current TLT implied volatility for 12 and 18 months was significantly lower during the 2013-2014 taper-tantrum period.

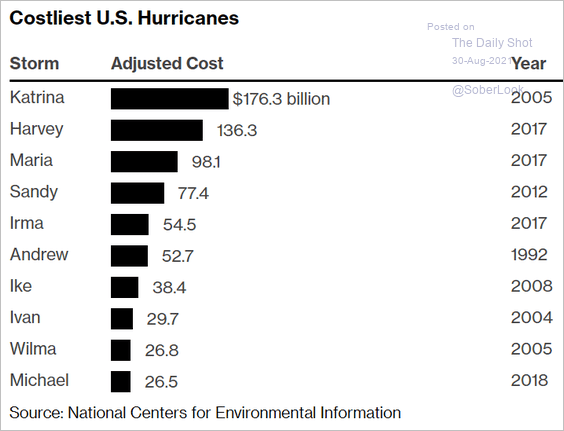

Food for Thought: Costliest US hurricanes (Ida could cost as much as $40bn):

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com