Greetings,

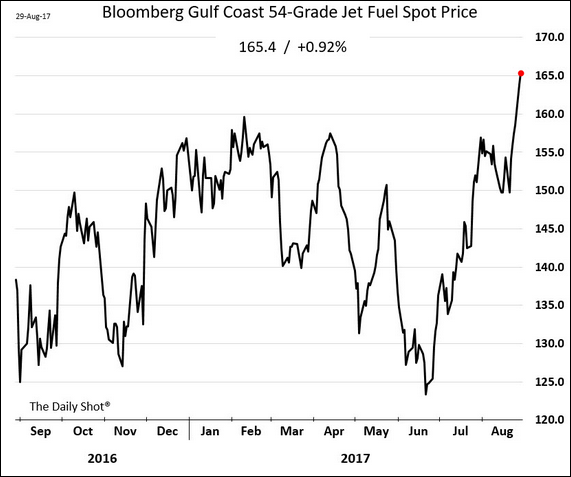

The United States: The US airline industry has been doing well recently. However, the Hurricane Harvey disaster has pushed jet fuel prices sharply higher amid shut refinery operations. Some suggest that airline ticket prices will soon rise as a result.

Turning to the corporate sector, this chart shows the time series analysis of quarterly earnings reports. Companies are striking an increasingly positive tone, are less focused on the White House agenda, are less worried about the economy, and are no longer concerned about a strong dollar.

Credit: An increasing percentage of new loans has leverage that’s greater than 5x.

Equity Markets: Market technicals don’t look great.

Bitcoin: Here is an interesting chart comparing several markets that had experienced frenzied buying at some point.

The Eurozone: The euro hit $1.20 for the first time since the start of 2015.

Emerging Markets: A couple of EM stock markets worth mentioning are Thailand and Tunisia. Both saw significant rallies recently.

Energy Markets: We now have higher prices showing up at the pump in the US

Food for Thought: Must-have apps for millennials.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com