Greetings,

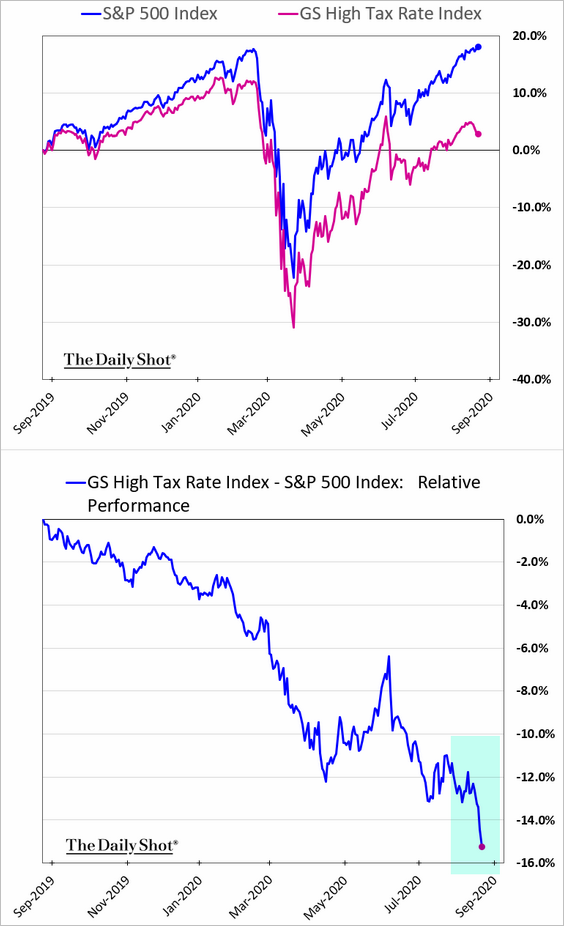

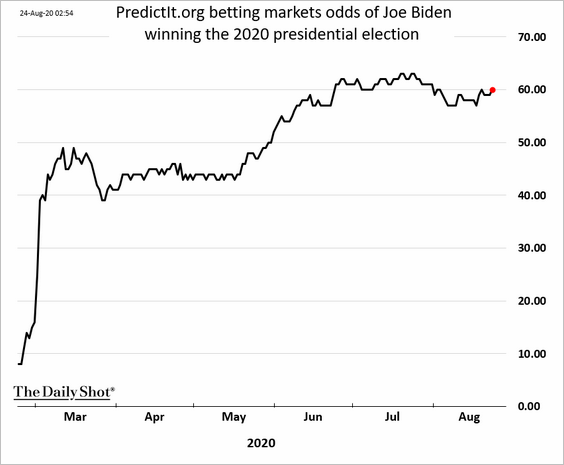

Equities: The stock market is increasingly pricing in higher corporate taxes as the US elections approach. The underperformance of companies with the highest median tax rates has accelerated.

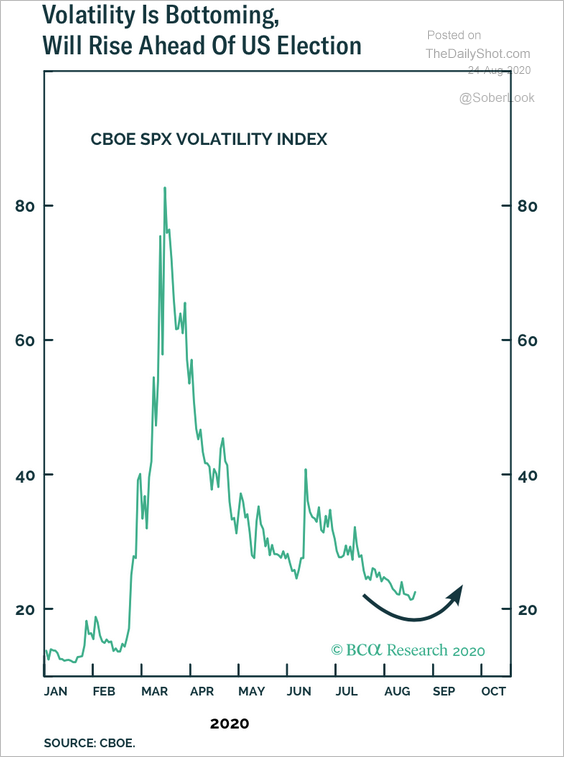

Will volatility start to rise ahead of the US elections?

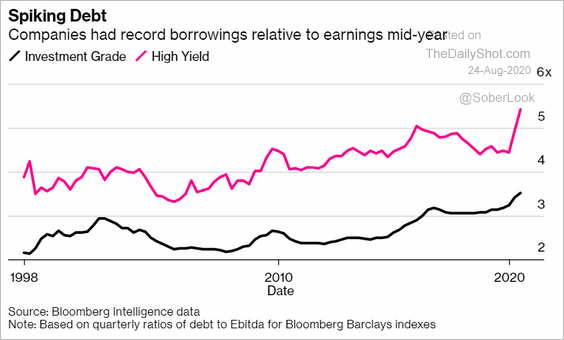

Credit: Leverage (debt-to-EBITDA) has risen sharply this year.

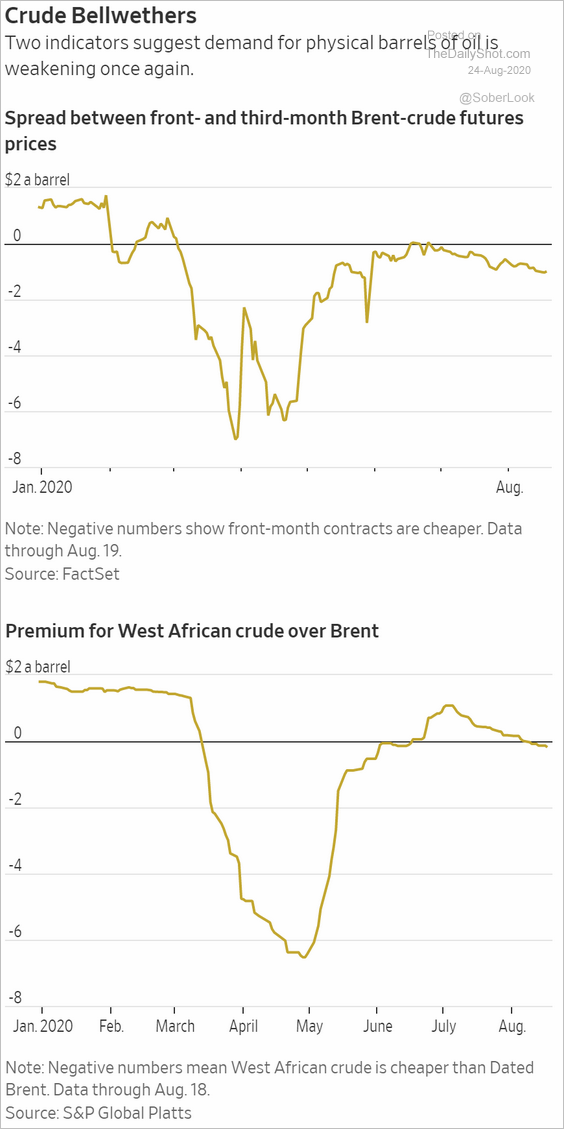

Energy: Brent contango (1st chart) and West African crude premium (2nd chart) point to softening oil demand.

China: The World Economics SMI report shows that China’s business confidence is improving at the fastest pace in years.

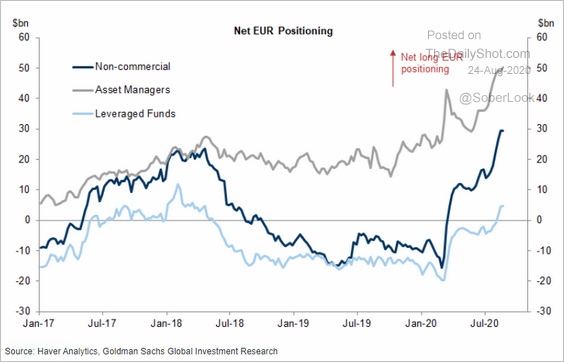

Eurozone: Euro positioning remains stretched. If the US elections go smoothly, the euro could take a hit later this year.

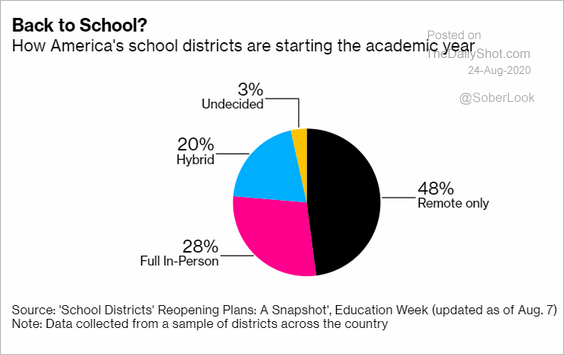

Food For Thought: How US school districts are starting the academic year:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Subscribe to the Daily Shot Brief

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount). To subscribe, please register here and use the coupon number DSB329075 (please click the “apply” button for the discount to take effect). A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot