Greetings,

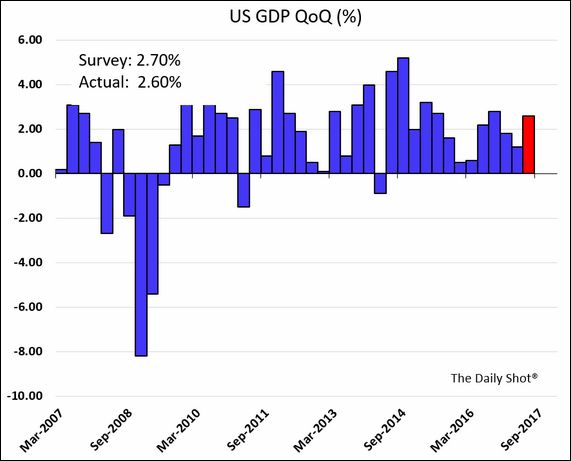

The United States: Let’s begin with the GDP report which was a touch weaker than expected.

Nonetheless, the second quarter expansion was more than double what we saw in the first quarter and represents a 2.1% increase from last year. Consumption drove much of the growth. Also, net exports were additive to the GDP for the second quarter in a row.

China: Residential property prices continue to show signs of strength.

Equity Markets: The percentage of bearish investors is approaching a multi-year low.

For example, Merrill Lynch’s private clients remain heavily weighted in stocks, with extremely low allocations to bonds and cash.

Emerging Markets: Which nations have borrowed the most in foreign currencies, making them vulnerable to a currency crisis?

The Eurozone: The euro rally remains intact. Is it overdone? Will a stronger euro make it more challenging for the ECB to begin removing stimulus?

Credit: Here are some statistics on infrastructure debt defaults.

Rates: Is the dollar oversold? The US currency has diverged from the slope of the yield curve on the short-end.

Food for Thought: What do people hate in each state (bases on the Hater app)

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com