Greetings,

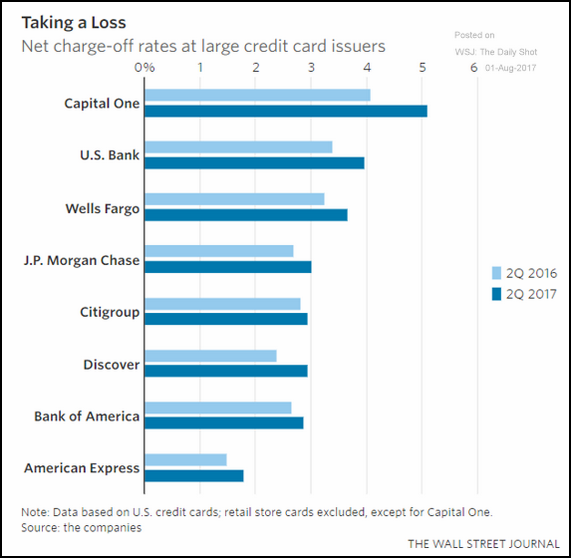

The United States: Credit card charge-off rates at banks have risen meaningfully this year.

Bitcoin: Bitcoin is heading back toward record levels reached back in June.

Equity Markets: Many industries are becoming concentrated as the largest firms gain revenue share.

Emerging Markets: The Russian ruble isn’t benefitting from the rally in crude oil, as the correlation between the two assets breaks down. Geopolitical concerns?

Separately, Russia’s produce prices spike. An unusually harsh winter and limited warehouse space created a shortage.

The Eurozone: Part of the reason for another jump in the euro was a higher than expected core CPI release. While inflation is still well below the ECB’s target, the report could give the central bank some food for thought.

Inflation expectations in the Eurozone jumped on the news.

Energy: US natural gas took a hit on Monday on forecasts for cooler weather in the Eastern part of the US.

Rates: Longer-dated Treasury term premium is on the rise again.

Food for Thought: Quality versus spending in America’s schools.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com