Greetings,

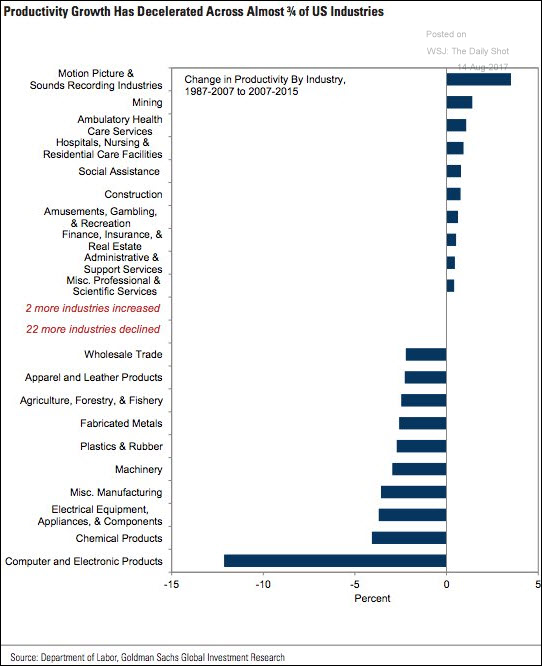

The United States: This chart shows the productivity growth breakdown by sector.

The Oxford Economics Global Risk Survey says that investors increasingly see policy errors driving the US into a recession as the top global economic risk.

Credit: This chart shows the credit spreads of the largest municipal bond issuers.

Equity Markets: The markets have done well after some of the scariest crises in the past.

Emerging Markets: This chart shows where the various EM nations are in the economic cycle.

Europe: Hedge funds and other speculative accounts continue to raise their bets on a further appreciation in the euro and the Canadian dollar. The combination of the two trends has created the biggest bet against the US dollar in years.

Bitcoin: The correlation between the Google search frequency for “bitcoin” and the Bitcoin price is remarkable.

Food for Thought: A question for the EU residents: Would you feel comfortable if one of your children was in a relationship with …

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com