Greetings,

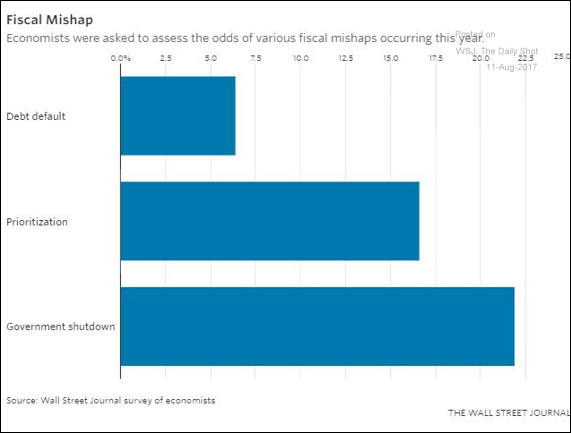

The United States: Economists are increasingly concerned about a fiscal “mishap” in the US.

Credit: This chart shows bond market durations and yields for different asset classes. Investors have been taking quite a bit of risk for limited returns.

Equity Markets: Implied volatility rose sharply in response to the North Korea tensions. VIX jumped five points on the day (first chart below). Up to now the number of days with market declines of 1% or more was at record lows. Will the trend change going forward (second chart below)?

Up to now the number of days with market declines of 1% or more was at record lows. Will the trend change going forward?

Emerging Markets: EM stocks slumped in response to the US – North Korea tensions. Here is the biggest EM ETF (EEM).

Europe: Ireland is still in deflation mode.

Energy Markets: US natural gas in storage is back at the 5-year average level.

Food for Thought: Who is spending the most on their child’s education?

Have a great weekend!

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com