Greetings,

United States: The Fed acknowledged economic improvements and higher inflation but sees price gains as “reflecting transitory factors.” Here are the changes from the previous FOMC statement.

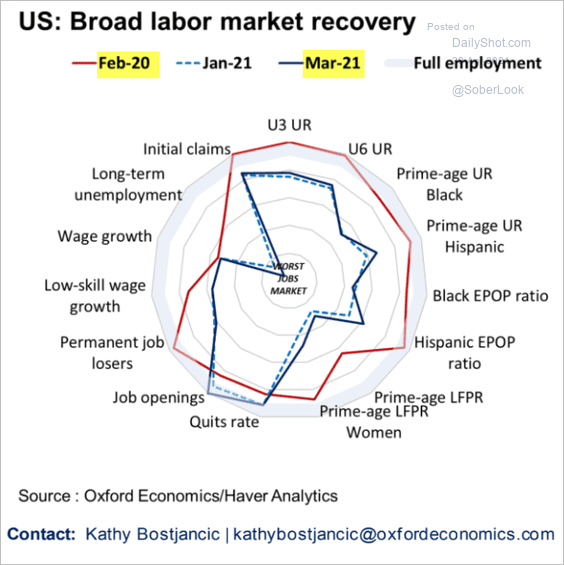

Moreover, Fed Chair Powell said that “it is not the time to start talking about tapering.” The US central bank remains extraordinarily dovish and entirely focused on the labor market recovery, especially in some vulnerable sectors.

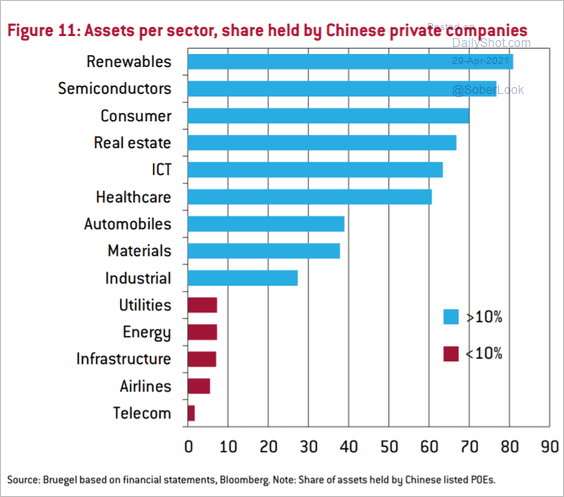

China: This chart shows the share of assets held by China’s private companies.

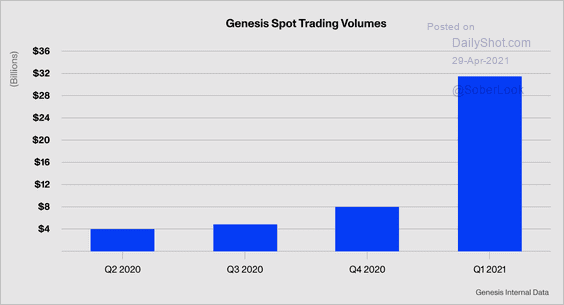

Cryptocurrency: Genesis Trading, a digital currency prime broker, transacted $31.5 billion in spot trading in Q1 – $8 billion of which was traded by corporates using bitcoin as a treasury reserve asset.

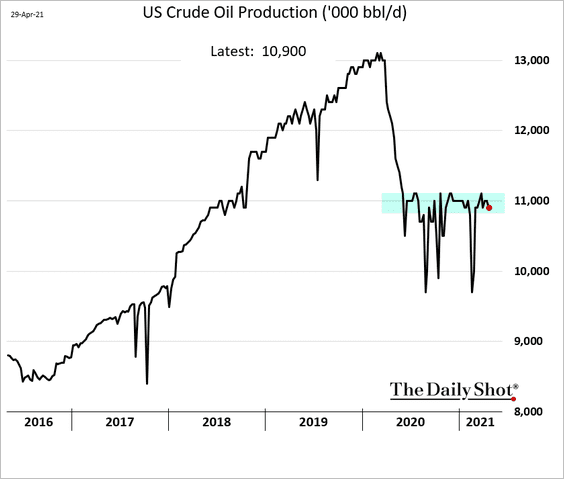

Energy: US crude oil production remains capped at 11 million barrels per day.

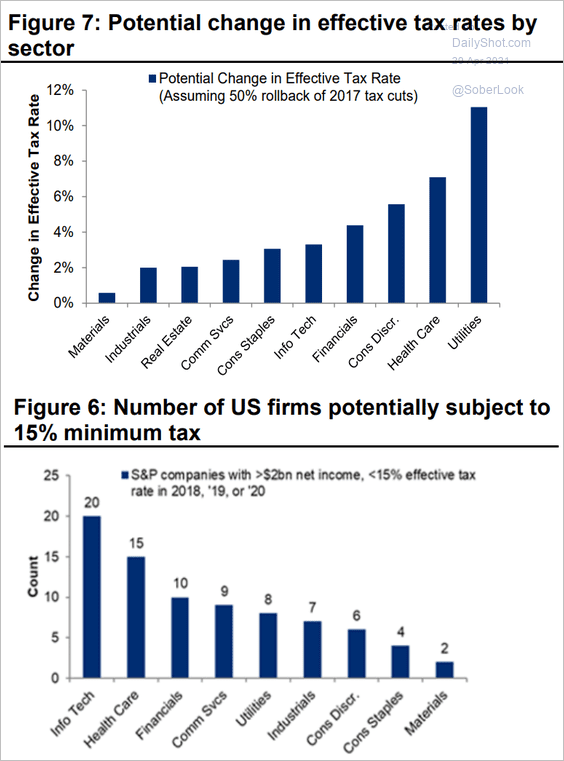

Equities: Which sectors are most vulnerable to tax hikes?

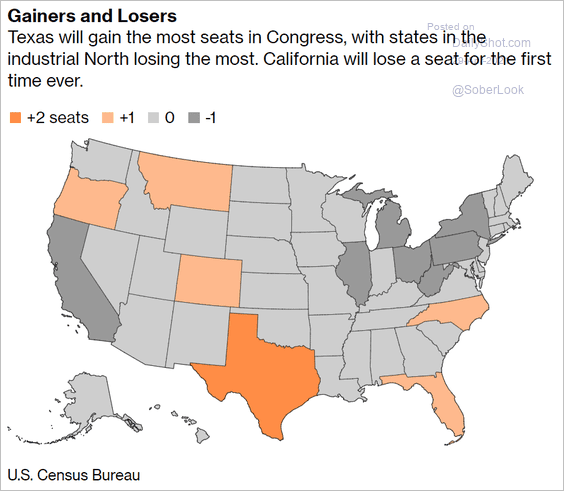

Food For Thought: States losing or gaining seats in Congress:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com