Greetings,

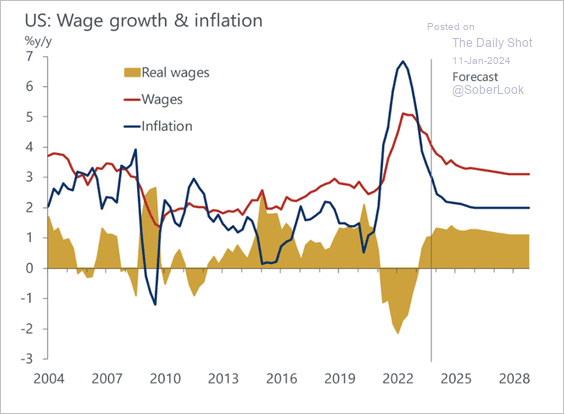

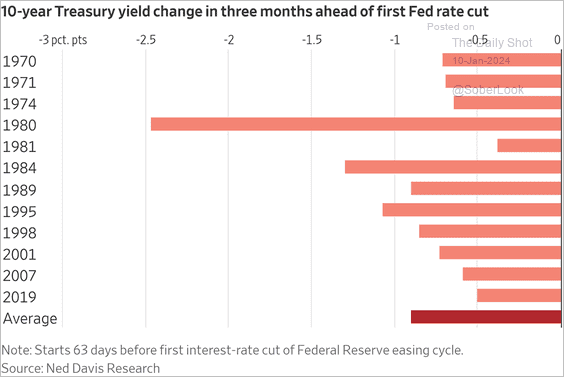

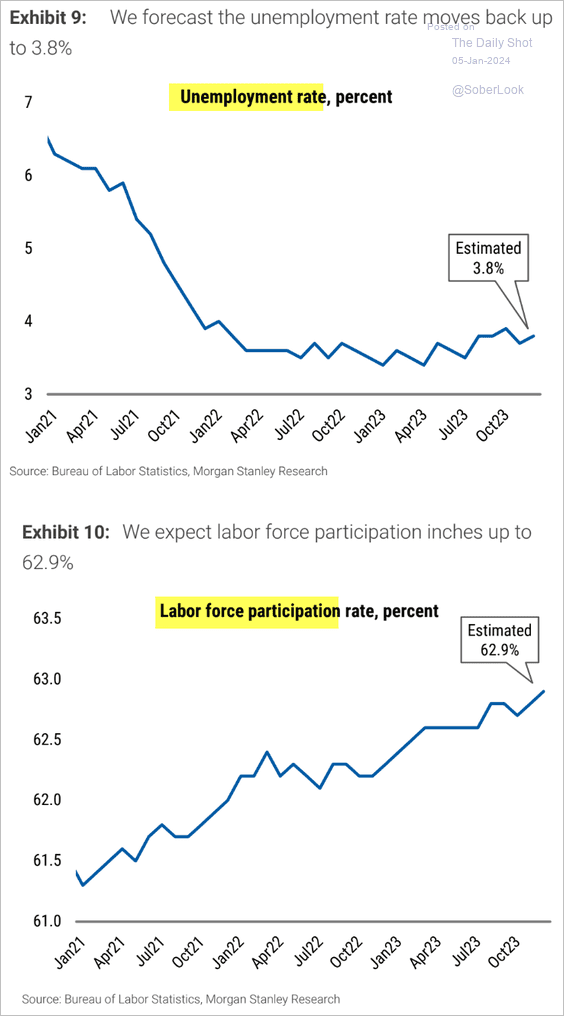

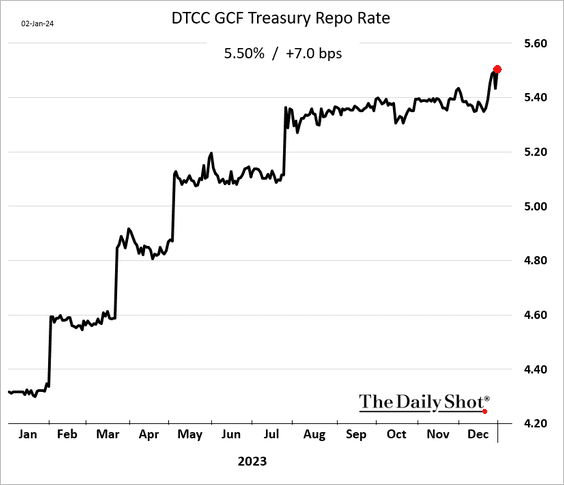

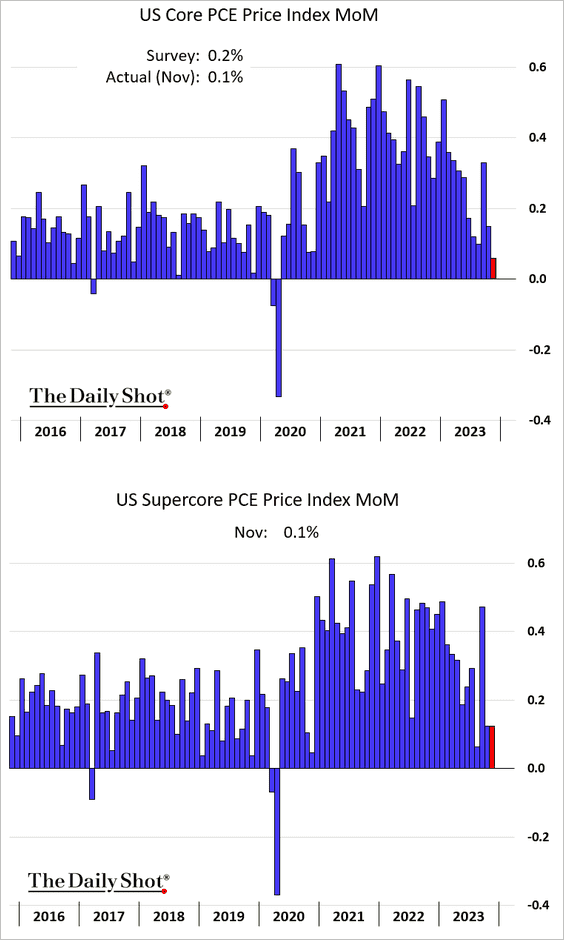

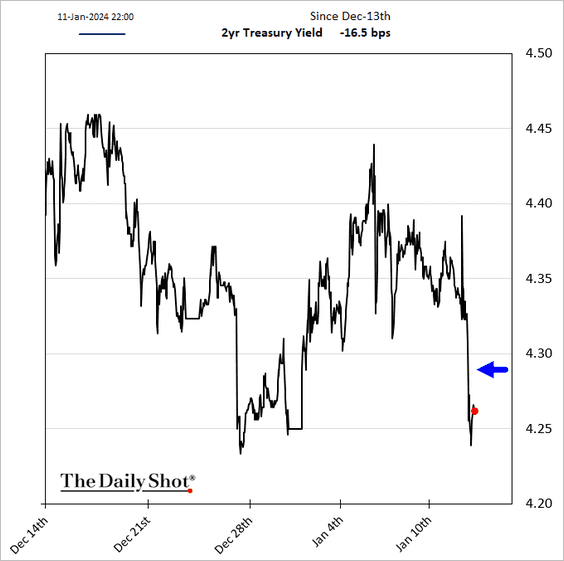

The United States: The market reaction to the CPI report was muted. Treasury yields declined.

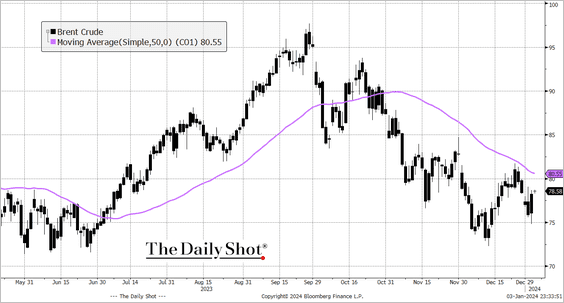

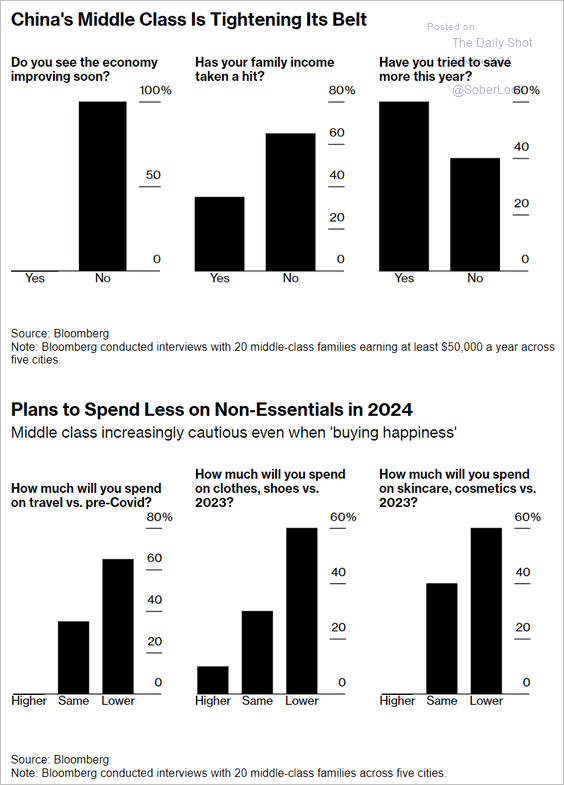

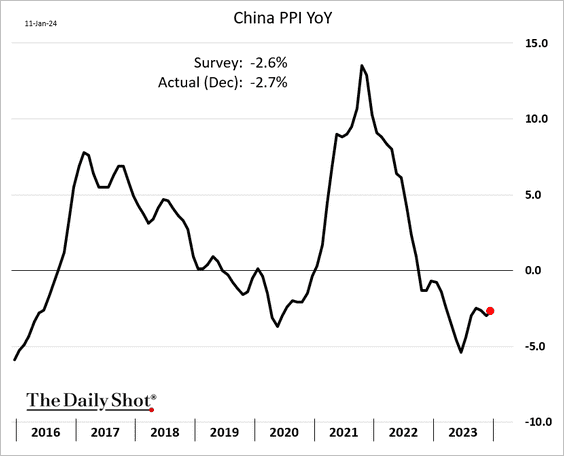

China: The PPI remains well below last year’s levels.

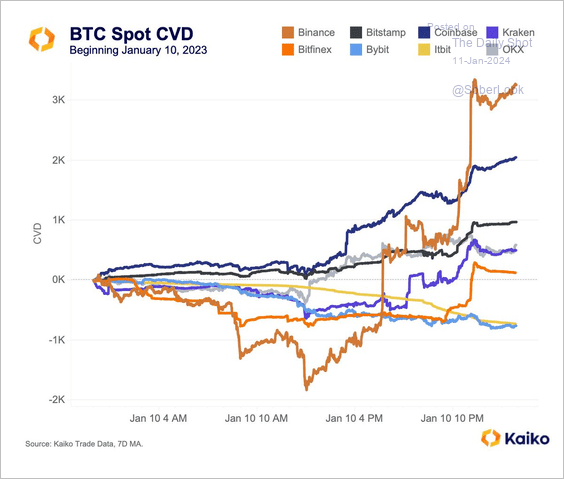

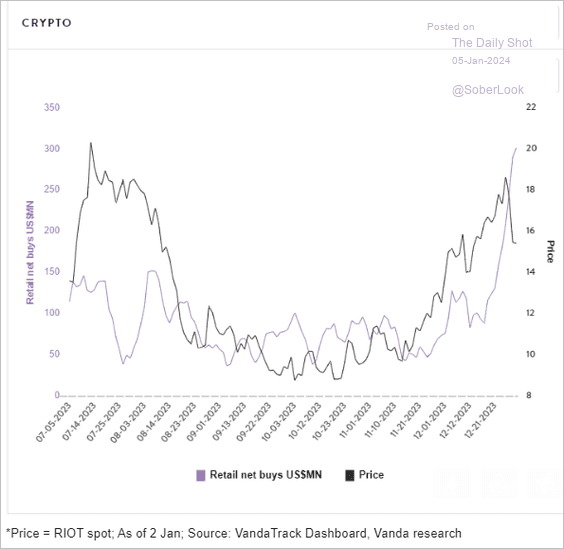

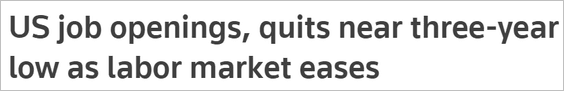

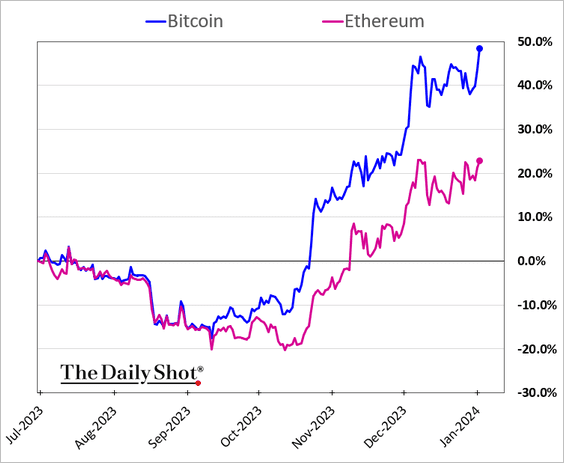

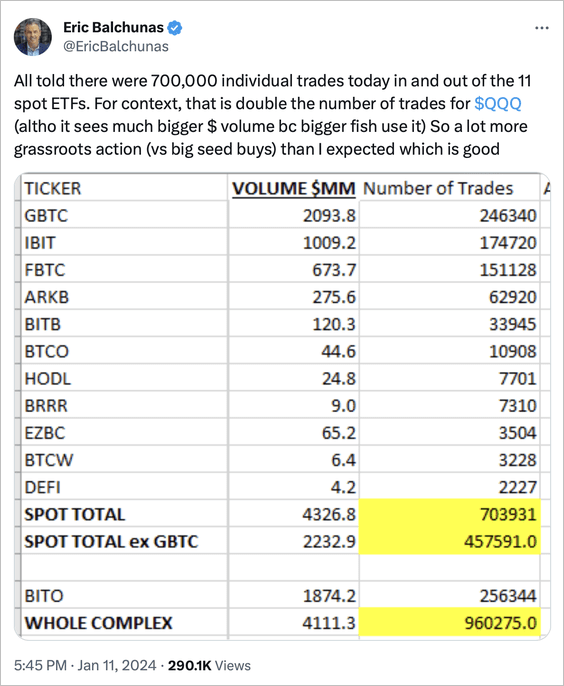

Cryptocurrency: Trading volumes surged for US spot-bitcoin ETFs on Thursday.

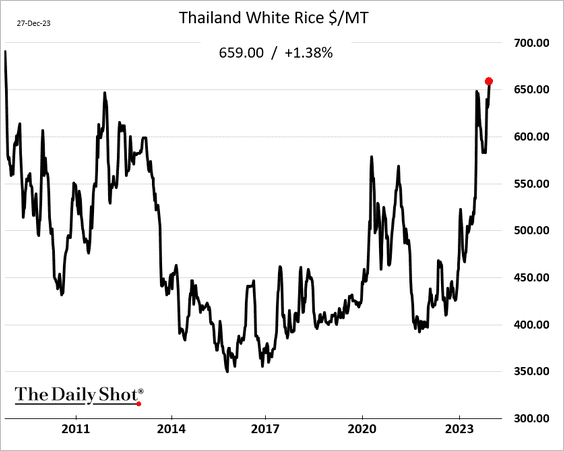

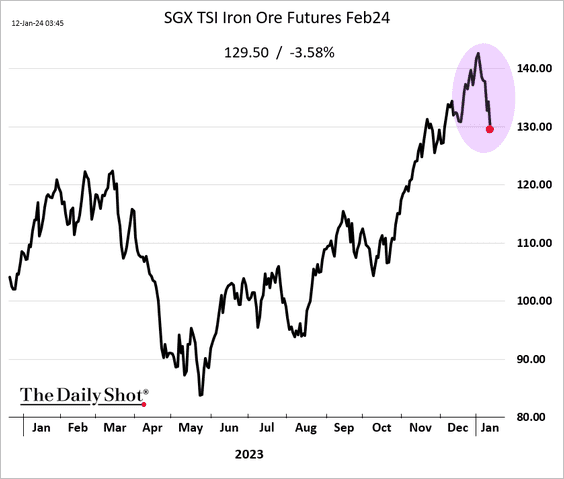

Commodities: The selloff in iron ore has accelerated.

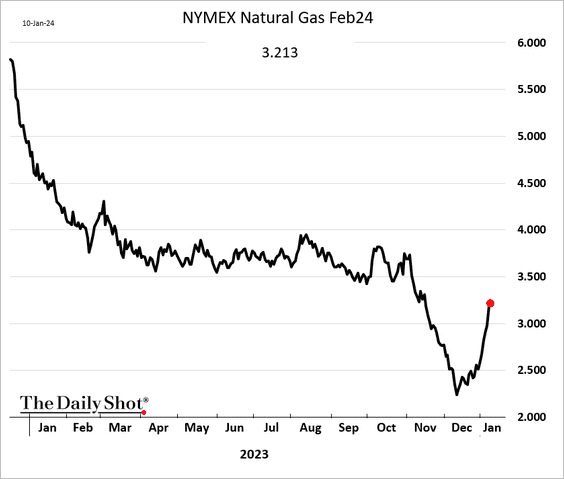

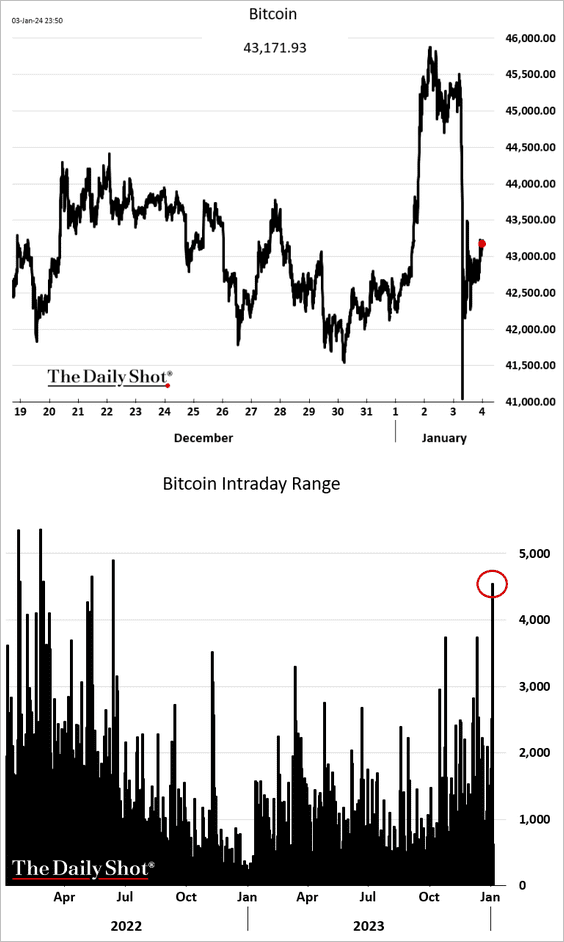

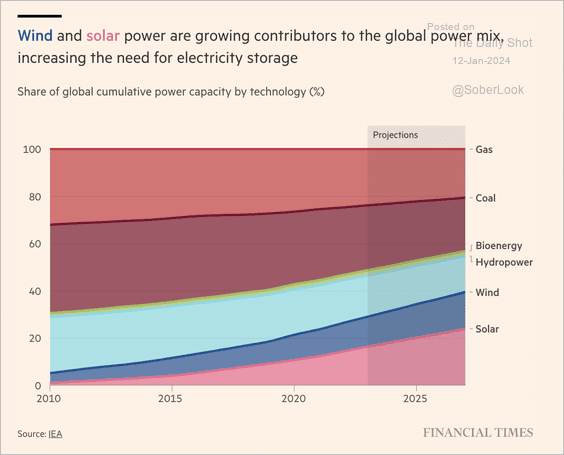

Energy: Here is a look at wind and solar contributions to the global power mix.

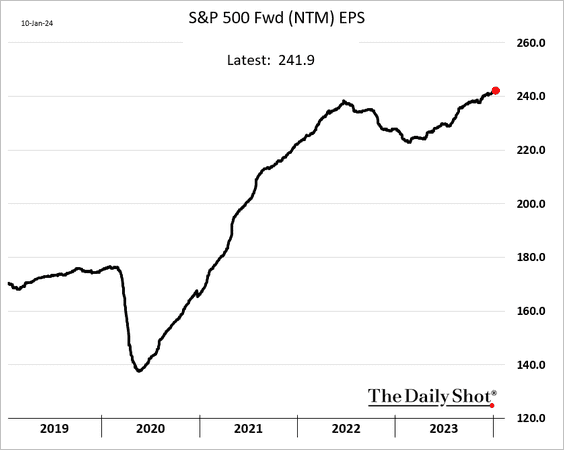

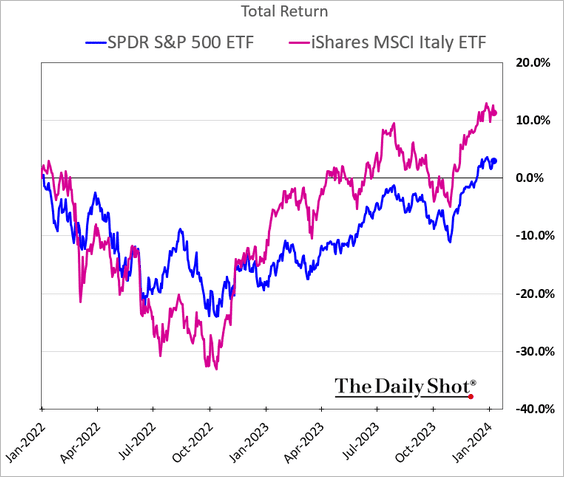

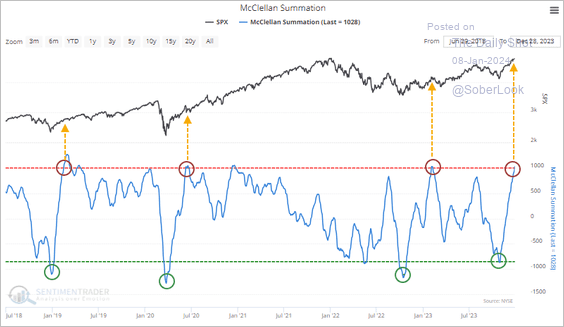

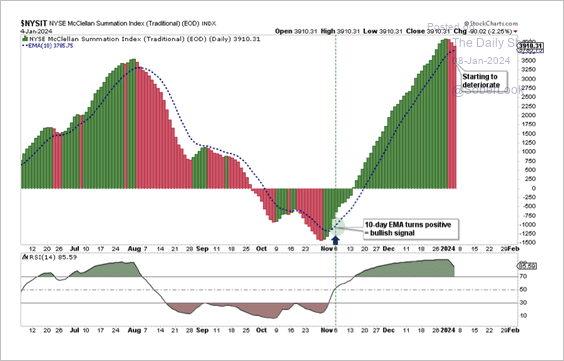

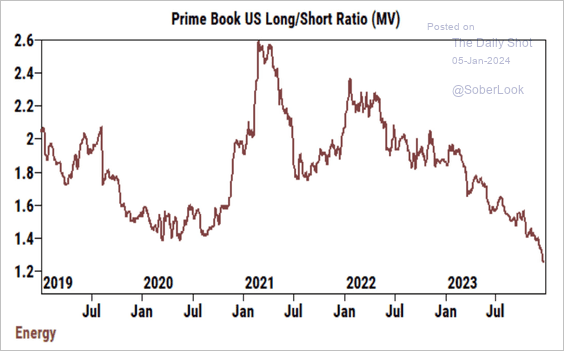

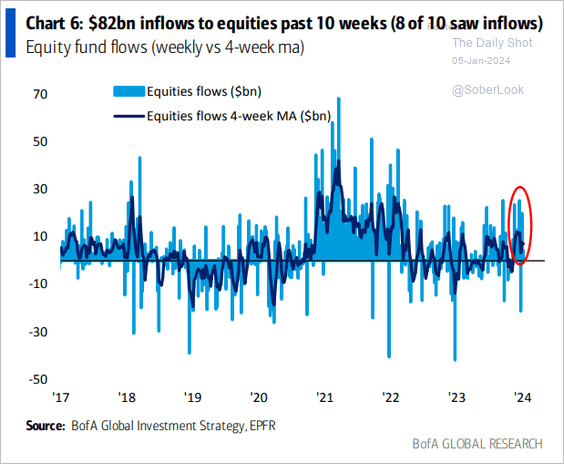

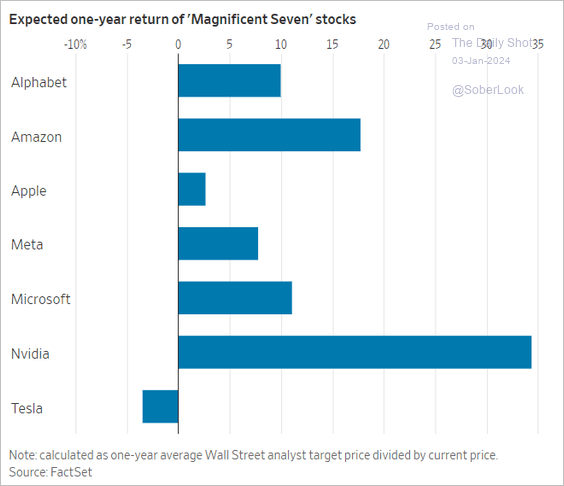

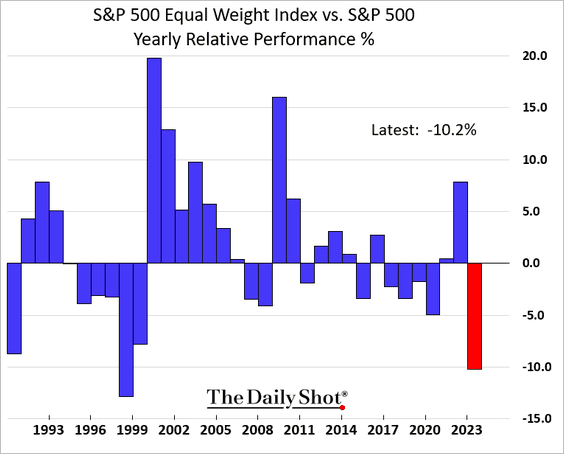

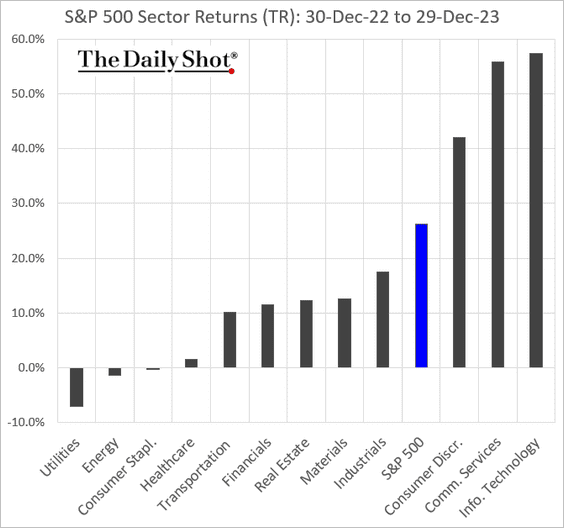

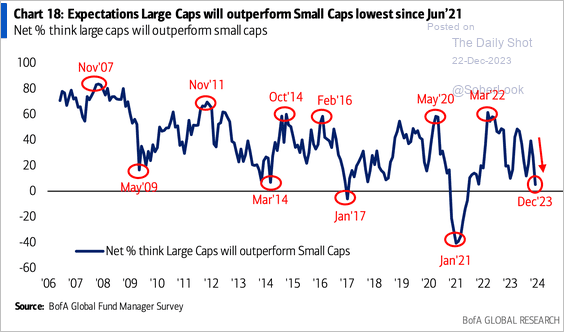

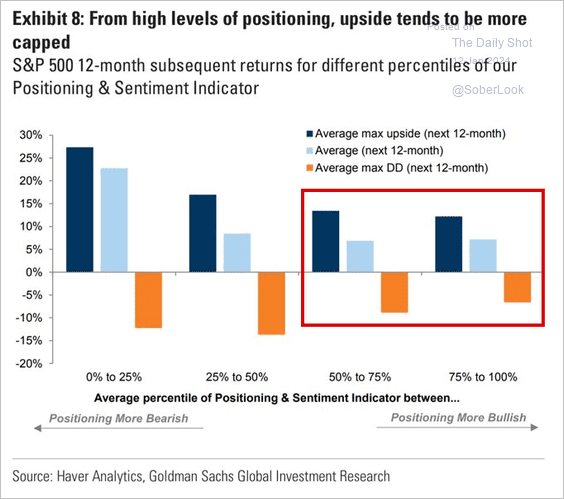

Equities: Bullish positioning tends to cap the upside for stocks.

Food for Thought: New England’s winning percentage under Bill Belichick:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief