Greetings,

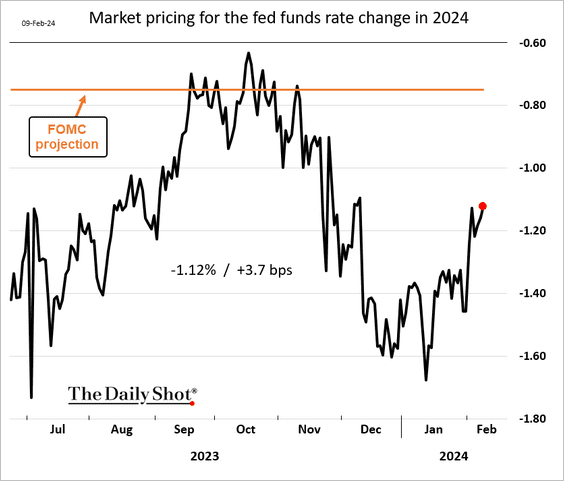

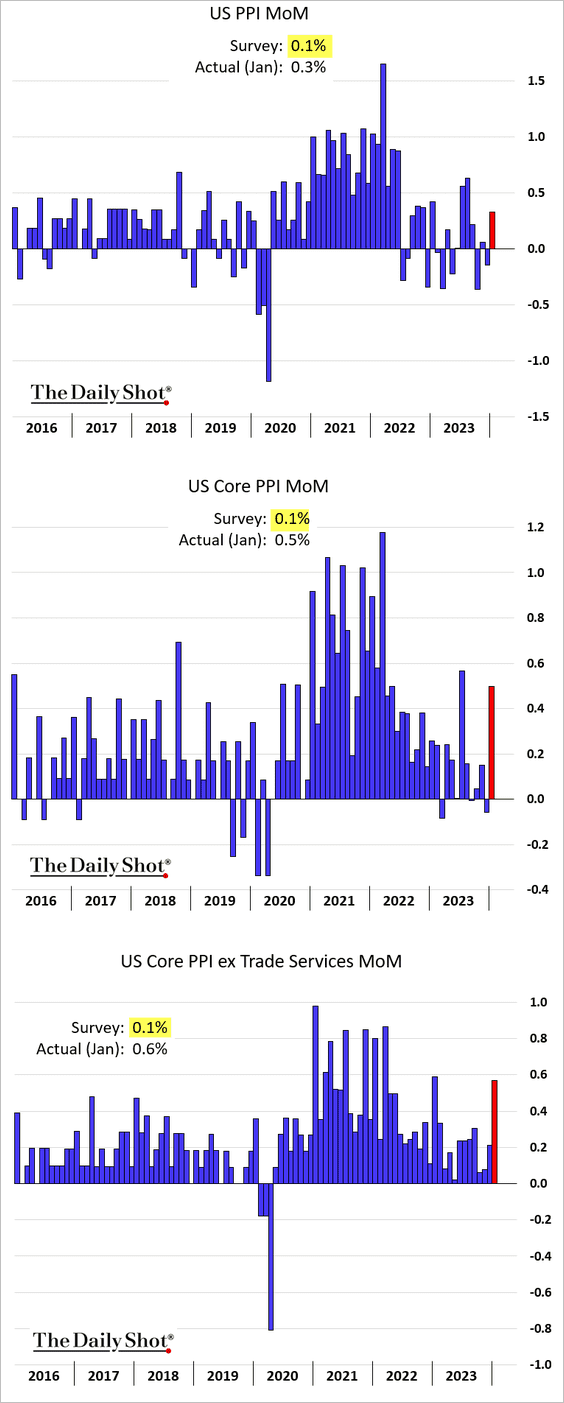

The United States: The January report on producer prices surpassed expectations, with the increase fueled by consumer-facing services sectors.

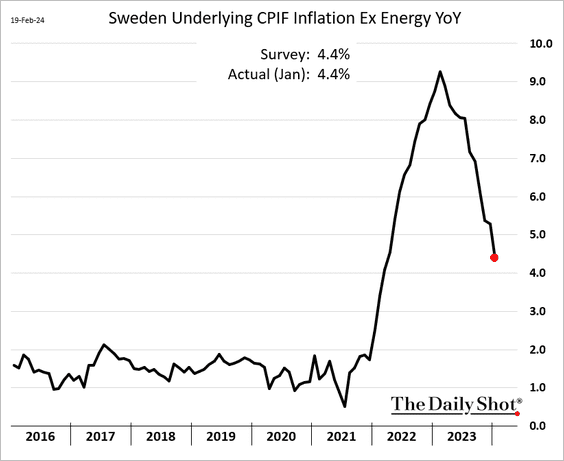

Europe: Sweden’s core inflation for January matched projections, reflecting an ongoing moderation in the pace of price increases.

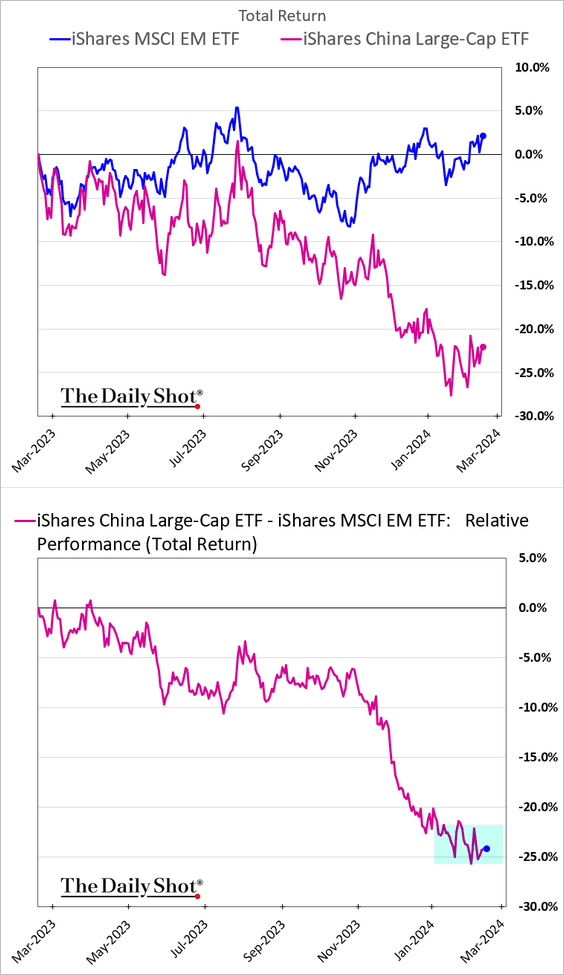

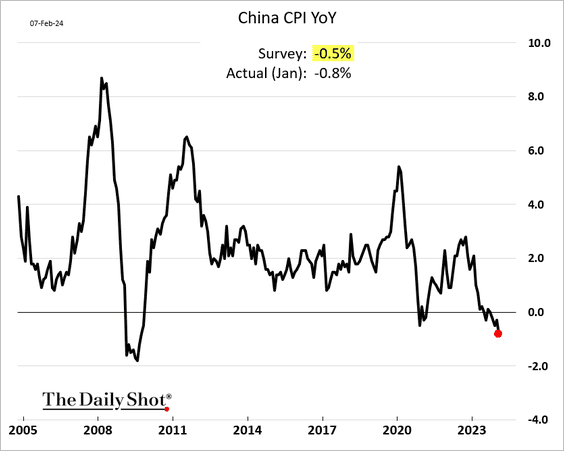

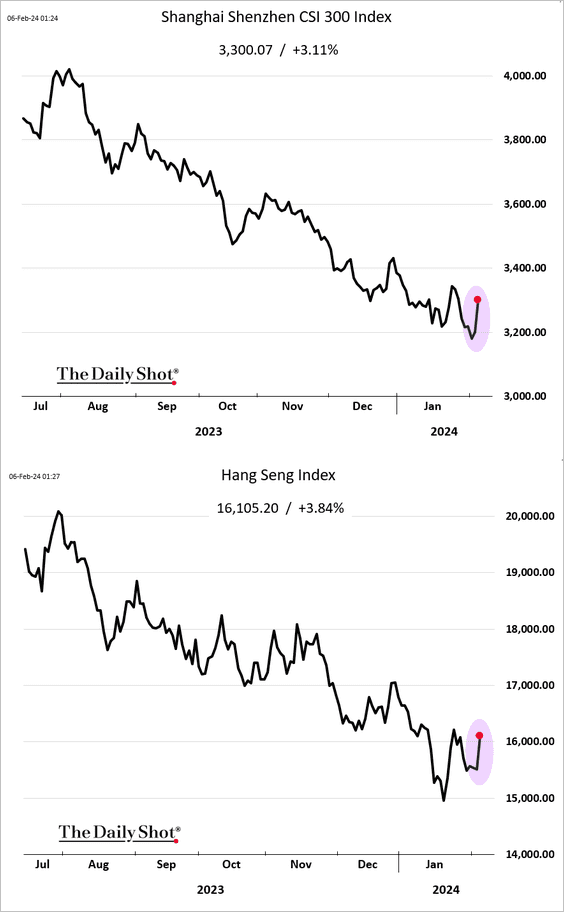

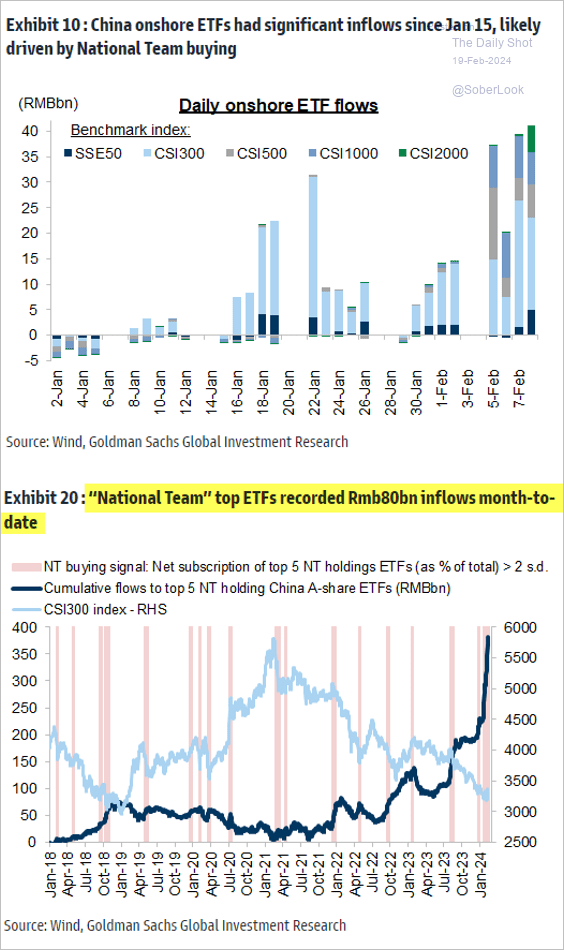

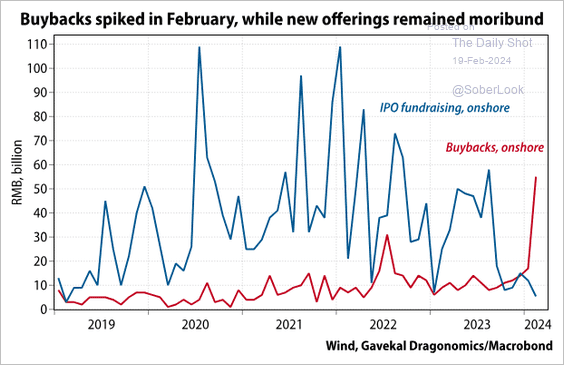

China: State-owned entities continue to bail out the stock market:

– Domestic ETF flows:

– Beijing-ordered share buybacks:

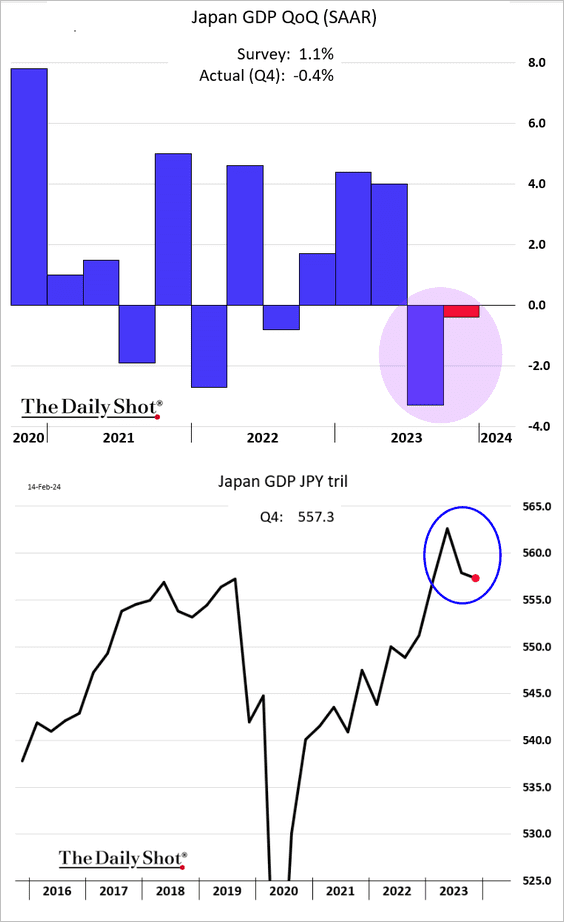

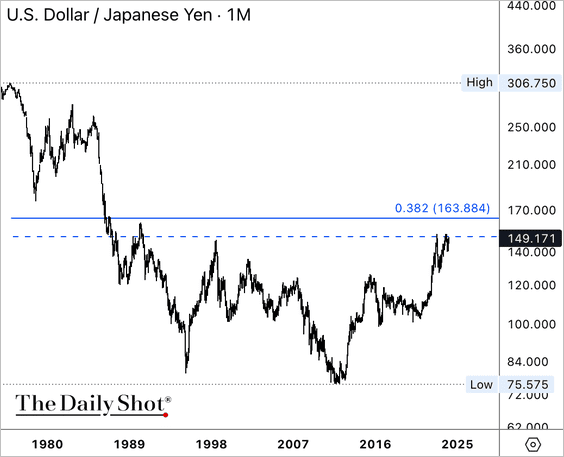

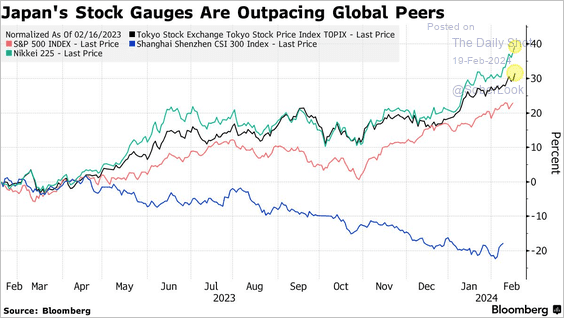

Asia-Pacific: Japan’s shares keep outperforming.

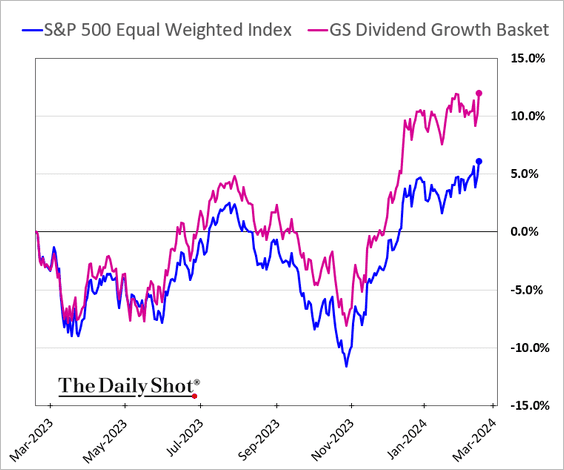

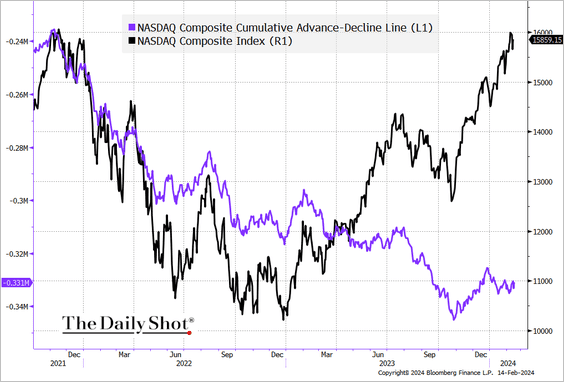

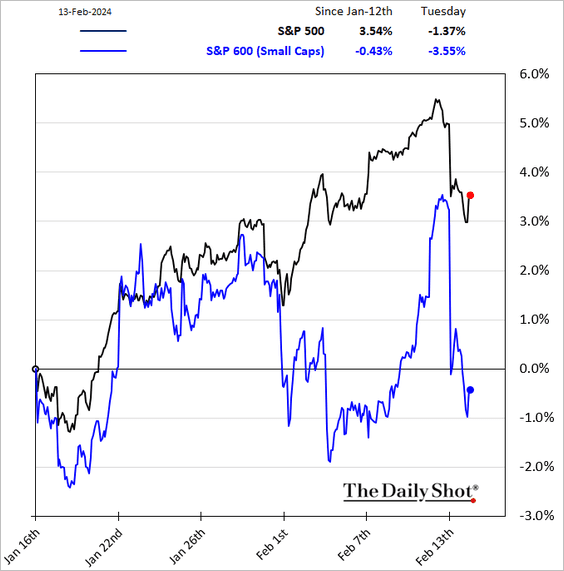

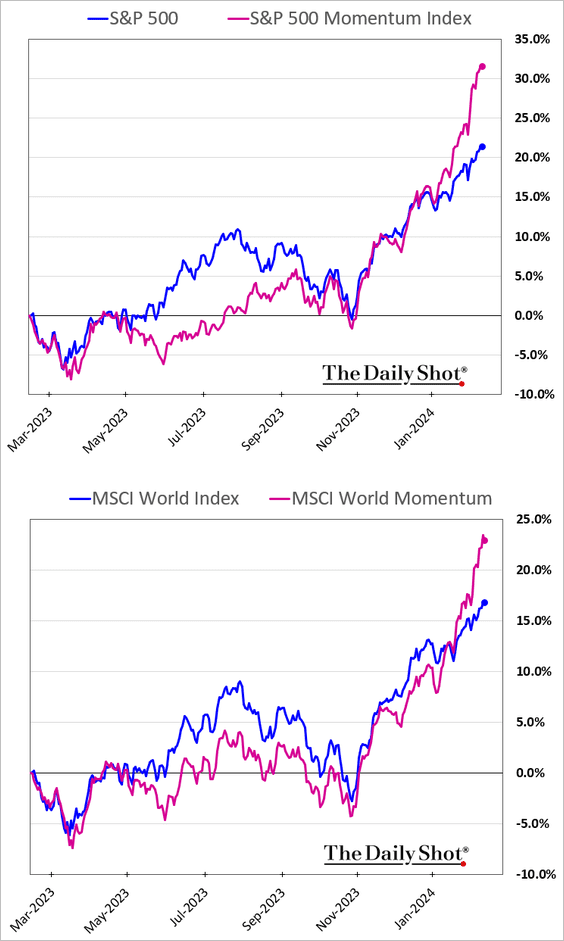

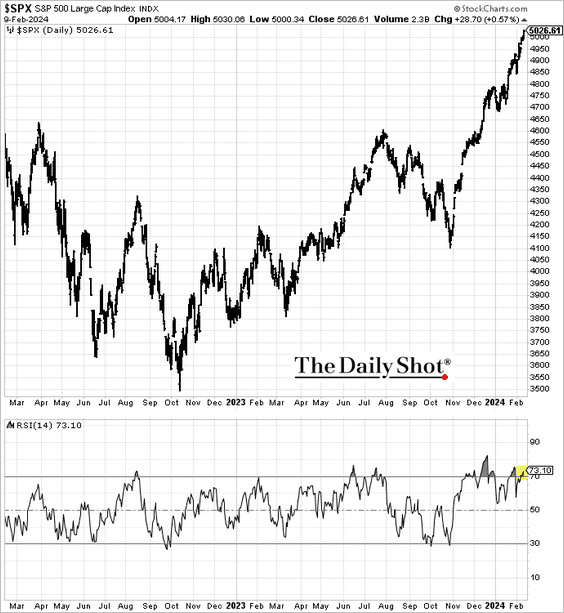

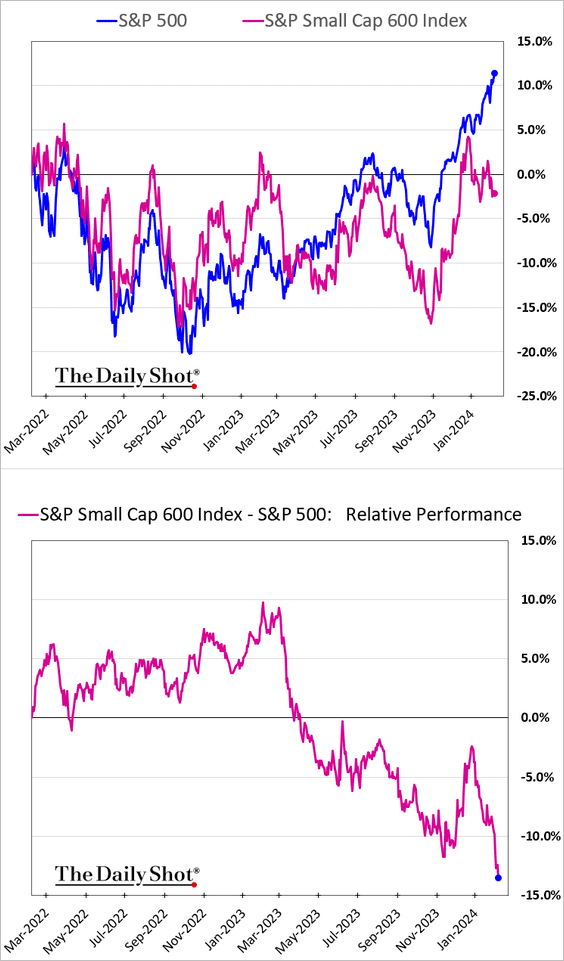

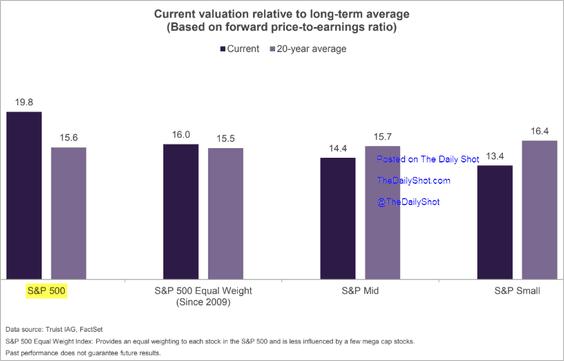

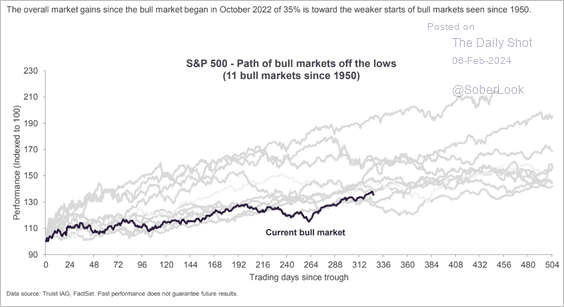

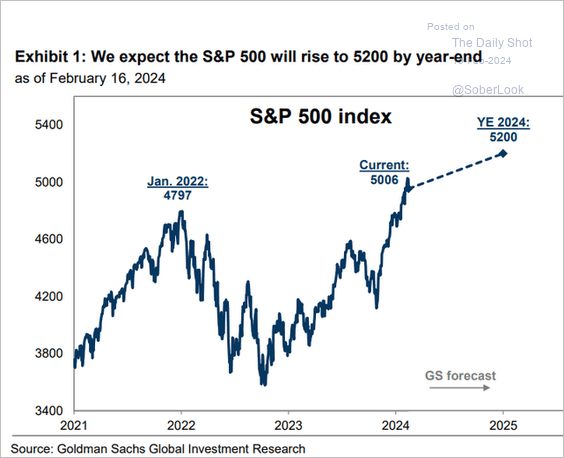

Equities: Goldman boosted its target for the S&P 500 this year.

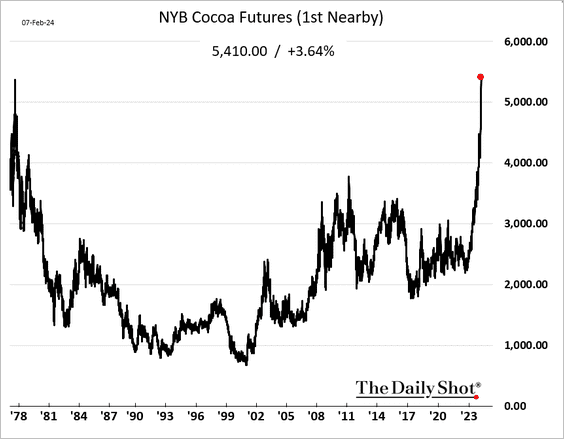

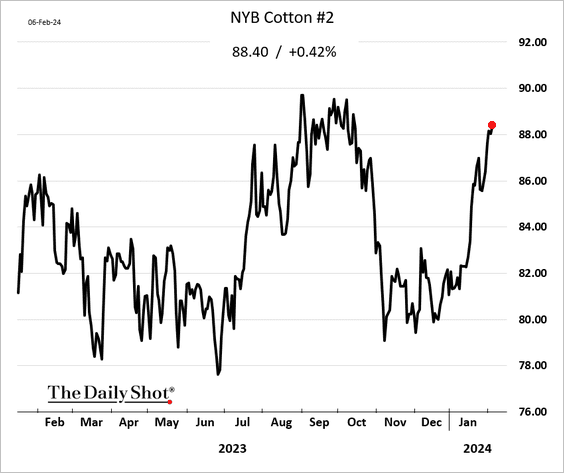

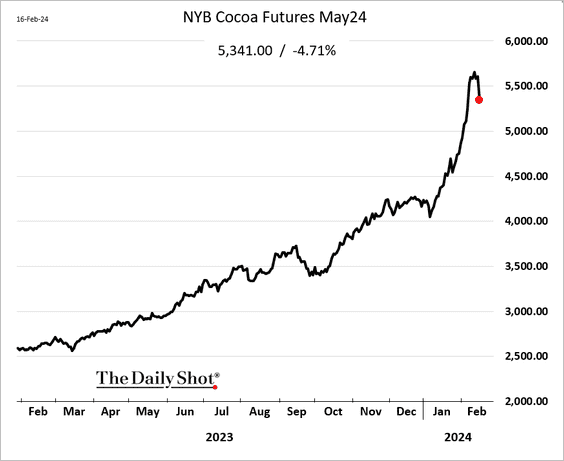

Commodities: The cocoa rally is fading.

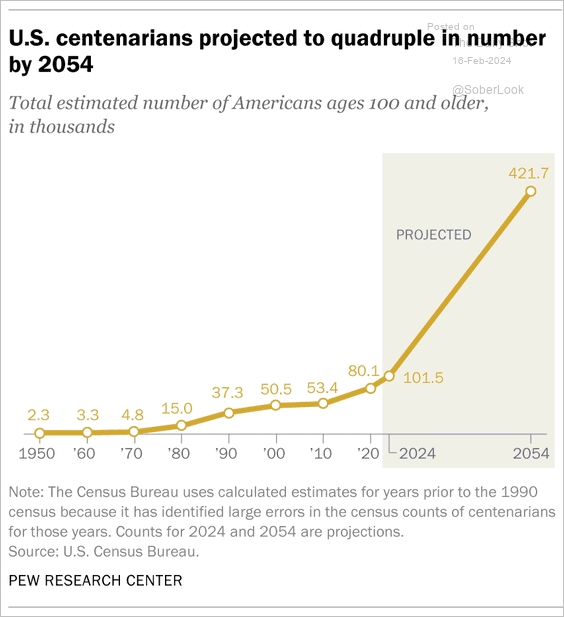

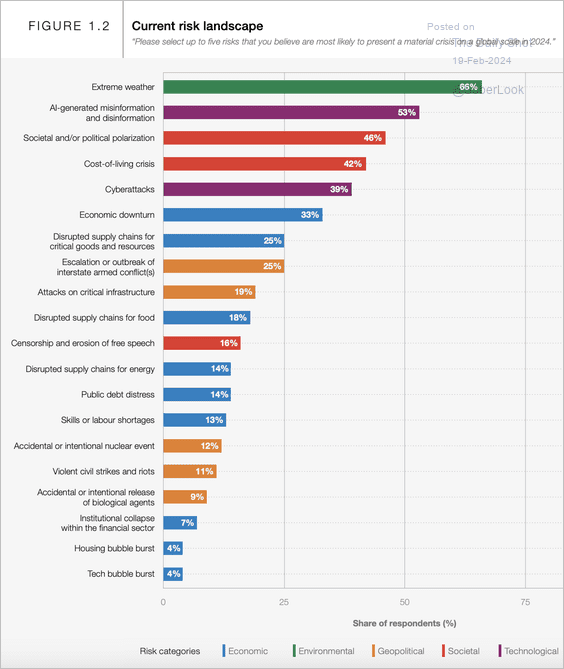

Food for Thought: Risks most likely to present a crisis on a global scale:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com