Greetings,

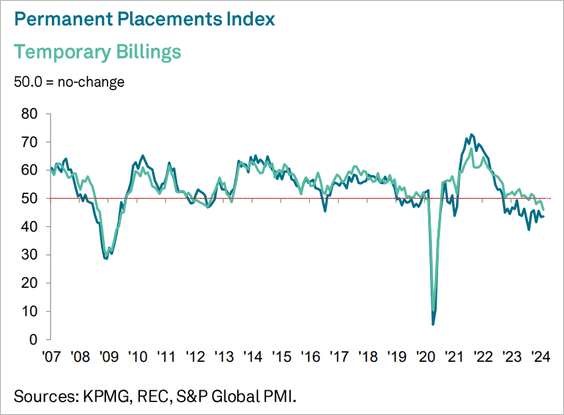

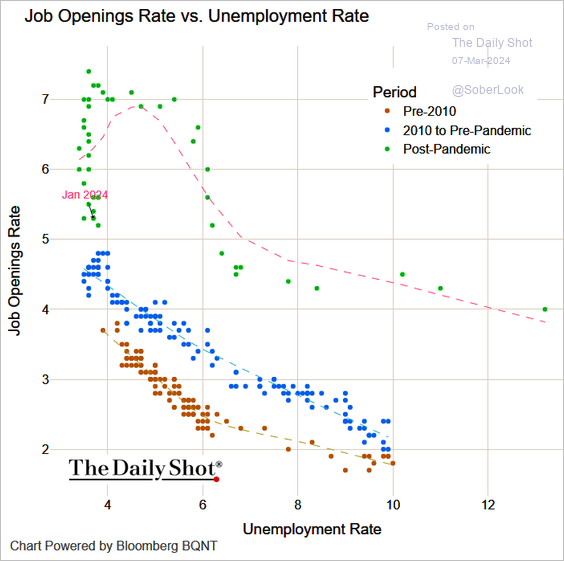

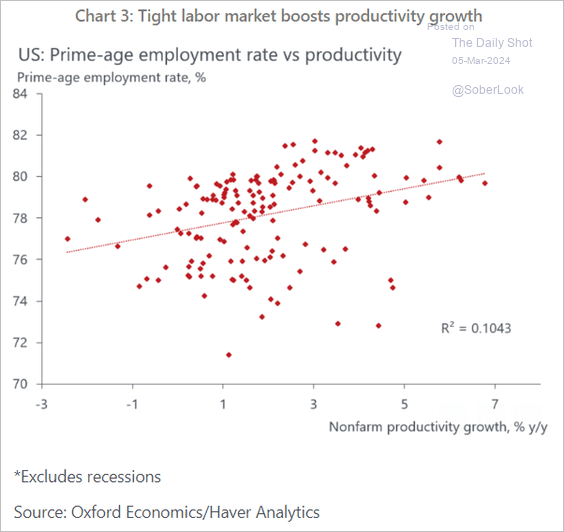

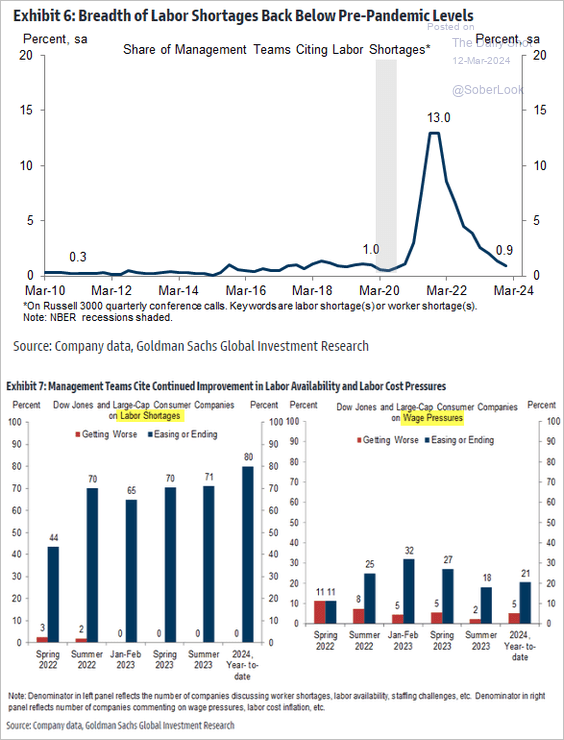

The United States: Companies report that labor shortages are easing.

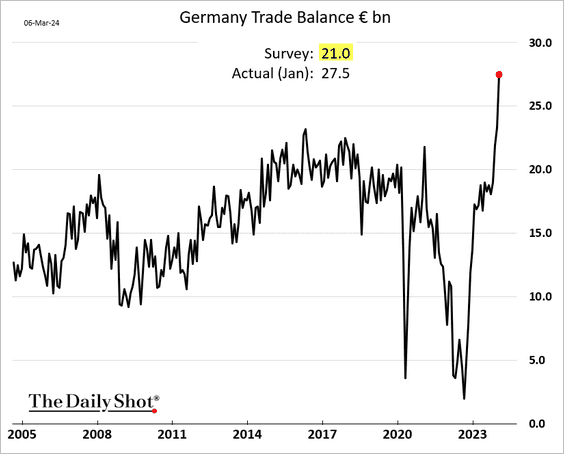

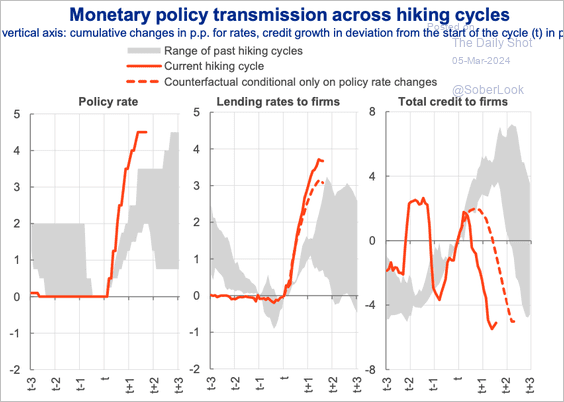

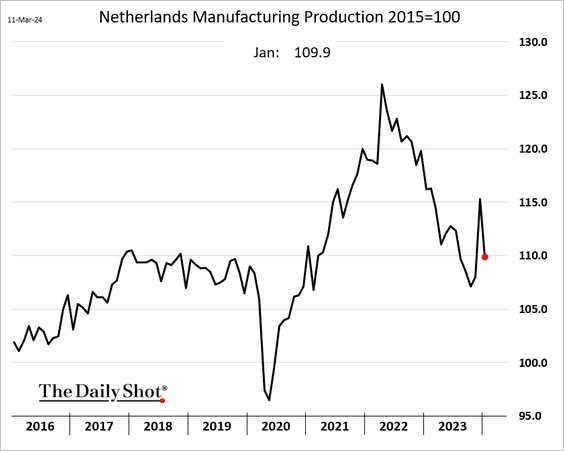

Europe: Dutch manufacturing production reversed much of the December surge, which was driven by one-off items.

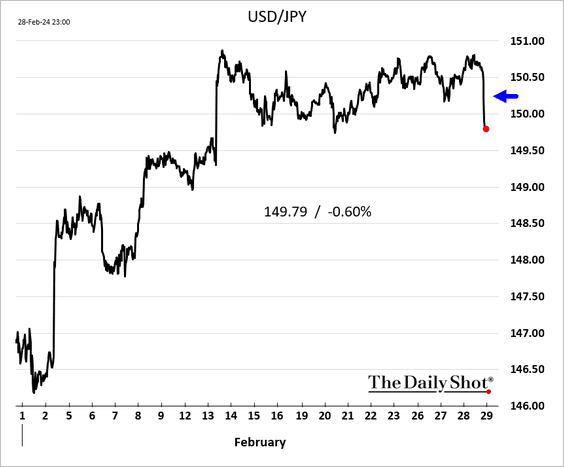

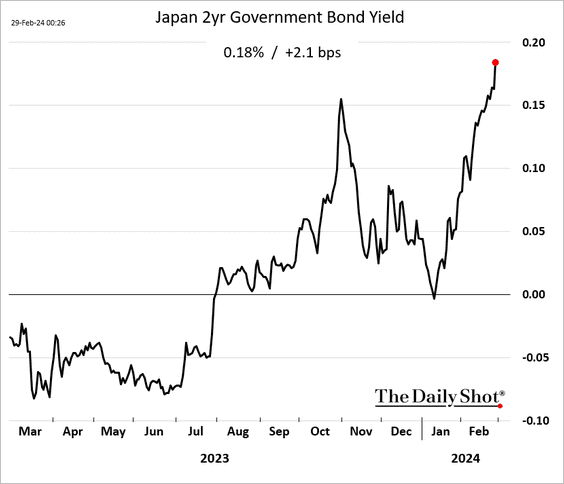

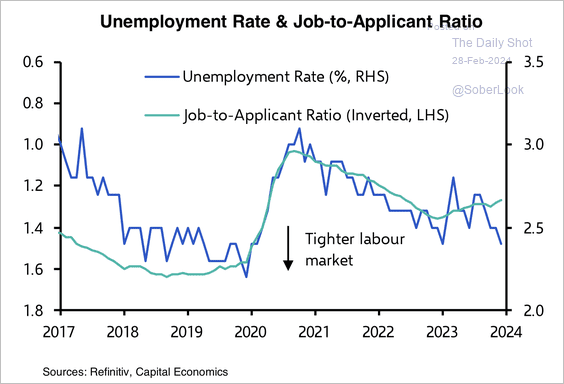

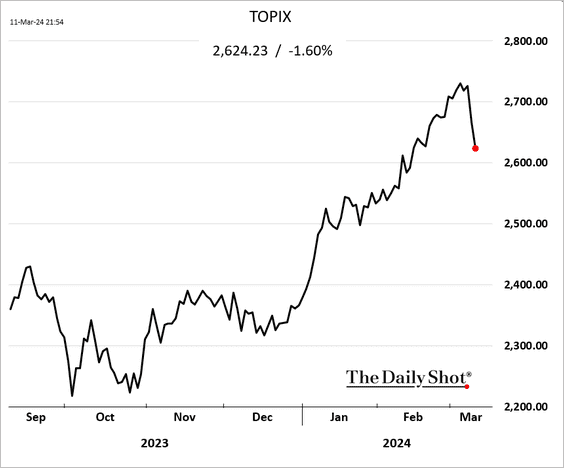

Japan: The stock rally has been fading amid growing expectations for the BoJ tightening policy this spring.

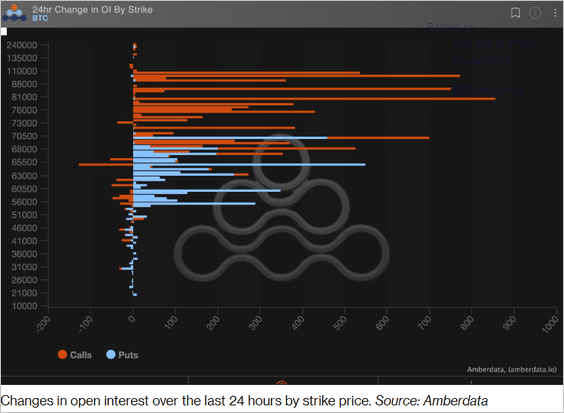

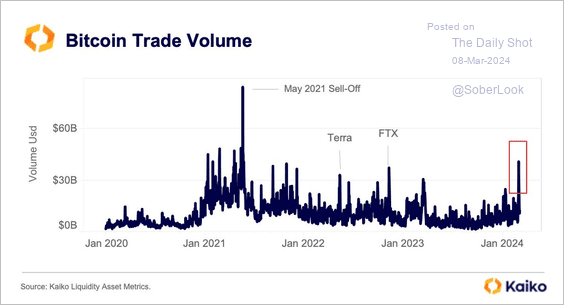

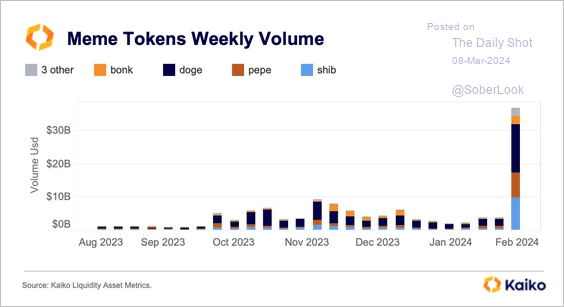

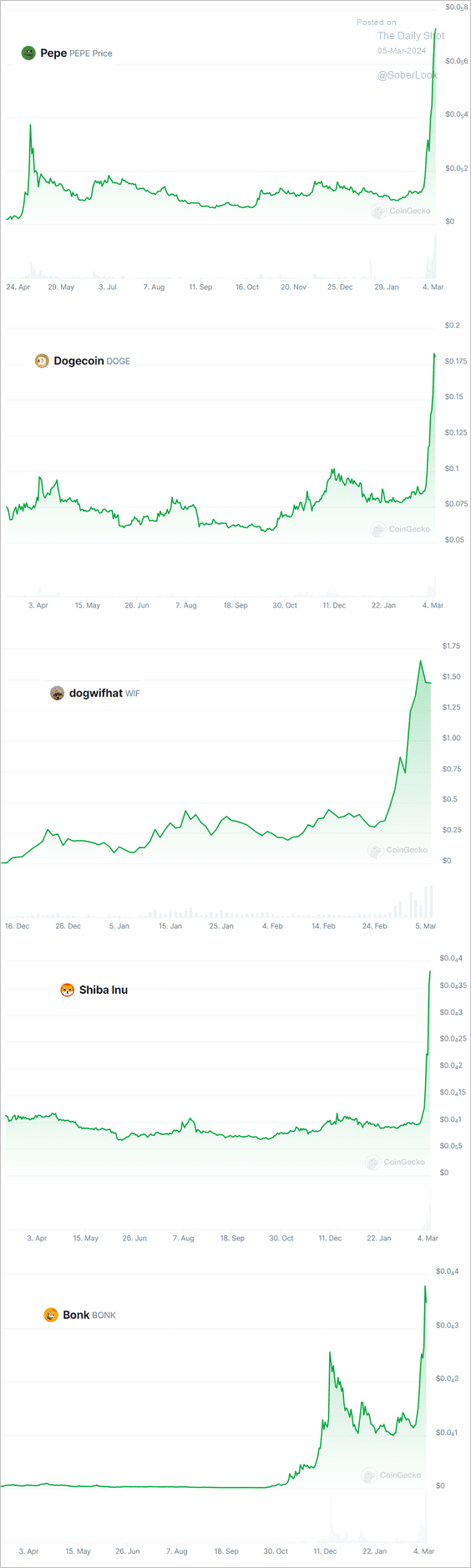

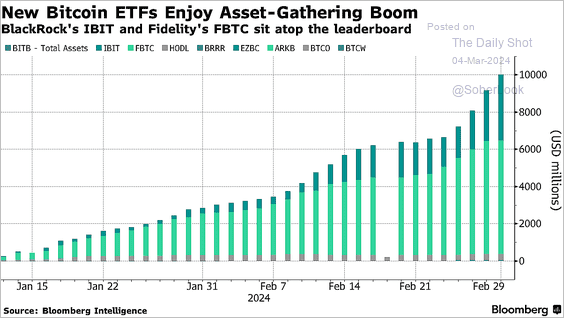

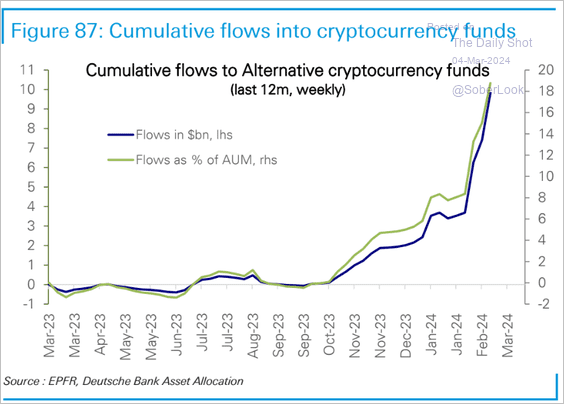

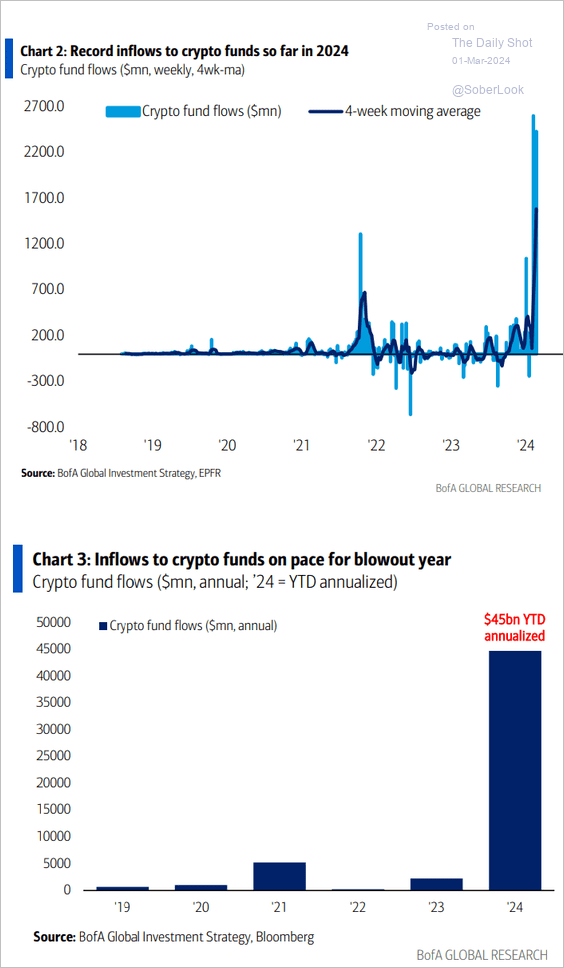

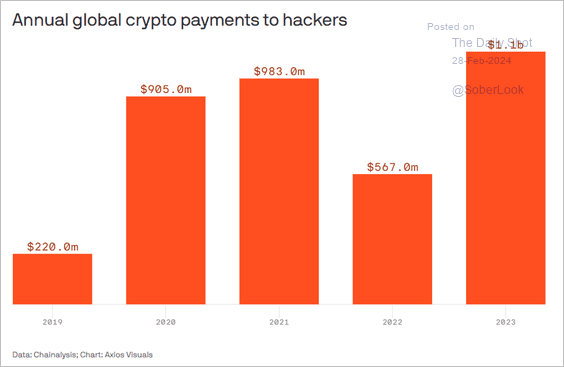

Cryptocurrency: Bitcoin blasted past $70k, hitting a record high.

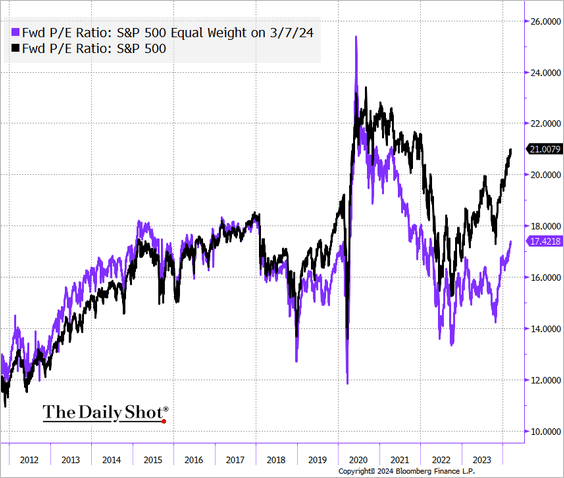

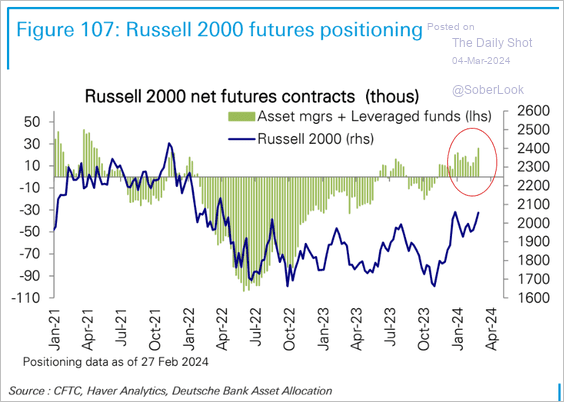

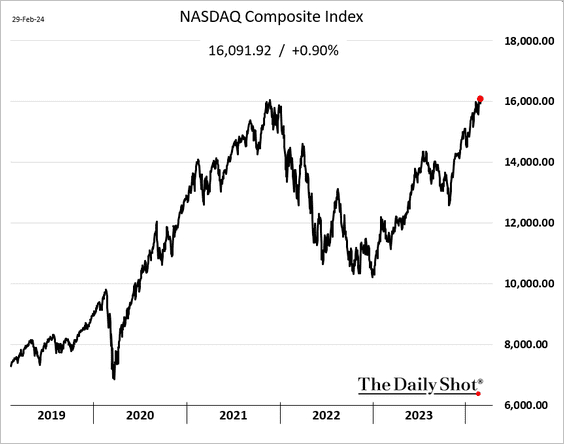

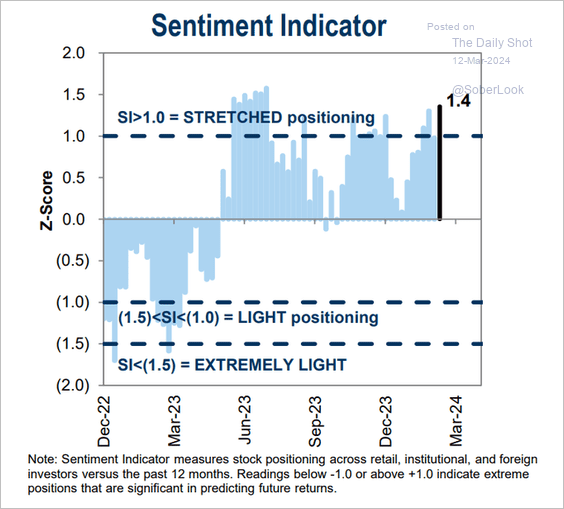

Equities: Goldman’s sentiment index is in “stretched” territory.

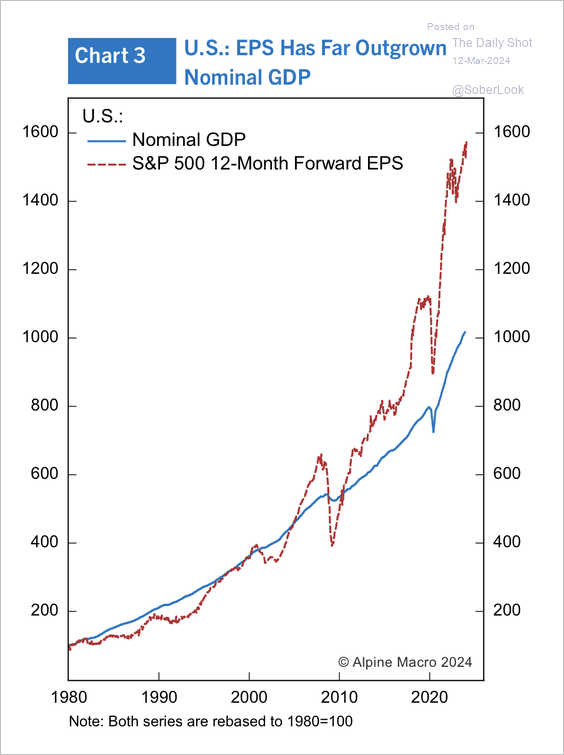

S&P 500 earnings have outgrown nominal GDP by a large margin over the past decade (partially reflecting US companies’ global operations).

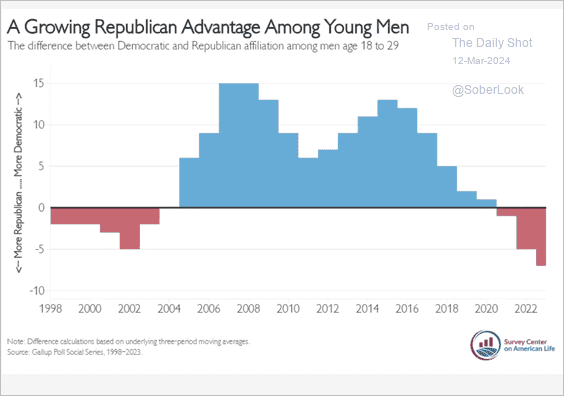

Food for Thought: Shift in political affiliation among US men aged 18-29:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com