Greetings,

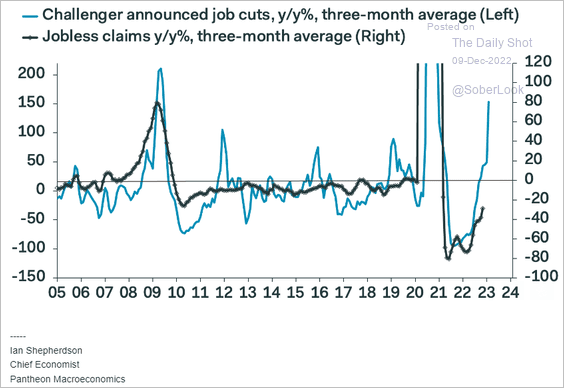

The United States: To begin, elevated layoffs point to higher jobless claims ahead.

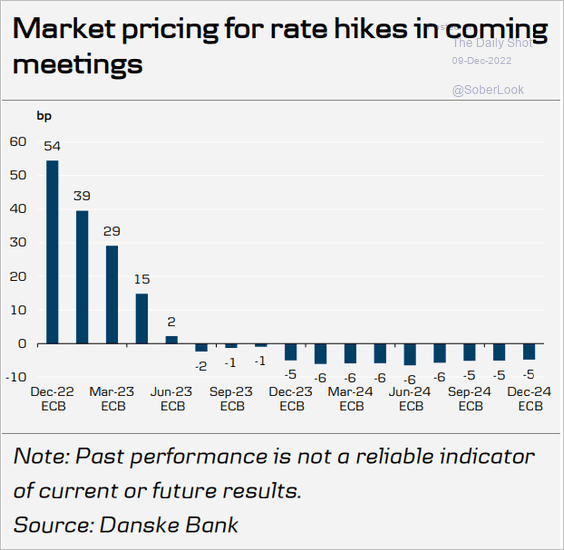

The Eurozone: Here is what the market is pricing in for ECB rate changes.

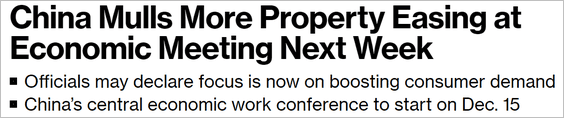

China: Property stocks are surging.

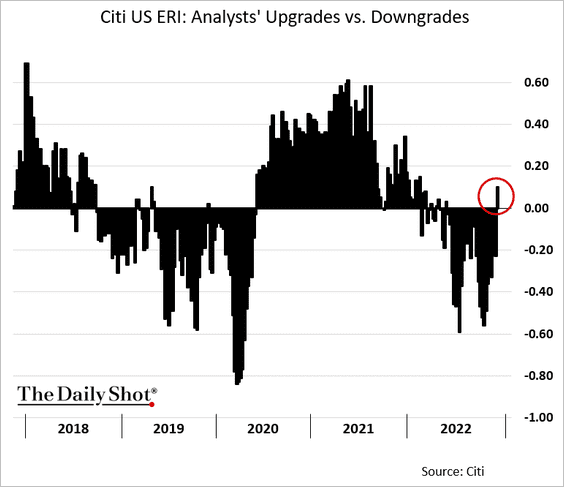

Equities: For the first time in 26 weeks, there were more earnings upgrades than downgrades.

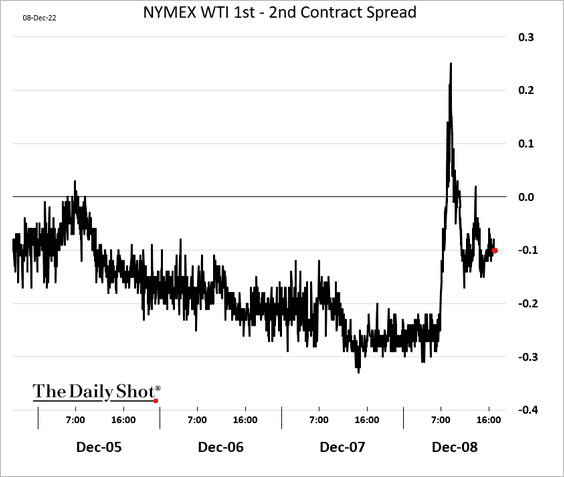

Energy: WTI temporarily moved back into backwardation on the Keystone news.

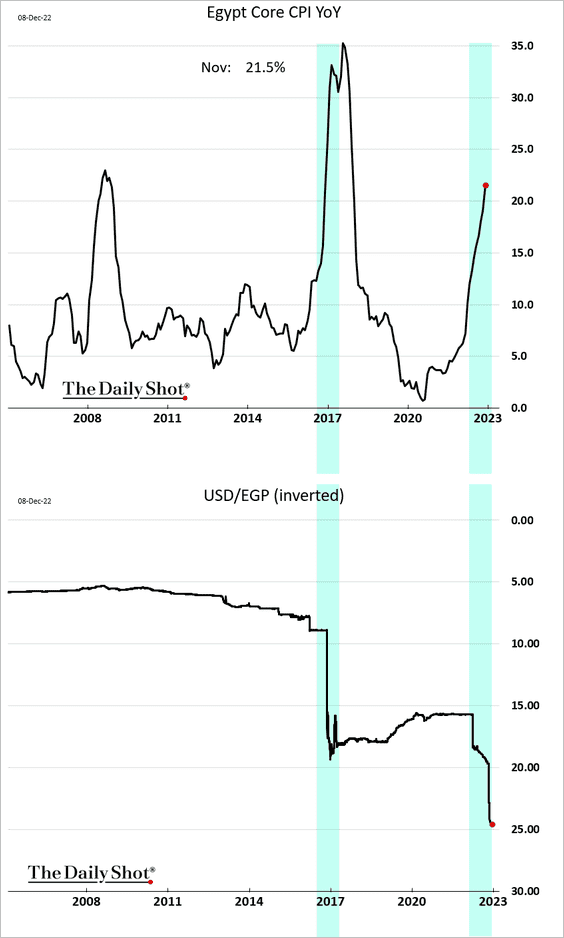

Emerging Markets: The currency devaluation is causing Egypt’s inflation to surge again.

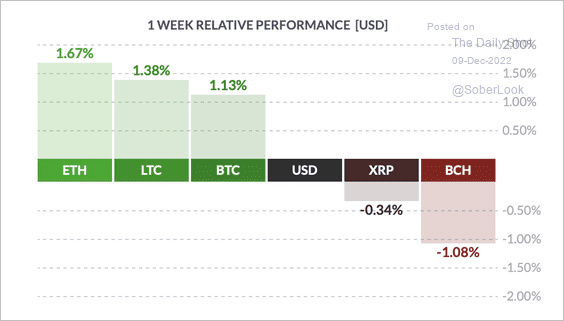

Cryptocurrency: It has been a mixed week for cryptos, with Ethereum outperforming other top tokens.

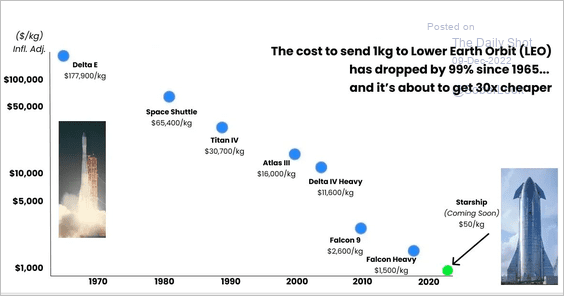

Food for Thought: To conclude the week, here is the change in cost to deliver cargo into orbit:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com