Greetings,

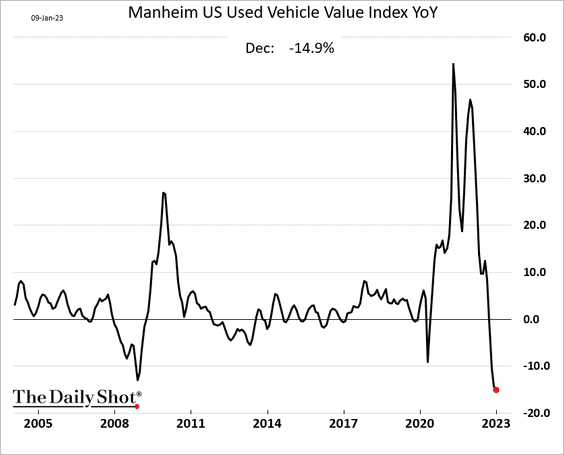

The United States: Wholesale used vehicle prices are down almost 15% from a year ago.

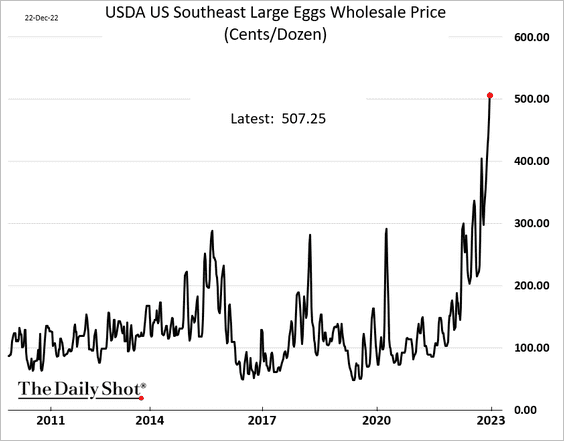

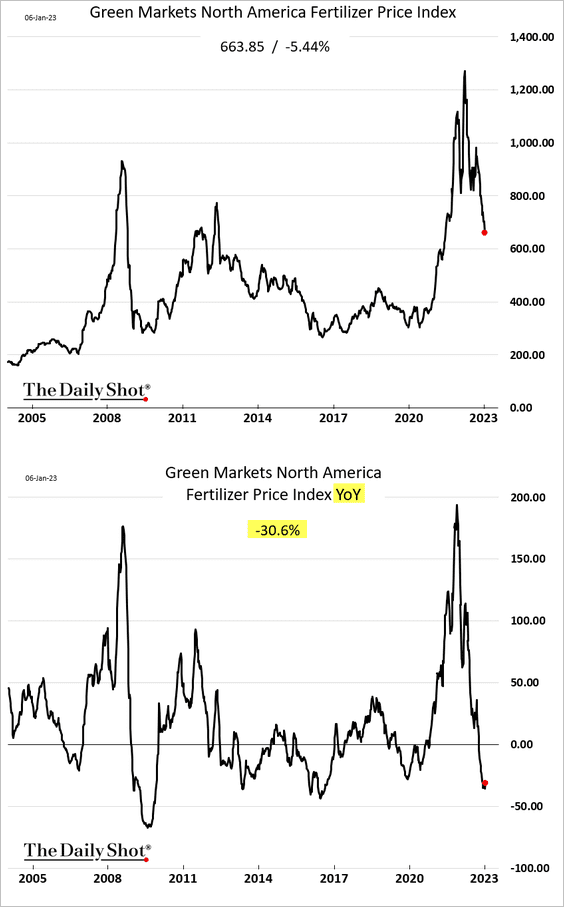

Weaker fertilizer prices signal lower food inflation ahead.

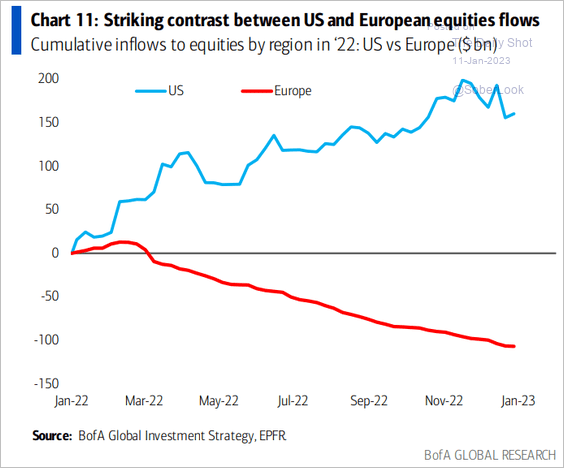

Europe: Are outflows from European equity funds over?

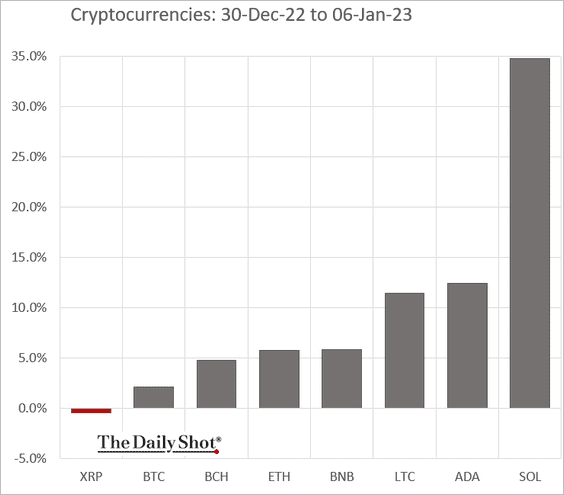

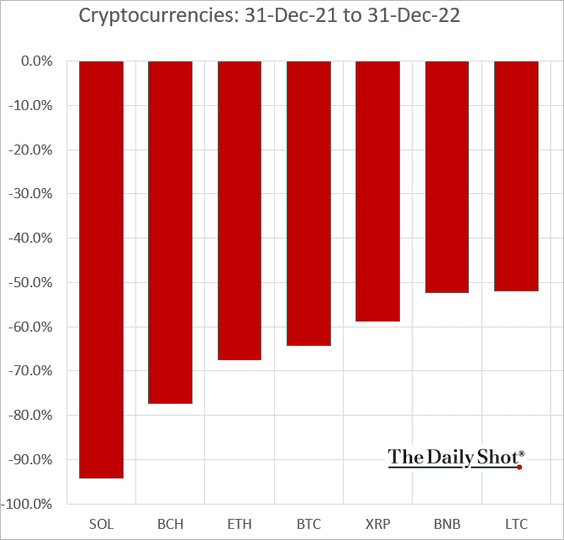

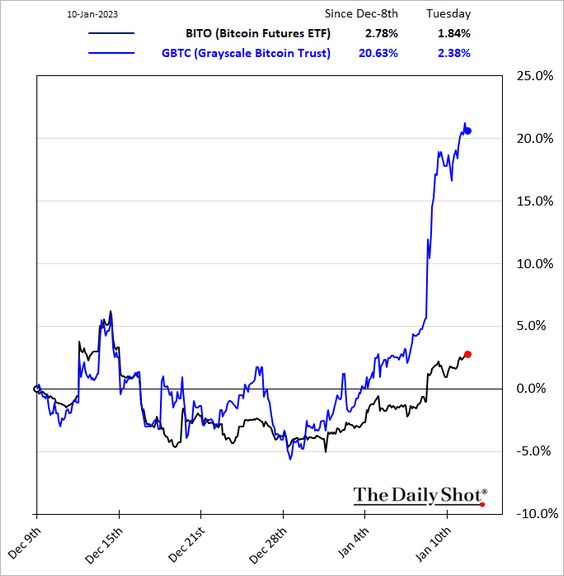

Cryptocurrency: Investors are betting that the GBTC discount to NAV will narrow.

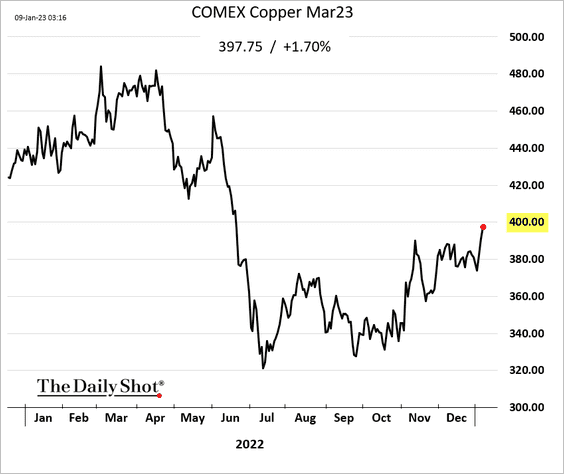

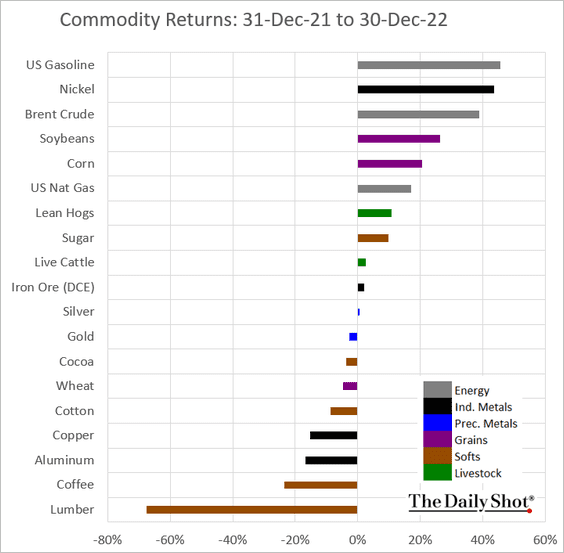

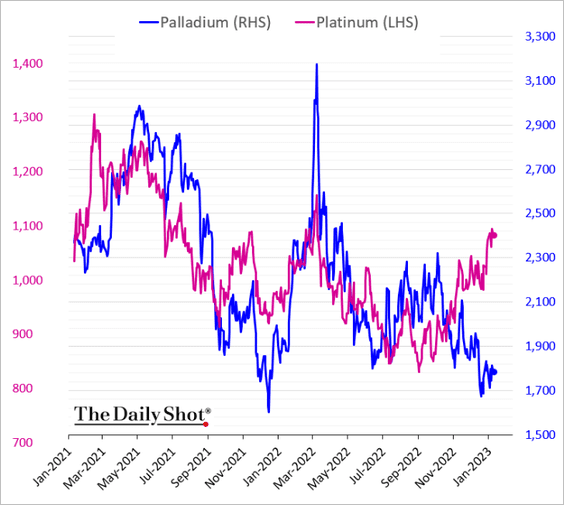

Commodities: Palladium has not participated in the precious metals rally.

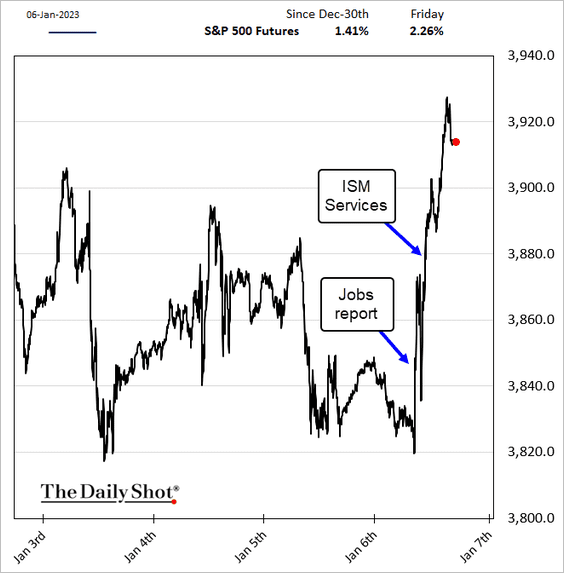

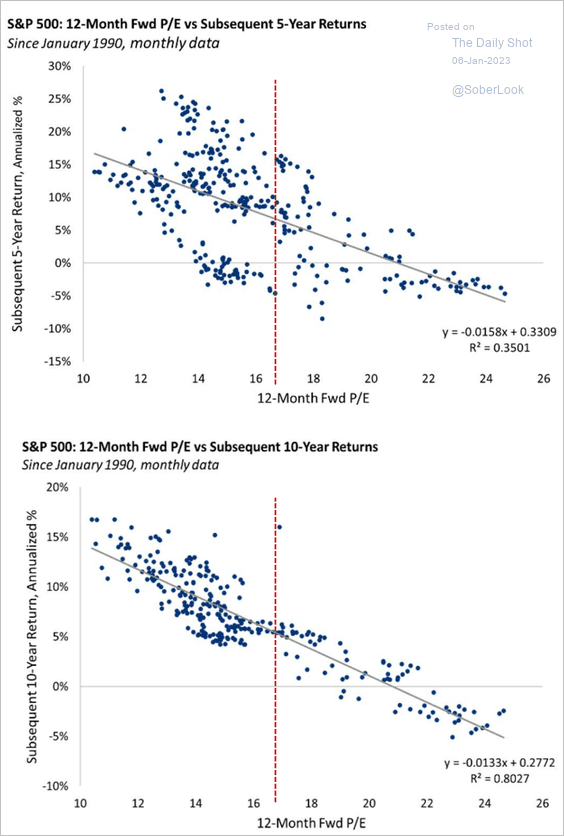

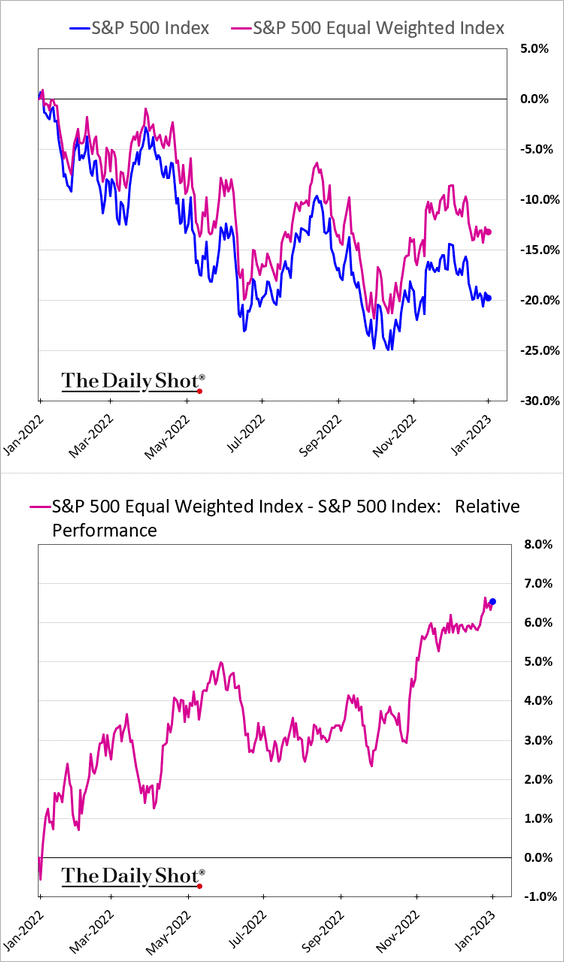

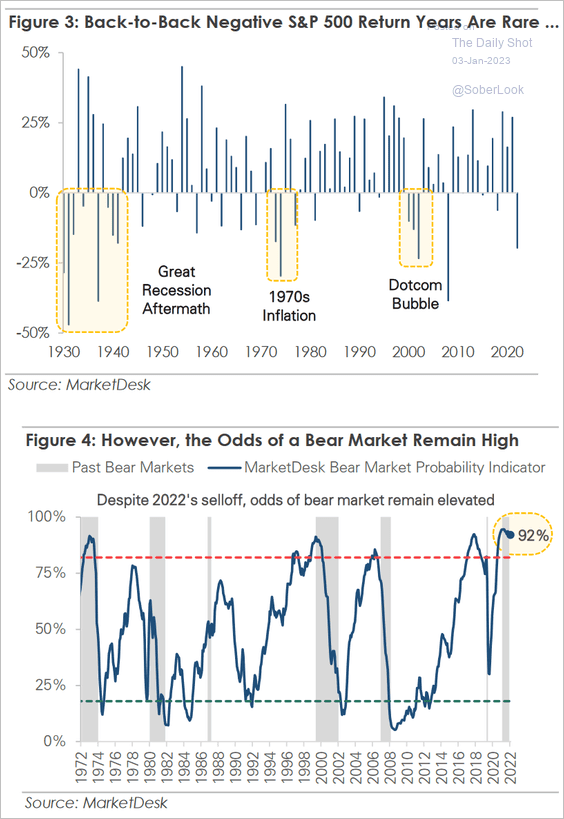

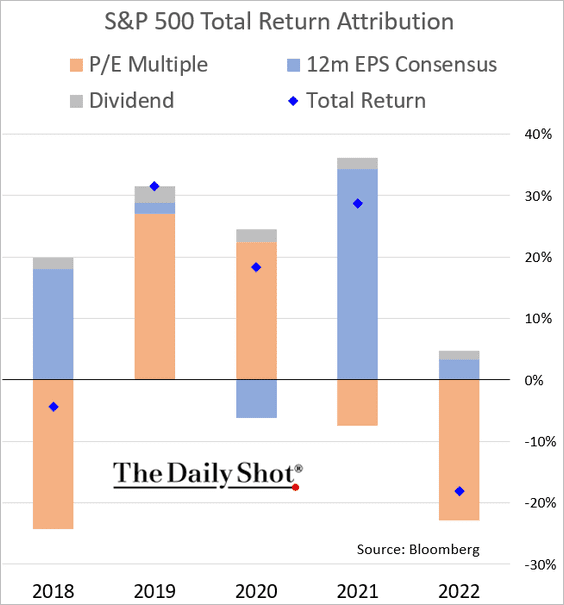

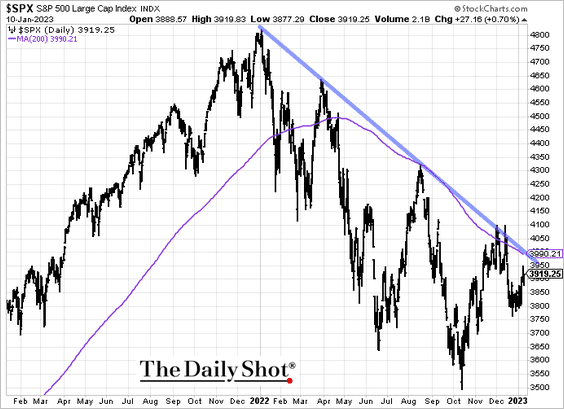

Equities: The S&P 500 will face resistance near 4,000.

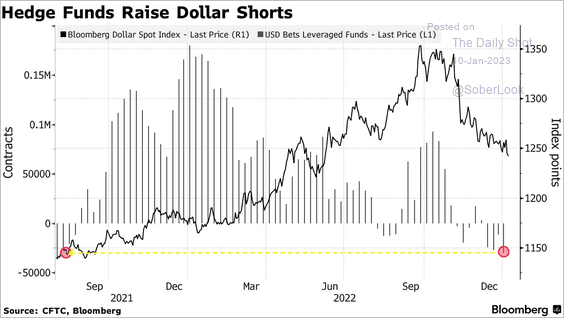

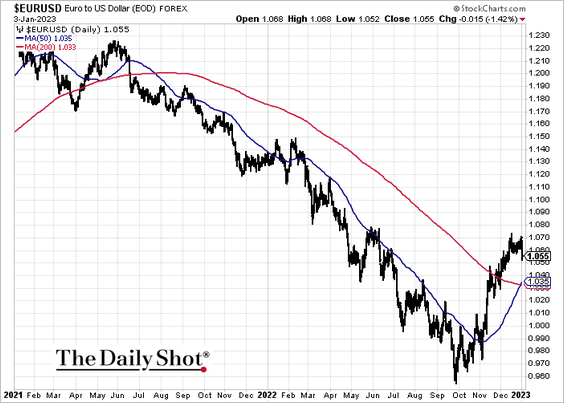

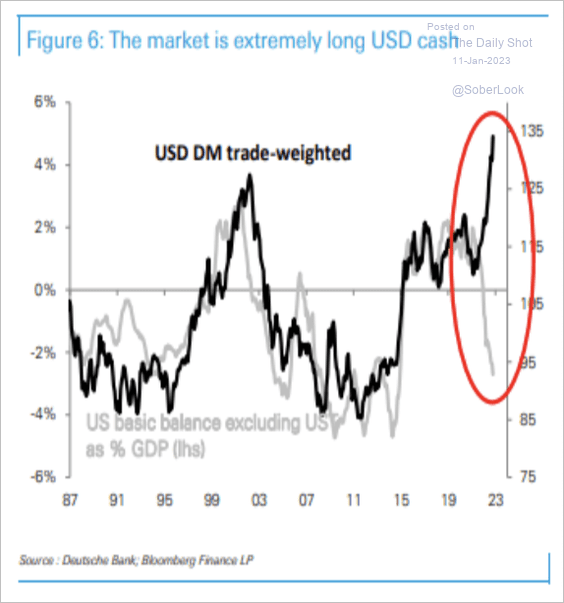

Global Developments: The market is sitting on significant USD cash exposure, which is vulnerable to further liquidation as the dollar’s safe-haven appeal declines, according to Deutsche Bank.

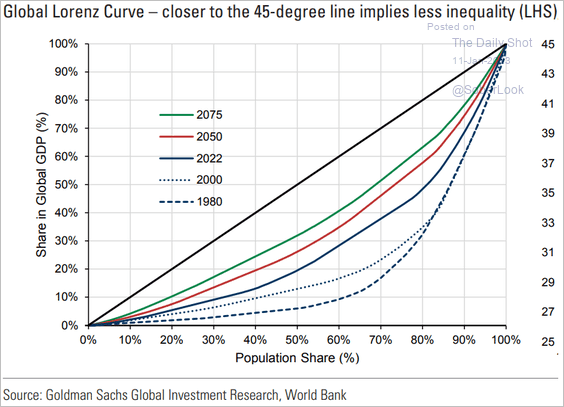

Food for Thought: Here’s a look at the global Lorenz Curve.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com