Greetings,

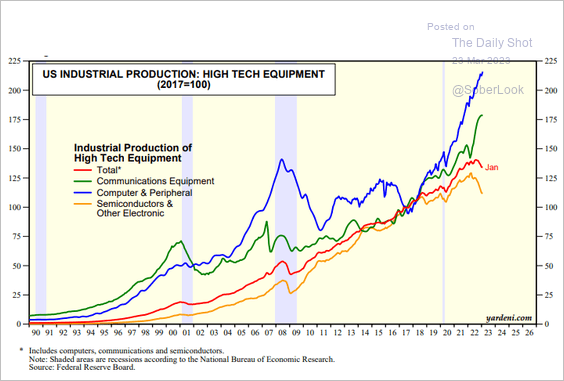

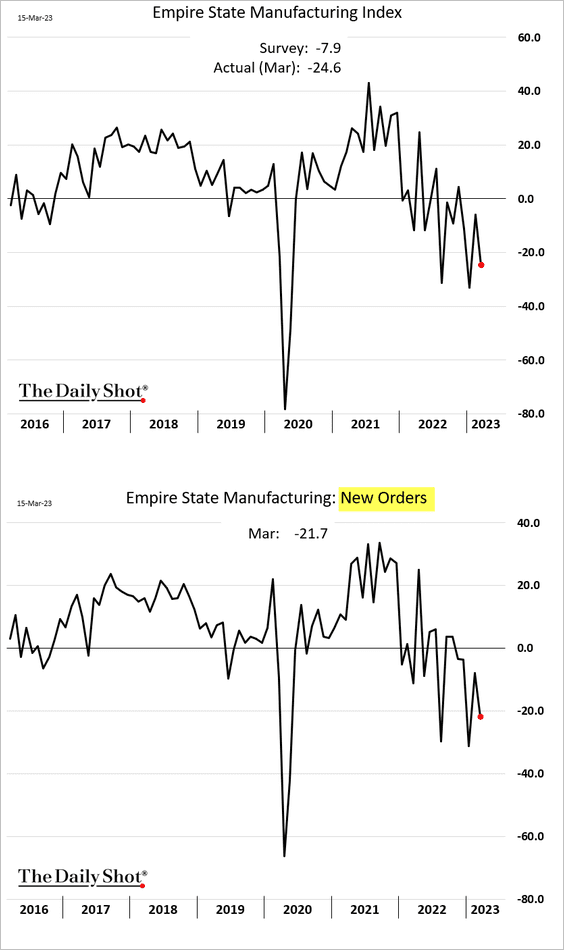

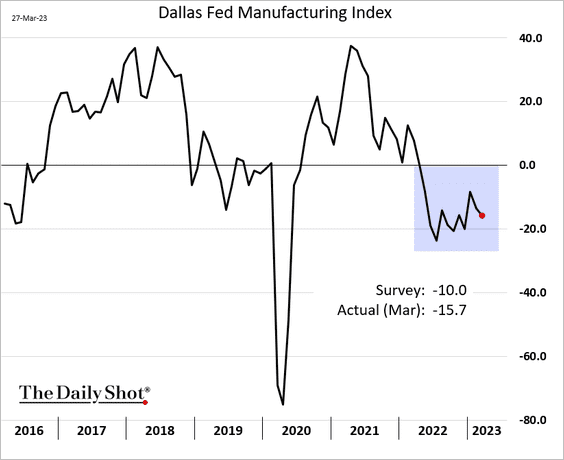

The United States: The Dallas Fed’s manufacturing index continues to show slowing factory activity in the region.

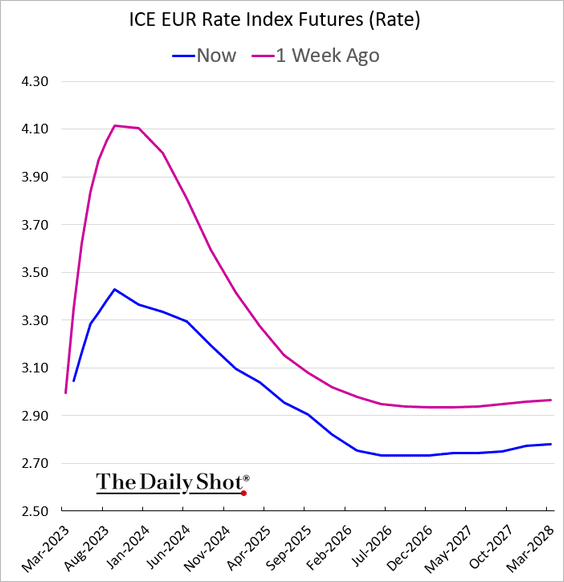

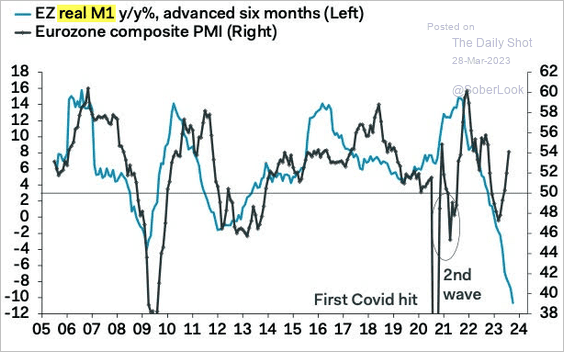

The Eurozone: The real M1 money supply is signaling a deep contraction in business activity.

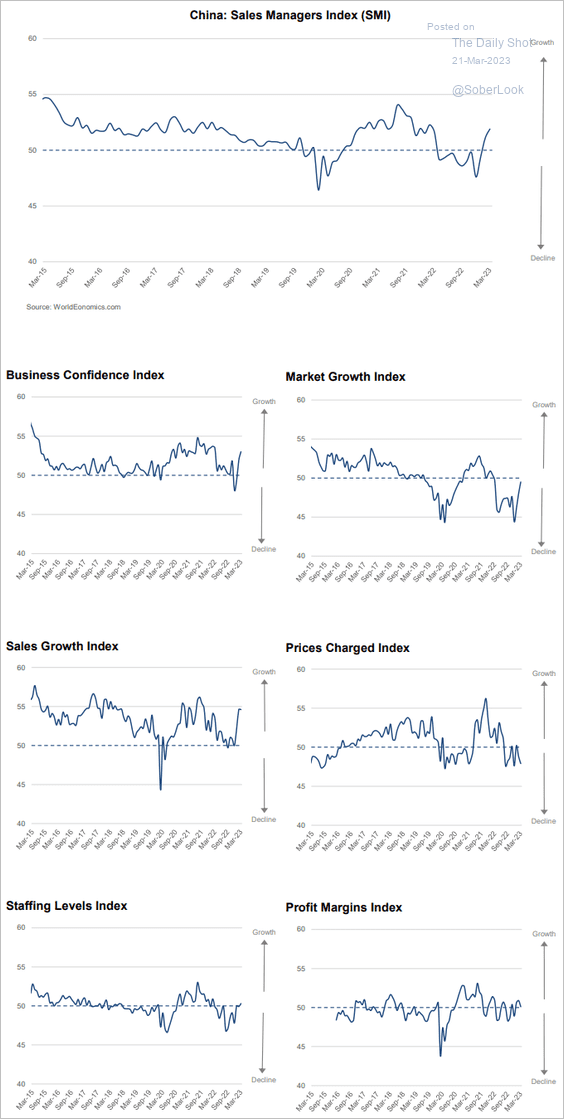

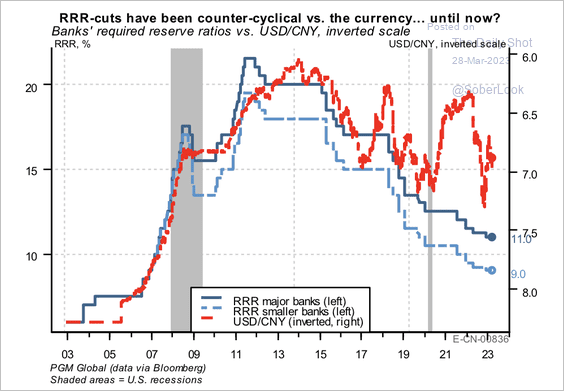

China: Policy easing has taken place within the context of a stronger Chinese yuan.

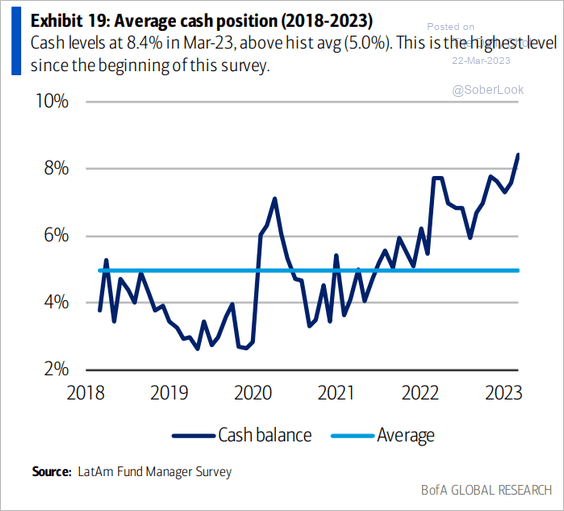

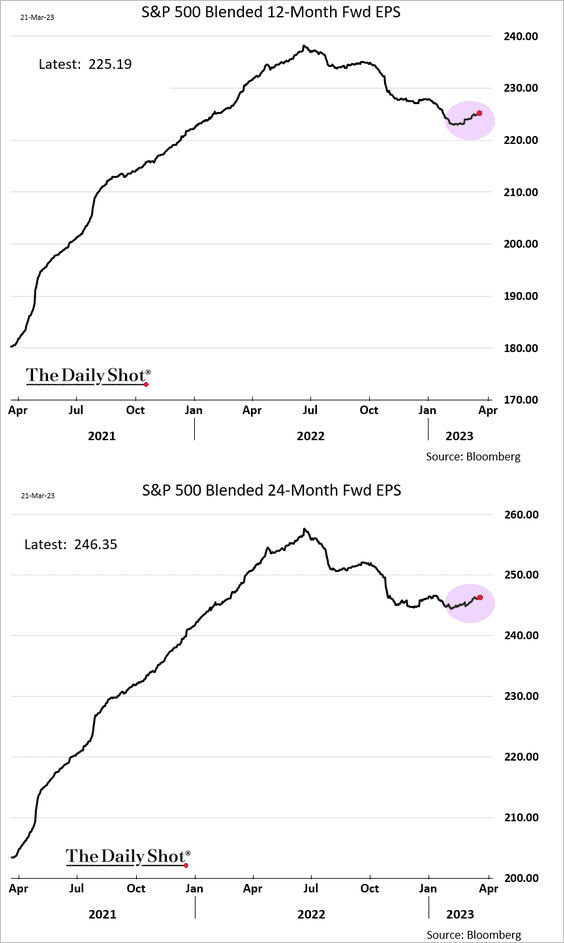

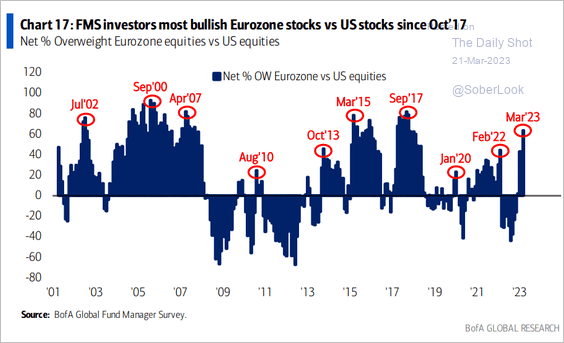

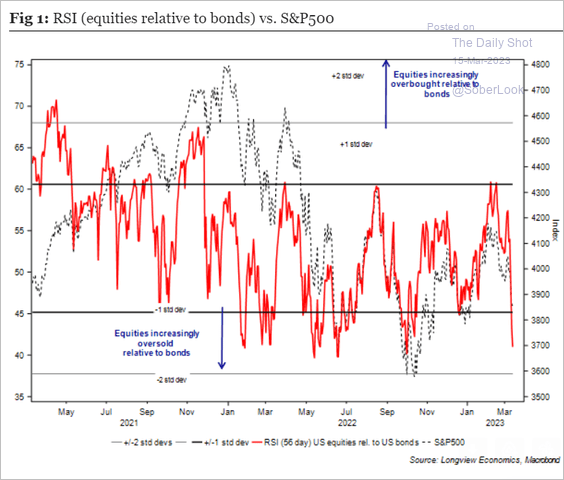

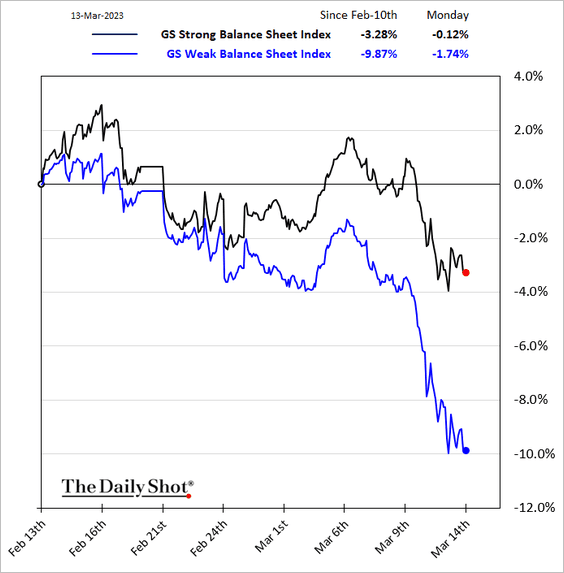

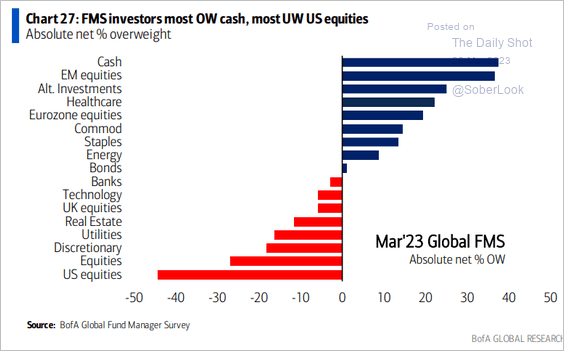

Equities: Investors are underweight US equities and overweight cash.

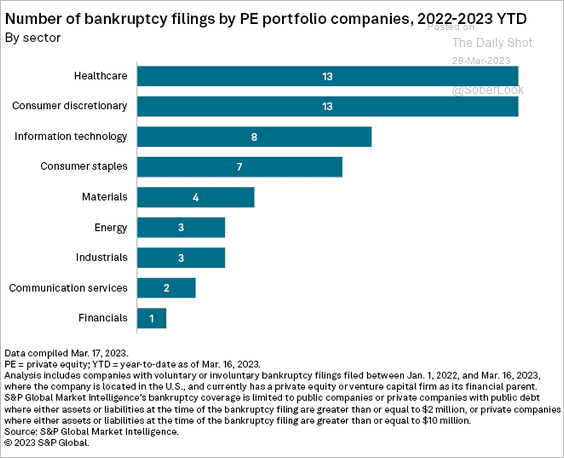

Alternatives: Here are recent PE portfolio company bankruptcies by sector.

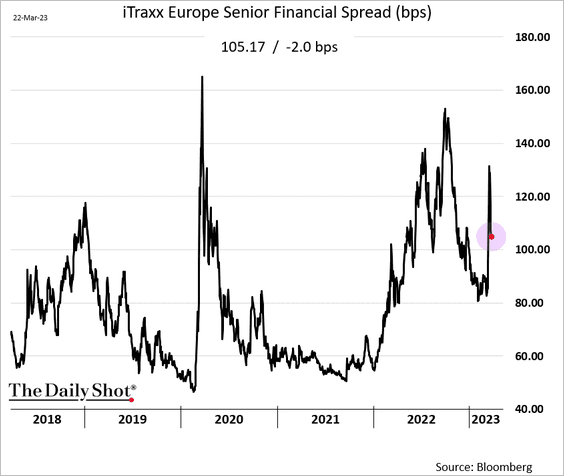

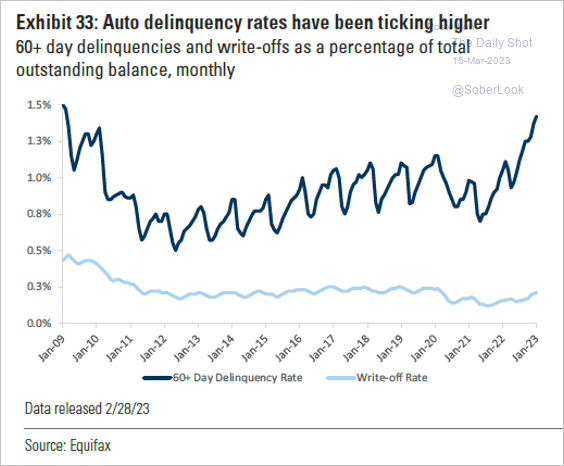

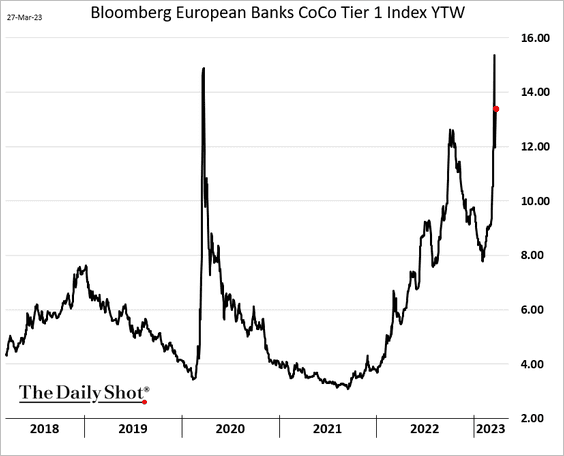

Credit: After the CS wipeout it will be challenging to rebuild confidence in the AT1 market. This chart shows the yield on Bloomberg’s European CoCo index.

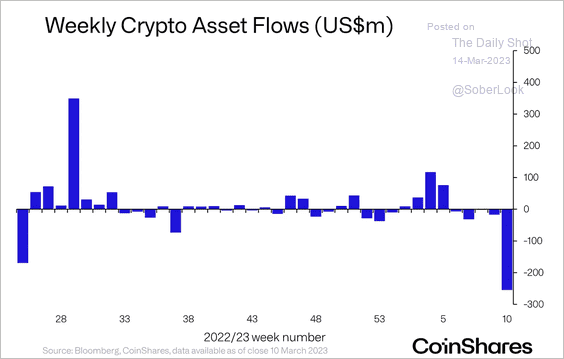

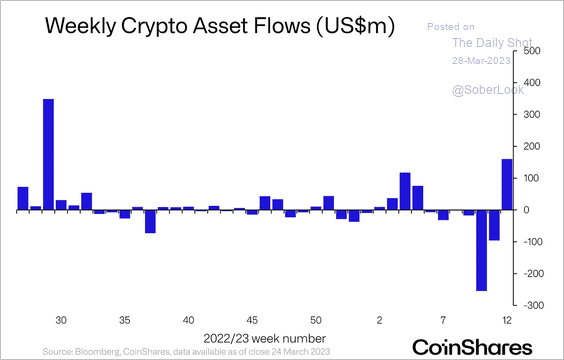

Cryptocurrency: Last week, crypto funds saw the largest inflows since July 2022.

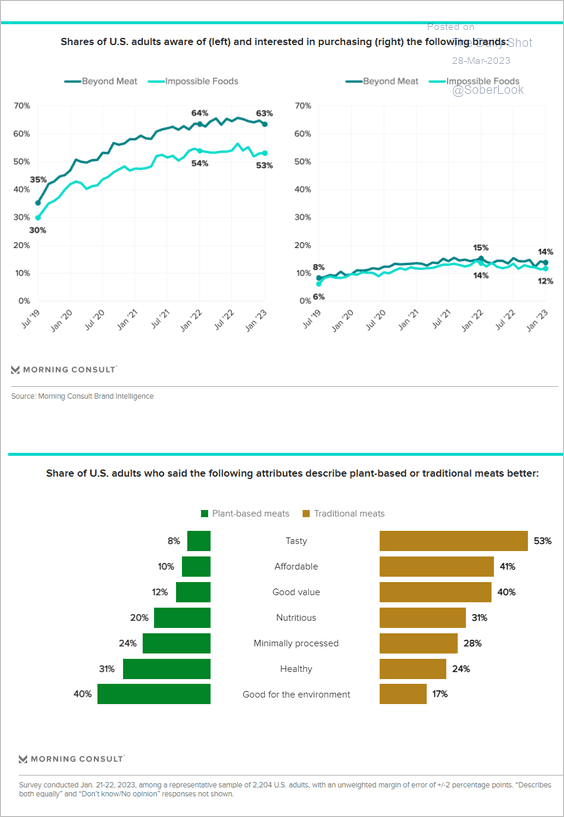

Food for Thought: Lastly, the plant-based meat industry has been facing challenges.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com