Greetings,

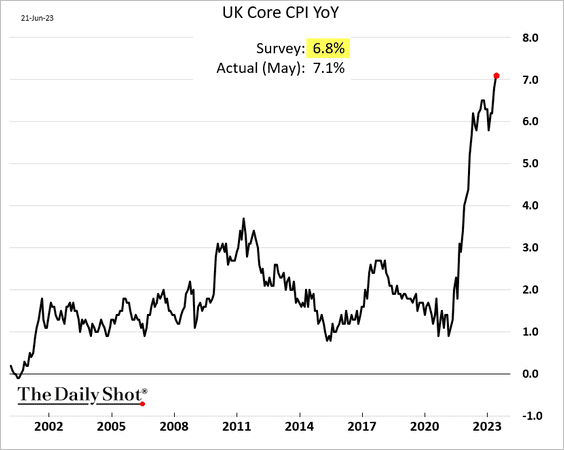

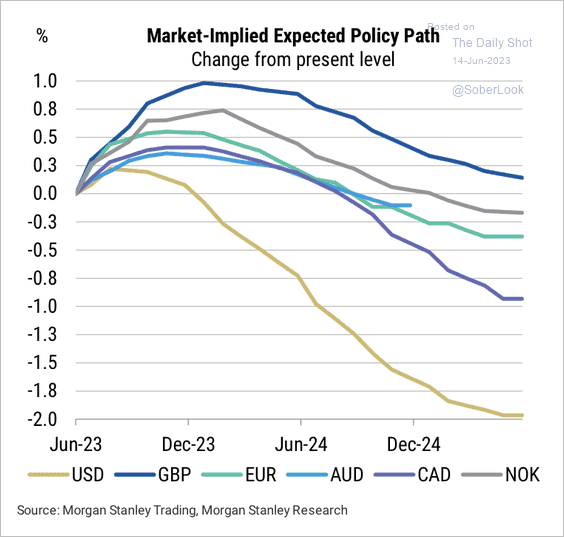

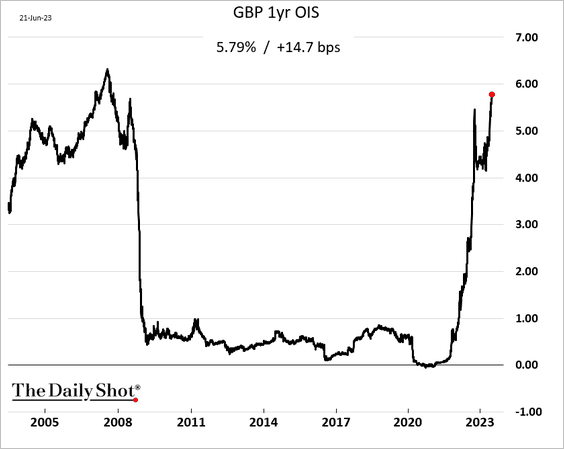

The United Kingdom: Short-term rates continue to surge, with markets pricing multiple BoE rate hikes ahead.

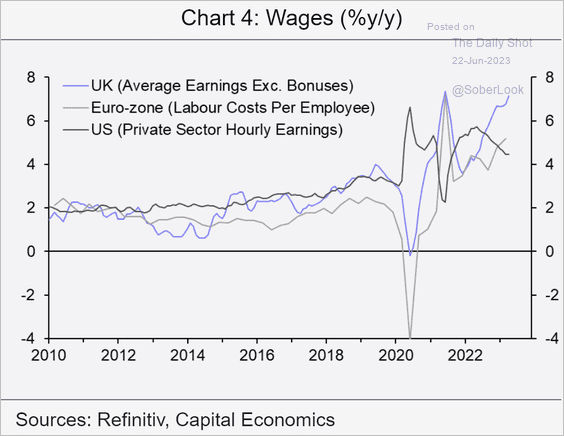

Elevated wage growth and extreme energy price shock explain why UK CPI has been outpacing other economies.

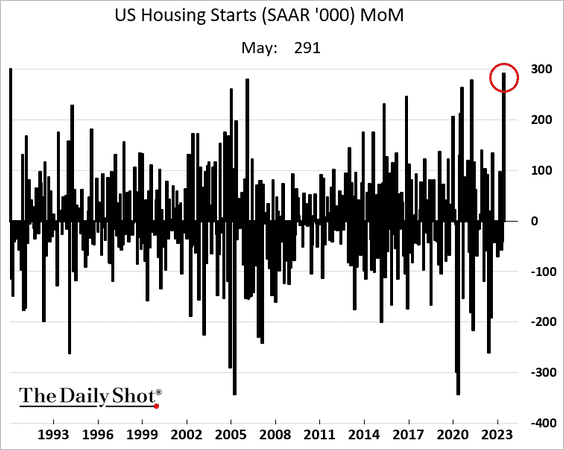

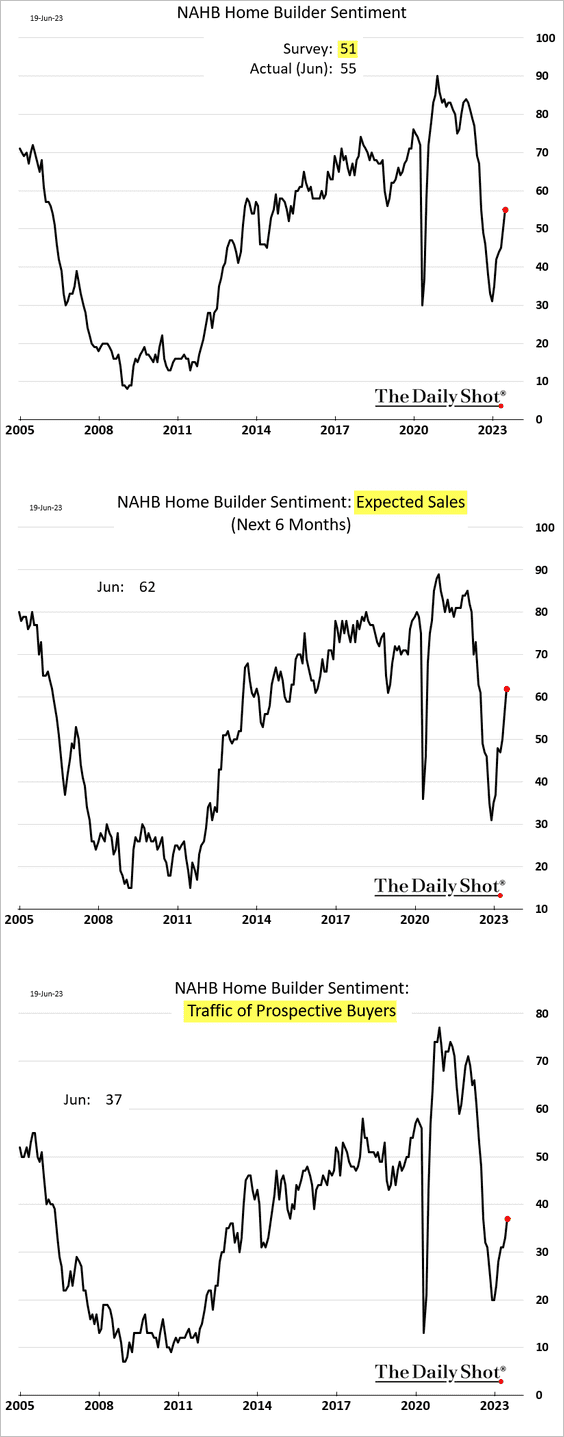

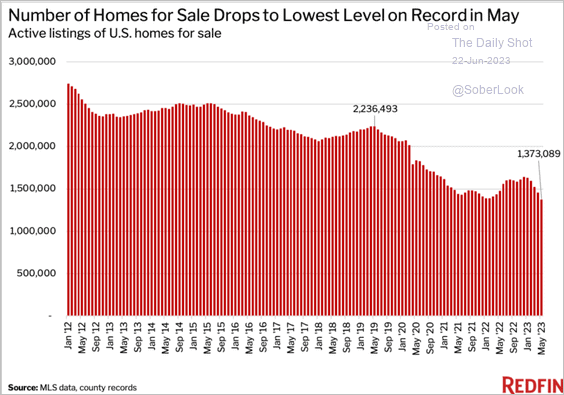

The United States: The supply of homes for sale continues to sink.

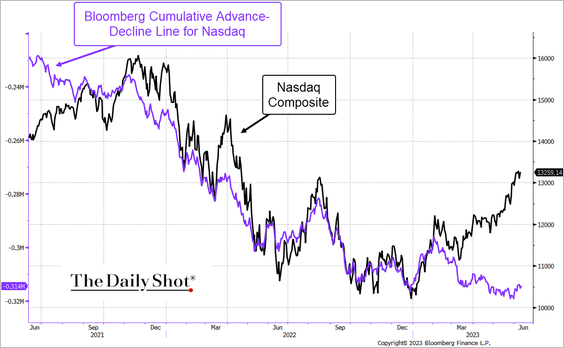

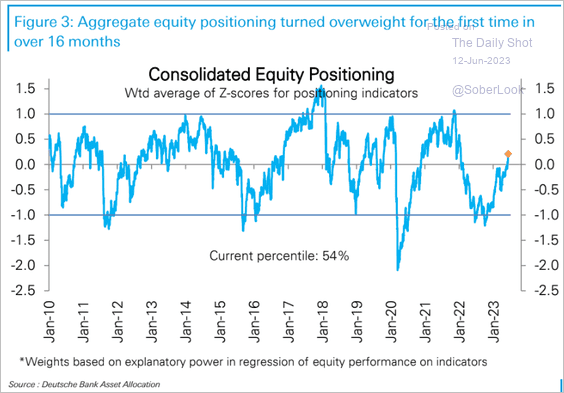

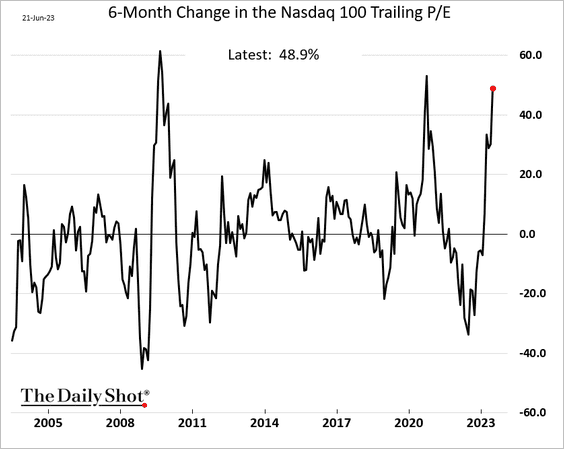

Equities: The Nasdaq 100 trailing PE ratio jumped by almost 50% over the past six months – a highly unusual move.

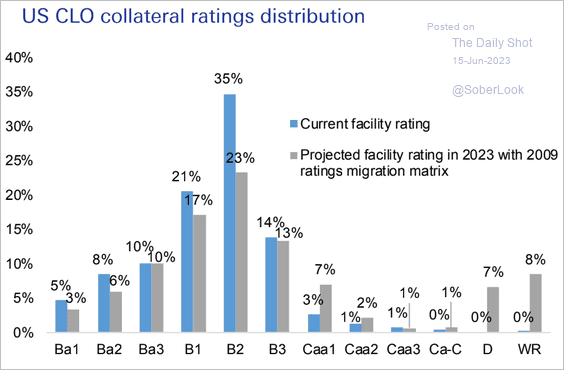

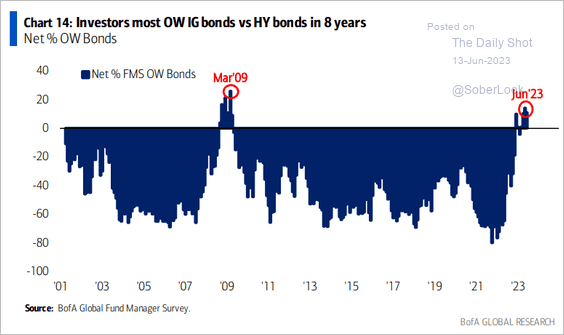

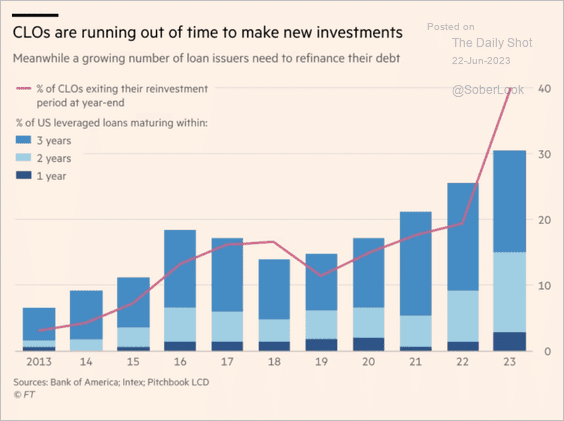

Credit: With many existing CLOs ending their reinvestment periods, new CLOs will have no shortage of product to buy.

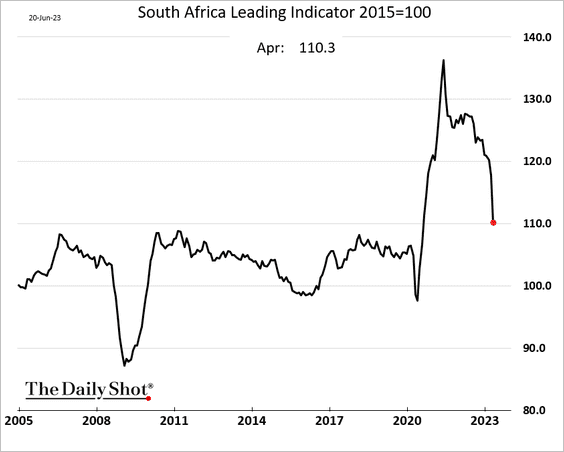

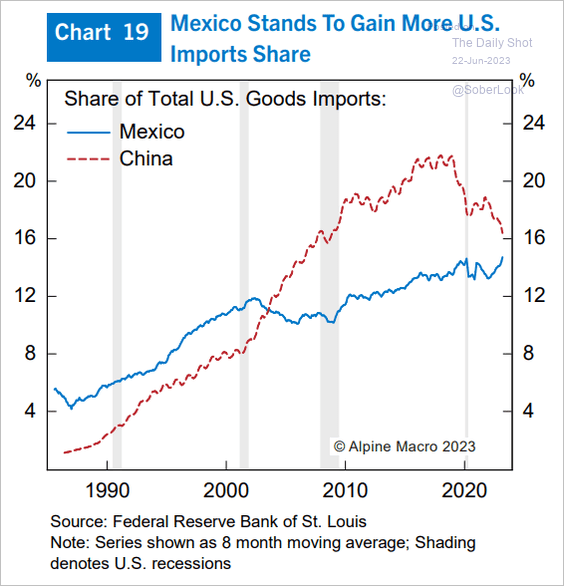

Emerging Markets: Mexico stands to gain from the US-China decoupling.

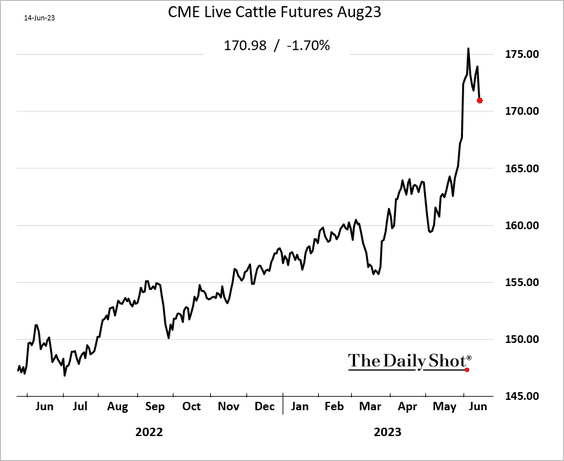

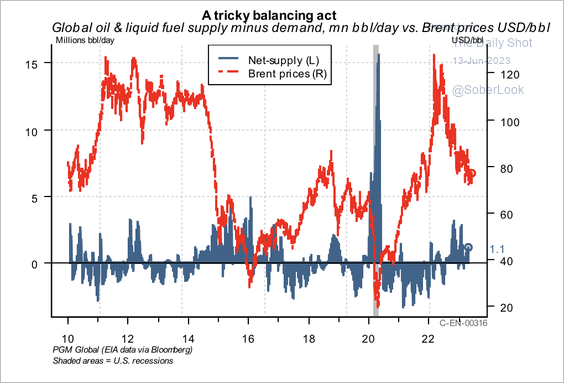

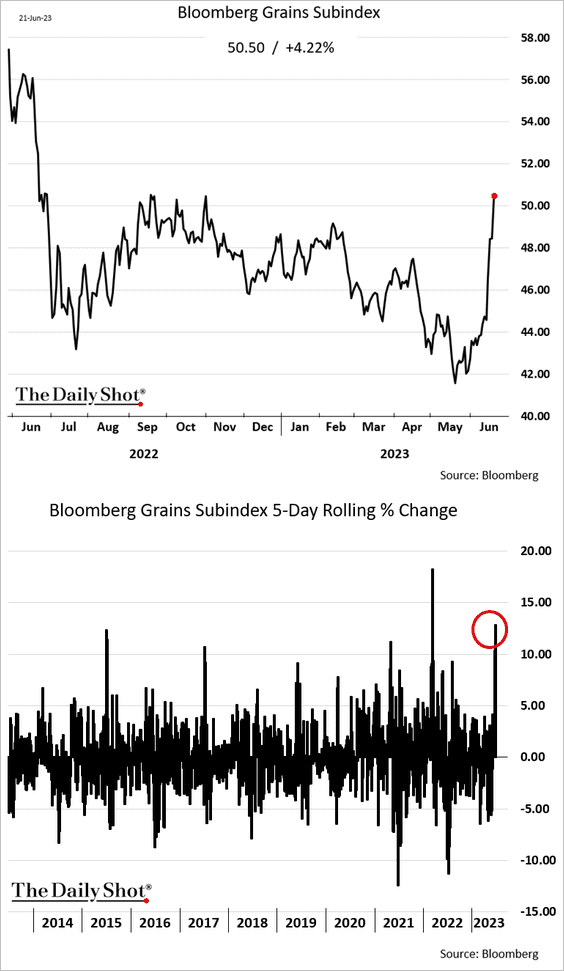

Commodities: US grains continue to surge as crop conditions deteriorate. Here is Bloomberg’s grain index:

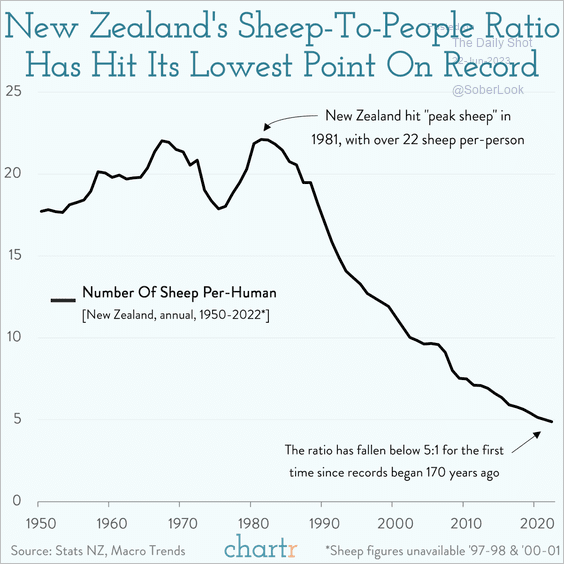

Food for Thought: Here is New Zealand’s sheep-to-people ratio:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

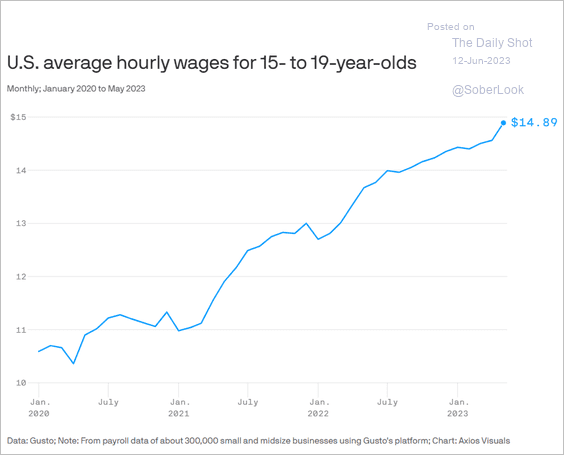

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief